Central Florida, Spring 2024

Central Florida Spring 2024 Edition – OurSeniors.net Magazine

Spring is in the Air! Yes OurSeniors.net Magazine Central Florida Spring 2024 Edition is officially out. Don’t miss it and if you do just check out https://ourseniors.net/

Contents

Winter 2024 | Volume 8 | Issue 2

In the News

6. MetroHealth Mobile Clinic Press Release

Community

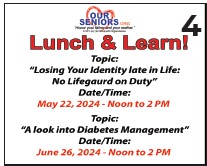

4. Lunch & Learn

May 22 & June 26

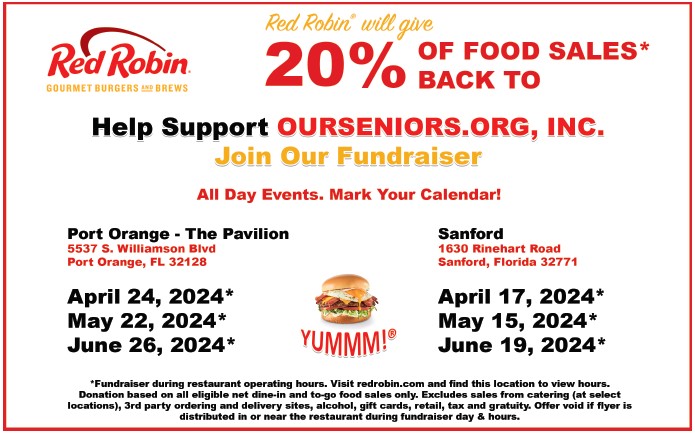

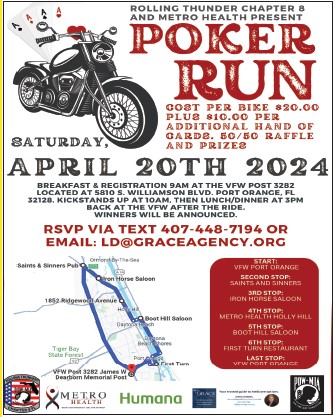

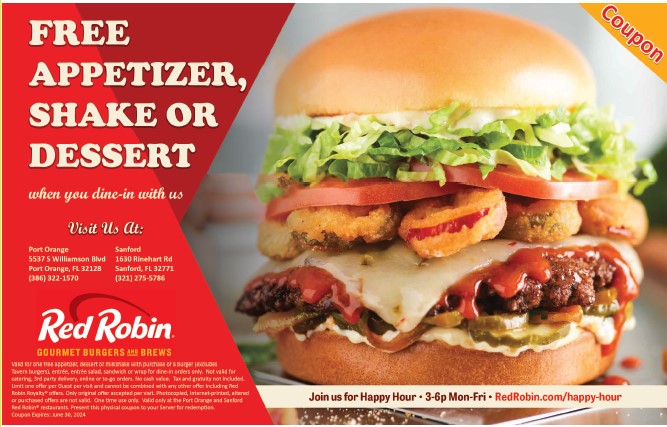

5. Red Robin Fundraiser Port Orange

April 24, May 22 & June 26

21. Red Robin Fundraiser Sanford

April 17, May 15 & June 19

Entertainment

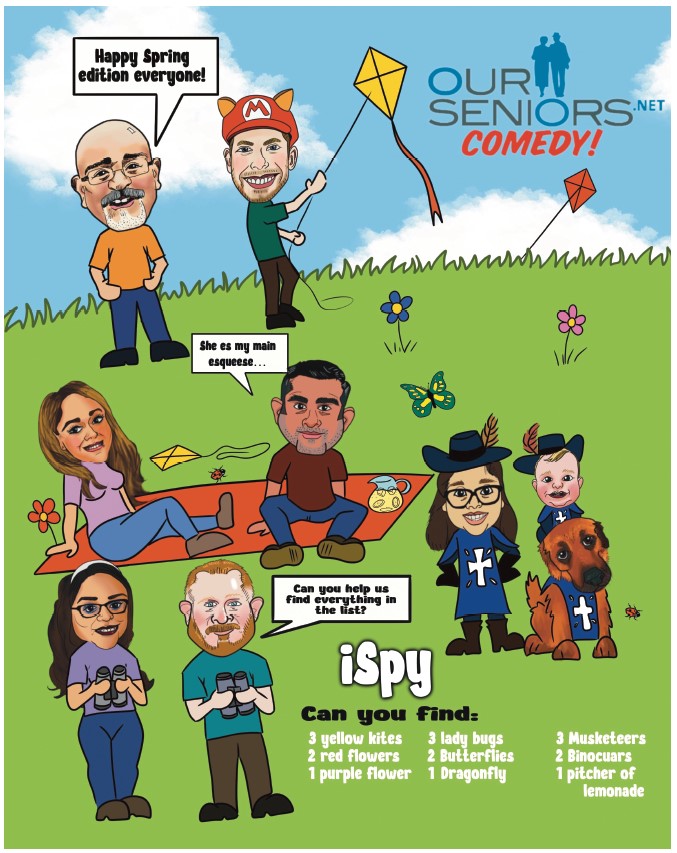

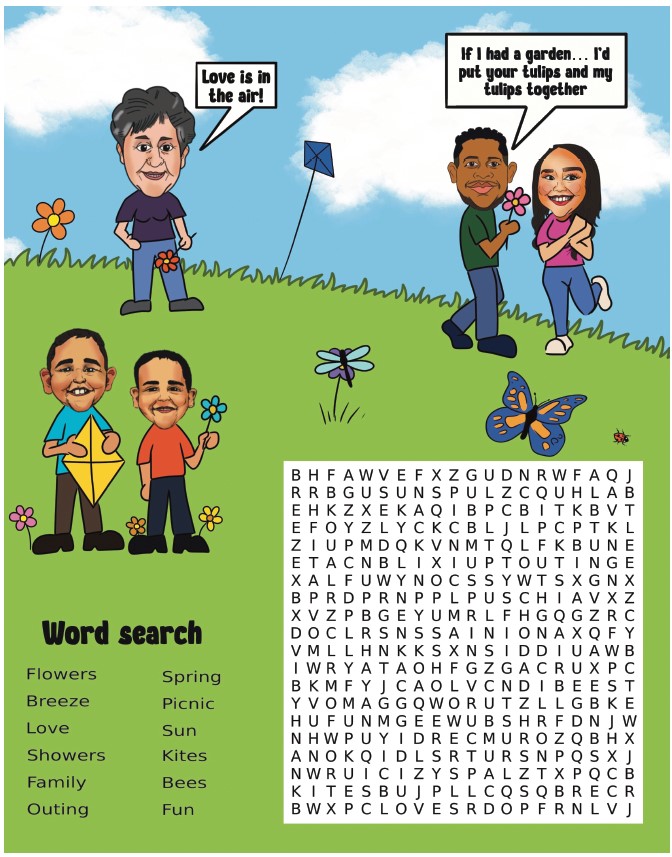

12. OurSeniors Comedy/ Word Search

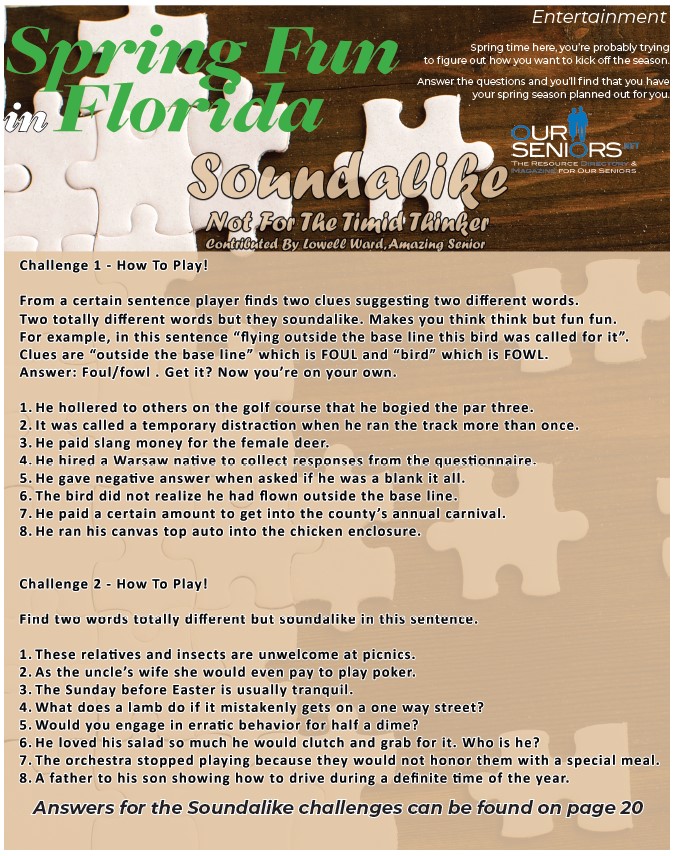

17. Brain Teaser’s: Soundalike Challenges

Fraud & Security

7. Stop Scammers From Stealing Your Identity

Health & Wellness

5. Ask Dr. Q

14. How to Reduce Sugar Intake without Drastic Changes

16. The Benefit of Owning and Caring for Pets

Inspirational

10. Amazing Senior, Elizabeth Hertling

Insurance

8. The Medicare Initial Enrollment Period

Legal

11. Top Estate Planning Mistakes in Florida

Don’t miss another edition by donating! Visit OurSeniors.org/donate

Disclaimer: The information published in this magazine and our website is intended for residents of the USA. The opinions, beliefs and viewpoints expressed by the various authors in this magazine and on this web site do not necessarily reflect the opinions, beliefs and viewpoints of OurSeniors.net Magazine or official policies of OurSeniors.net Magazine, OurSeniors Radio, OurSeniors Discounts, OurSeniors.org, Inc. and or its related entities. It may contain general information about medical conditions, public and private health service organizations and other third-party information including but not limited to testimonials. The information is not advice (legal, medical or otherwise) and should not be treated as such. Consult your licensed Professional such as Attorney and or Doctor etc. for further advice. No claim is made as to the accuracy, authenticity or completeness of any information and, is often provided in a generalized or summarized format for brevity. OurSeniors.net Magazine, LLC and or its subsidiaries, does not accept any liability for the information (nor for the use of any information) provided by this magazine and or website. The information presented by this magazine and website is provided on the basis that all viewers undertake responsibility for assessing the relevance and accuracy of the data related to their circumstances. Thank you for reading our magazine and visiting www.OurSeniors.net and please contact us if we can be of further assistance. All real estate advertised in OurSeniors.net is subject to the Federal Fair Housing Act. This federal law makes it illegal to advertise any preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preferences, limitation, or discrimination. We will not knowingly accept any advertising for real estate which violates the law. All persons are hereby informed that all real estate advertised in OurSeniors.net is available on an equal opportunity basis. Information contained herein has been furnished by community owners, managers and agents. OurSeniors.net and or OurSeniors.online, OurSeniorsDiscounts.net and or OurSeniors.org, Inc. and OurSeniors.net Magazine, LLC do not make any representations as to opinions and facts. All terms and conditions of rentals are subject to change. OurSeniors.net reserves the right to refuse advertising space to anyone deemed unsuitable for placement in this publication. OurSeniors.net, OurSeniors.online, OurSeniorsDiscounts.net and or OurSeniors.org, Inc., and OurSeniors.net Magazine, LLC retains all rights reserved by copyright 2023 OurSeniors.net, and or OurSeniors.net Magazine, LLC. This publication or parts thereof may not be reproduced in any form without the written permission of the publisher. For further Disclaimer information please visit www.ourseniors.net and click Disclaimer on the footer of the website. Please note that websites and links are referenced in the magazine, and you may have complete access to our online version by visiting. https://ourseniors.net/editions/.

To All OurSeniors Readers, Subscribers, Vendors, and Donors,

Help Us to Help Seniors

Sometimes it is a good idea to remind ourselves of some very basic facts. What are we about? Why do we work and strive so hard? For what purpose? For OurSeniors.org, the answer is simple: OurSeniors is about serving the needs of seniors. That is our vision, our purpose, our objective.

The world is filled with good causes. Some serve the needs of children, or refugees, or the homeless. These are all good organizations, worthy of support. Strangely, the needs of seniors are seldom at or near the top of the list. This is odd because most adults will one day fall into the large and growing group we call “seniors.” We will not become refugees or homeless, but the challenges of senior life will confront most of us.

Seniors are the fastest growing part of our population, and they often have needs that can be met only with outside help. Hopefully, senior years are “golden,” but they also bring health issues, cognitive decline, financial challenges and sometimes social isolation and loneliness. OurSeniors.org exists to help meet those needs. That is why we publish, present, organize, and engage in the many activities that benefit seniors. It is also why most of these activities are completely free to seniors.

Consider just a few of these activities, starting with OurSeniors.Net Radio. Each week the live show hosts a guest with information on a topic of direct interest to seniors. The show is broadcast on WNGB radio and made available online via YouTube. The OurSeniors Lunch and Learn programs provide much the same type of information, plus the opportunity for seniors to meet and socialize in person with their peers. The OurSeniors Approved Vendors and Pro Team listings provide seniors and their families with dependable professionals and businesses who specialize in providing service to seniors.

Both the online and printed editions of OurSeniors.Net Magazine are recognized as the best senior-oriented publications in Florida. Quarterly, they bring news, features, entertainment, and savings to the senior community. The Amazing Senior feature has spotlighted the accomplishments of very famous seniors like Mr. Pat Boone, but also the quiet deeds of other members of the “Greatest Generation.”

All these great products, services and events serve the needs of seniors in their own way. That is our reason to exist. Those products and services share other common qualities: they are free to seniors and cost money to produce. OurSeniors.org is a nonprofit, 501 C (3) organization. It does not try to generate a profit, but it has expenses that must be met. In recent times, these expenses have risen dramatically. For example, the cost of printing and distributing this magazine has almost doubled, while it has become very difficult to offset those costs with advertising income. Just like us, our great sponsors and supporters are looking for ways to cut expenses. Sometimes this means us, and the result is fewer resources to help seniors.

That is why we are issuing this appeal. Please help keep OurSeniors a viable and useful service to the senior community! Now is the time to contribute to this nonprofit that serves the needs of seniors. Please help us continue this mission. Of course, donations made to 501 C (3) organizations like OurSeniors are tax deductible for the donors, so give while you live!

Go to this website www.ourseniors.org/donate/ or call us at 386-267-6898 to help us help seniors!

-As always, you as a reader are part of everything that we achieve, and that will never go unnoticed.

OurSeniors.net Team

“Ask Dr. Q.” gives OurSeniors readers a chance to get expert answers to specific senior-related health questions. Dr. Steven Quaning is Medical Director and Chief Physician at Metro Health, a network of medical practices dedicated to senior care. He is Board Certified in Geriatric Medicine, medical care specifically aimed at seniors.

In our “Ask Dr. Q” feature, readers have an opportunity to get answers to specific senior medical questions. Here are some examples-

Q? I have been diagnosed with diabetes. How will this affect my future health?

Answer- Diabetes is a condition that affects how the body uses glucose, a type of sugar. This causes high levels of blood sugar, which can damage the eyes, kidneys, nerves, and blood vessels. If diabetes is properly managed and controlled, its impact on your overall health can be minimized. To maintain control, it is important to monitor blood sugar levels, follow a healthy diet and exercise plan, and take the medications prescribed by your doctor. Uncontrolled diabetes may contribute to heart disease, loss of vision, nerve damage, foot problems, and other serious conditions.

Diabetes is one of the common conditions affecting people of all ages, but especially seniors. Older patients are most likely to suffer from conditions like heart disease that can be made worse when the patient is diabetic. This is why it is so very important for seniors to follow the treatment plan laid out by their physician. Doctors will do all they can to help, but patient (and family) involvement is essential. Stick to the treatment plan your doctor has prescribed.

Q? Is there a simple blood test to detect potential signs of Alzheimer’s?

Answer- Yes. The test looks for a protein in the blood. It was up to 97% accurate, and the researchers found about 20% of people in the study would need follow-up testing to confirm whether they had conclusive signs of Alzheimer’s. MetroHealth has partnered with K2 Medical Research to provide access to this simple test. K2 Medical Research is now available at the MetroHealth of Holly Hill location, Monday – Thursday from 10am to 3pm. The address is 1852 Ridgewood Ave Holly Hill FL 32117. Please call us at (407) 500-5252 to schedule a test.

Q? I have travel limitations because I am at a facility can MetroHealth come and see me?

Answer- MetroHealth believes that everyone deserves access to quality healthcare, no matter where they live. Our new initiative, MetroHealth Mobile Clinic, is bringing 1:1 PCP visits, x-rays, and lab services to community locations. This Mobile Clinic will continue to make primary care services accessible to our members, bringing healthcare services directly to your neighborhood.

—–

Disclaimer. The information provided in Ask Dr. Q or on our website is intended for informational purposes only. It should not be construed as a substitute for professional medical advice. Please note that not all questions submitted may be answered. Always consult your physician or healthcare provider for medical advice. For additional Disclaimer information please visit ourseniors.net/disclaimer/

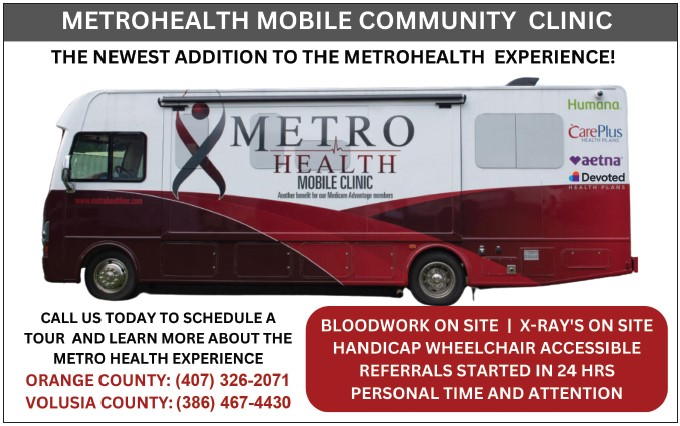

MetroHealth, an OurSeniors.Net partner, is committed to making high-quality primary care accessible to the senior community. Accessibility is an important issue in providing senior healthcare. For many seniors, lack of mobility is a roadblock that prevents them from getting prompt, effective medical care.

MetroHealth has invested in a unique solution to this common problem. The MetroHealth Mobile Clinics literally a clinic on wheels, a primary care office for seniors that comes to you. Whether a senior needs bloodwork, X-rays, referrals, or personalized care, the Mobile Clinic will be there to serve.

Senior health and well-being are Metro’s priorities. The professionals at MetroHealth look forward to traveling to your community in the Mobile Clinic to provide seniors with the best care possible.

the MetroHealth Mobile Clinic, is a fully equipped medical office that comes to seniors, so that they will not be hampered by lack of mobility. The physicians and other professionals who will operate the Mobile Clinic are senior care specialists, including the chief officer of MetroHealth, Dr. Stephen Quaning, MD. As a geriatric physician, he understands that compassion and empathy are as important as technical skill in senior care.

The Mobile Care Clinic will reflect that doctrine. Starting with easy entrance and wheelchair access for seniors, a courteous reception and greeting, seniors will find themselves welcome in this practice. It will not be necessary to travel to numerous locations for lab tests, x-rays, or other routine medical procedures.

Obviously, the Mobile Care Clinic represents a major investment by MetroHealth. The medical equipment alone is a large investment, and the clinic has a self-contained examining room. MetroHealth is making this investment because it sees a need for this go-to-the-patient approach. Like OurSeniors.Net, MetroHealth’s vision is to serve the needs of seniors.

MetroHealth welcomes “get-to-know-us” visits before committing to becoming a patient. This includes the Mobile Clinic if it is in a convenient location.

The Mobile Clinic has already had a few appearances at various locations in Central Florida. In the future MetroHealth plans to deploy the Mobile Clinic in locations where there are concentrations of seniors. This may include assisted living facilities, retirement villages, or 55+ communities.

If you are a senior and a Medicare patient, or if you are involved in coordinating patient care, please contact MetroHealth and yes you can schedule a tour by calling in Orange County: (407) 326-2071 | Volusia County: (386) 467-4430.

Identity theft is one of the fastest growing white-collar crimes in the United States. ID theft occurs when someone steals another person’s personal information. According to a 2024 Consumer Affairs Report: “2024 Identity Theft Statistics”, Identity theft has soared 584% over the last 20 years (https://www.consumeraffairs.com/identity-theft-statistics.html).

How is illegally obtained personal data used?

Fraudsters are known to use a variety of sophisticated and unsophisticated ruses to get their hands on one’s personal information. Some of these rather cleaver approaches include:

Calling credit card companies pretending to be the card holder and asking to change the mailing address on the account. Thus, keeping the true card holder in the dark during the scam.

Opening new credit card accounts using the stolen identification.

Establishing phone and wireless accounts using purloined identification.

Opening bank accounts and writing bad checks on those accounts.

Taking out loans using illegally obtained information.

How can ID theft be prevented?

With respect to ID theft prevention, it is time for seniors and juniors of all ages to trade in their flip phone for a smart phone and begin protecting themselves from the jaws of fraudsters.

The following tips can substantially help reduce victimization:

Regularly ordering credit report copies from all three reporting agencies – Equifax, Experian, TransUnion.

Joining credit monitoring services to help catch fraudulent behavior before it cleans out your savings account and destroys your reputation.

Using strong passwords that contain upper case and lower letters, numbers, and symbols (i.e. $%#@) Never use passwords with family names, dates of birth, ages, addresses, etc.)

Never automatically save passwords on your computer.

Always know who you are speaking with before giving out personal information.

Always shred documents that contain sensitive information.

Always deposit mail in official U.S. Post Office Mailboxes. A good rule to follow is to lookup mail pickup times and place your package in the box just prior to mail pickup.

Use gel-tip pens when writing checks. Gel tip pens contain special ink that fends off scammers from using special chemicals to remove the ink and alter the check.

When possible, use compactor services in lieu of dumpsters.

Pay strict attention to billing cycles and follow-up when bills are late in arriving.

Always update computer virus protection and install updates when available.

Never download unknown files

Avoid unsubscribing from annoying marketing emails. If you want to unsubscribe, go to the incoming company’s website, and unsubscribe from there.

Always use firewall technologies to curtail illegal hacking.

Never throw away old computer equipment without destroying the hard drive assembly. Simply deleting data via keyboard is not enough, experts know how to retrieve previously deleted data.

Always take advantage of “opt out” programming options.

What to do if you are the victim of ID theft?

ID theft prevention practitioners suggest if you suspect that your personal information has been compromised consider taking the following seven steps:

Follow-up with the source of the fraudulent behavior

Get a copy of your credit report and check it out line by line.

Place a fraud alert in your file.

File disputes on all fraudulent activities.

Close all accounts that have been compromised.

File a police report.

File a complaint with the Federal Trade Commission. (www.reportfraud.ftc.gov)

An ounce of prevention is worth a pound of cure!

All ID thefts cannot be prevented, but they can be reduced by managing one’s personal data wisely. The keys to preventing ID thievery begins and ends with taking direct responsibility for safeguarding one’s personal information. Regardless of whether it’s a senior citizen or junior citizen, it’s extremely important to be thermostats not thermometers when it comes to safeguarding personal information.

Resolving identity thievery is a time-consuming endeavor and an extremely frustrating task indeed. The good news is that you do not have to be deeply steeped in the abyss of ID theft deceit, you have a path forward to get back on the road to fiscal solvency.

As Walt Disney was quoted as saying “the way to get started is to cease talking and start doing”. The power of prevention is far greater than the power of despair. Seniors and juniors of all ages should climb aboard the ID theft prevention express and enjoy the ride to fiscal stability and security.

OurSeniors are likely to intersect with Medicare frequently. In many cases, a senior’s first ever interaction with Medicare may be the most important; it will have lasting effects.

Unfortunately, many younger seniors are not well prepared for this introduction. They have given little thought to their Medicare options and do not understand how early choices will affect them in the future. Months before turning 65, they will begin receiving advertisements via mail, email, or even telephone directing them to various Medicare options. Some of these options may be well-suited to their needs, but others not.

Medicare’s Initial Enrollment Period begins three months before the enrollee’s birth month, includes that birth month, and goes on for three months more. During this seven-month period, the senior is asked to make important choices. Seniors who started receiving Social Security benefits before age 65 will automatically be enrolled in Original Medicare Parts A and B. Seniors who are not already getting benefits should enroll themselves as early as possible in the enrollment period. You can enroll in Medicare online through the official Social Security website, by calling the Social Security Administration at 1-800-772-1213, or by visiting your local Social Security office.

Whether you are enrolled automatically or self-enrolled, Medicare will send you a welcome letter early in your Initial Enrollment Period. This is accompanied by instructions on how to proceed. These instructions will tell you how to enroll in an Advantage plan (Medicare Part C) or to remain with Original Medicare, Parts A and B. Seniors will make a better choice if they have prepared for this decision, but most have not. If you or someone you know is about to enter the Initial Enrollment Period, NOW is the time to plan this out. The best decision is very much an individual matter. Even a senior couple, living in the same house, may have very different needs.

Advantage plans are a form of “managed care,” in which the Medicare enrollee is placed in a network of doctors, hospitals, pharmacies, and other care providers associated with that plan. Using a provider outside the network may not be covered by Advantage plans. Many medical professionals feel that managed care is better care, because it encourages coordination between care providers. Advantage plans simplify things for most seniors; they combine hospital, doctor, pharmacy, and other coverage into one package. They may offer other perks like gym memberships designed to keep seniors healthy. On the other hand, Advantage plans restrict the choices you can make and may require prior approval before you see a specialist. Once you are in an Advantage plan, it is difficult to change until the Annual Enrollment Period that comes once a year.

Original Medicare provides major (but not complete) coverage for hospital and non-hospital expenses. It allows you to choose any care provider who accepts Medicare, not restricting you to a network. Original Medicare alone includes no prescription drug coverage. Because this coverage is not complete, it is wise to buy a supplemental plan (Medigap) to cover hospital and non-hospital care and a separate Part D plan to help pay drug costs. This means that you will be dealing with several different insurance policies.

Choosing between Advantage Medicare and Original is the first big decision you must make. This may be a complicated choice involving several factors. Each senior’s circumstances will be different, so you must educate yourself to make this decision. Below are some key facts to consider when deciding.

Advantage plans are local organizations with a fixed set (a network) of local providers from whom you must get care. Medigap plans pay for Medicare approved services throughout the United States.

Medigap plans are designed to fill in the gaps between what a provider charges and what Medicare pays (typically 80% of the approved charge.) There are ten standard Medigap plans labeled with letters A, B, C, D, F, G, K, L, M, and N. Each lettered plan provides a specific set of benefits, and the coverage is the same for all plans with the same letter, regardless of the insurance company offering them or where they are sold.

Advantage plans can vary greatly between insurance companies and locations. Seniors opting for an Advantage plan should compare benefits and costs carefully. Review the plan’s Summary of Benefits document. It will tell you what’s covered, as well as listing copay amounts, deductibles, and premiums for which you’ll be responsible.

The monthly payment deducted from Social Security benefits is the same for Original Medicare and Advantage plan members. Seniors enrolled in Medicare Advantage plans continue to pay their Medicare Part B premium, which is typically deducted from their Social Security benefits. Medicare Advantage plans are sometimes called replacement plans, but this isn’t quite true. You’ll need Original Medicare in order to enroll in Part C.

Advantage plan benefits are subject to change each year, while Medigap letter plans are unchanging by law. Advantage members should review their Annual Notice of Change letter each year to be certain the plan still meets their needs.

The Initial Enrollment Period offers a one-time opportunity to be automatically accepted by a company offering Medigap plans. If you miss this chance, the underwriter may require you to pass a physical examination, pay a higher premium or even refuse to write the policy. Once you are accepted by a Medigap plan provider, you are guaranteed coverage if you pay the premium. You cannot be cancelled or charged higher than normal premiums.

That is a brief summary of the Initial Enrollment Period. In the future, we will try to bring bite-sized lessons about important aspects of Medicare. A lot of OurSeniors cross paths with Medicare each day. We call it Medicare Corners. Thanks for reading our blog and have a great day!

Each birthday is a special event, a day to be remembered and celebrated. For Elizabeth Cummings Hertling and those who know her, several recent birthdays have been especially memorable. Two years ago, the city of Orlando sent a delegation of firemen to help her celebrate. The mayor also showed up. After all, turning one hundred years old does not happen that often. Mind you, that was two years ago. By the time this article is in print, Elizabeth will have celebrated birthday number 102!

There are many reasons for selecting a person as one of the OurSenior’s “Amazing Seniors.” If you could talk to this 100+ year old lady, you would certainly agree that she qualifies. At 102, Elizabeth Hertling’s mind and expressiveness are those of a vital, young adult. She remembers her youth, her employers, her travels in the U.S. and Europe. She clearly remembers the world into which she was born and how very different it was from today.

She was born 102 years ago in the town of Charleston, West Virginia. Charleston was West Virginia’s capital and the largest city in the state, but it was still a relatively small town. At an early age, her mother and father divorced, and she was raised by her mother. Asked what she remembered about her childhood, she had two comments- “We were poor” and “I never want to see another snowflake.”

Elizabeth is a member of that group we call “The Greatest Generation,” the people who would not allow adverse circumstances to keep them down or discourage them. At the age of 18, she got her first job working at the S. S. Kresge & Co. store in Charleston. Kresge stores were open 9 to 5 on weekdays and 9 to 9 on Saturdays. That made a 52-hour week for which she earned $9.95! Elizabeth describes herself as one of those people who would try anything, so she quickly adapted when asked to work at the hardware counter. In those days, it was an unusual place to find a woman working.

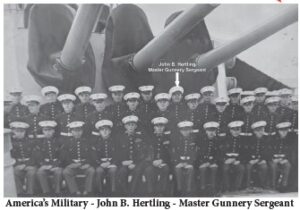

Her hard work and talent with figures were recognized. She was promoted to the office and bookkeeping department where she earned $17 a week. All the time, she was working to improve herself. On scholarship, she took courses at Kanawha College and the University of Charleston. A big part of her life would be spent in administrative and accounting fields, often for America’s military.

Surely, many days of work and study have blended together in her memories of Charleston, but some recollections stand out. Seniors may recall “paper boys” who would stand on street corners shouting out headlines and selling local newspapers. That was how she learned about the attack at Pearl Harbor after coming out of a movie theatre. Four years later, she was watching an impromptu parade celebration of V.E. Day when the parade Marshall recruited her into the march, handed her his baton, and let her lead the way.

Like many members of that “Greatest Generation,” Elizabeth was not satisfied staying at home forever. Her attitude has always been “Do what you want. If you don’t like it at first, try it anyway!” One day she saw a copy of a book you may recall, “Fodors Europe on $10 a Day.” That gave her the desire to travel, and she took off for Europe with no partner or traveling companion and visited ten countries in 31 days. Elizabeth was always ready for adventure!

When she returned, she resumed her career, often working in military related jobs. One of those was in Camp Lejeune, where she made the acquaintance of General Chesty Puller, the most decorated Marine in history. America recalls General Puller as a fierce fighting man, but Elizabeth remembers his devotion to family.

In her travels and adventures, she found time to marry three times, outliving each of her husbands. She encountered several serious health problems, including a cancer that may have been related the pollution found in Camp Lejeune drinking water. Each time, she fought off the disease and seemed to go on and on. She did give up driving last year, but she has kept her Prius just in case. For years, she was known as the “Bridge Lady” at Orlando’s Beardall Senior Center, where she organized the bridge games and tournaments.

Elizabeth is looking forward to more good years. After all she had aunts who lived to be 105 and 108. Most of all, she is spunky, alert, and full of fun! When OurSeniors.net asked about her secret to longevity, she did not name any food, exercise, or health product. She repeated her advice, “Do what you want. If you don’t like it at first, try it anyway. You can change it when you get old.”

Here’s to you, Elizabeth Hertling. You truly deserve the title, “Amazing Senior.”

It’s a topic many find uncomfortable to talk about, but it’s common fodder for poets, songwriters, novelists and artists: death. We all have to face it one day, and if we’re lucky we have loved ones to be there for us when the time comes. One of the best things we can do to help our loved ones is to have a plan in place and make sure that plan avoids these estate planning mistakes.

The most common mistake is to have no estate plan in place at all; no will, no durable power of attorney, no health care surrogate or no living will. Without those documents to guide your family they may not know your wishes or be able to help you if you become disabled.

No will means that when you die Florida law dictates who inherits your estate. Having beneficiaries on assets like bank accounts will keep them out of probate, but otherwise your assets will pass to the people determined by Florida law. That would be a surviving spouse first, then your children, then your parents, then your siblings, then nieces and nephews, then cousins, and so on. If that’s not what you want, you need a will to state who your heirs are.

No durable power of attorney or health care surrogate means there’s no one named to make financial, legal, or health care decisions for you if you can’t. That may force your family to seek a guardianship over you which can be expensive and time-consuming.

No living will means your family will have to decide about end-of-life care and whether your body is kept alive for a prolonged time using machines. If you do not want artificial means prolonging the death process you need a living will saying so.

The next most common mistake is to have an improperly executed will. Florida law requires a written, signed will with two witnesses who also sign in your presence. Having a will with insufficient witnesses is just as bad as having no will at all. Further, to make the probate easier all three signatures should be notarized in a self-proving affidavit.

Another common mistake is creating a revocable trust and then not funding it. The main purpose of a revocable trust is to minimize the need for probate. The trust cannot do that if assets that are otherwise subject to probate are not transferred to it while you’re alive or if other provisions are not made to transfer them automatically upon death.

Florida’s rules for how homestead is treated at death are fairly unique, and not properly following them can be a disastrous mistake. First, Florida restricts who can inherit a homestead if the deceased owner was married at the time of death. In that case, only the spouse can inherit the homestead. Any attempt to leave it to someone else is an invalid gift. If the deceased has no surviving children, or only children with the surviving spouse, the spouse gets the homestead outright. If there are children from another relationship, then the surviving spouse gets to choose a life estate or a one-half interest in the homestead, and the children get what’s left over. That’s why it’s important to have a second spouse waive any homestead right if the goal is to leave it to the children from the first marriage.

Second, Florida law provides very strong creditor protections for a homestead that passes to family. Essentially, no creditor can touch it except for the mortgage-holder, a worker who puts a construction lien on it, or the IRS. Other than that, the homestead passes to your family regardless of how much you owed when you died. The mistake that occasionally occurs is that the will contains a direction to sell the homestead and distribute the funds among the family. That direction to sell cancels that creditor protection, and all the probate creditors that crawl out of the woodwork after you die can go after it.

Estate planning is essential for helping our loved ones know what we want to happen when we pass and for giving them the legal authority to help us when we need it. Mistakes can happen, but most can be avoided with qualified professional help. See your estate planning attorney to make sure your plan is what you want and need. After all, the worst planning mistake is not to plan.

Sugars are sweet, caloric compounds that occur naturally in fruits, vegetables, milk and honey, and are one of three main types of carbohydrates which include starches and fibers. Carbohydrates are one of the three macronutrients found in foods and drinks along with proteins and fats. Carbohydrates are an essential part of a person’s diet because they are broken down glucose and provide the main source of energy for a person’s cells, tissues, and organs. They are particularly important for red blood cells, the central nervous system and the brain.

It’s estimated that an average person in the U.S. consumes about 270 calories per day from added sugars. Added sugars are used to provide sweetness, color and flavor, body, bulk, volume and texture in many foods. They do not have a different caloric value than naturally occurring sugars and metabolize at the same rate. Still, added sugars should be something to look out for because according to the Dietary Guidelines for Americans 2015 – 2020 and our senior magazine, people should consume less than 10% of calories per day from added sugars to aid in maintaining a healthy eating pattern.

Hidden Dangers of Sugar Intake

The extra number of calories that one consumes with moderately high to high sugar intake can lead to weight gain and a subsequent downward energy spiral as sugar calories are metabolized and depleted over a few hours. Here is a list of hidden dangers seniors should be aware of with unchecked sugar consumption:

Negative Effects Worsen with Age – A person’s metabolism slows down with age, and seniors particularly need fewer calories per day to maintain a healthy functioning body. Added sugars take up a bigger chunk of the number of calories one needs, and it can quickly lead to an imbalanced Body Mass Index-(BMI).

Can Increase Risk for Several Diseases – Research suggests that sugar increases health risks leading to type-2 diabetes, heart diseases, and certain types of cancer in seniors. High sugar intake is also linked to inflammation that can make arthritis or joint pain symptoms worse.

It’s Linked to a Shorter Lifespan – Regardless of a person’s physical activity, weight, or healthy diet choices, a person that consumes more than 20% of calories from added sugars is more likely to die from heart disease than people who consume less than 10% of calories from added sugars.

Possible Increase in “Senior Moments” – As we age, people become less adept at metabolizing glucose levels in the bloodstream which is associated with several health issues. Recent studies show that higher glucose levels in people over 50 are linked with momentary forgetfulness and point to where the aging process acts in the brain.

Simple Steps to Reduce Sugar Intake

If you have an uncontrollable sweet tooth and have personal or health reasons to cut the amount of sugar you consume, there are numerous things you can do to reduce the amount of sugar intake per day without having to sacrifice flavor or pleasure to lead a healthier life.

Examine Food Nutritional Labels – People tend to look at calories, fat content, sodium levels, and carbs when reading nutritional levels. This is a great start but often people forget to look at ingredients to find instances where sugars have been added for taste. Anything from tomato sauce to salad dressing to bread may contain added sugars you can cut off.

Buy Individually Wrapped Sweets – Most of us have heard the phrase “you can’t stop at just one” and associate it with snack foods like chips or sweets. For anyone who has a sweet tooth, having just one piece of candy triggers your brain’s reward system. This can be curtailed, somewhat, by buying individually wrapped desserts so that you can keep track of the amount of sugar you consume.

Beware of So-Called “Health” Foods – In the last decade, many people have been convinced to purchase so-called healthier snacks including yogurts, granola bars, and energy bars. But a lot of these options may pack as much sugar (and sodium) like candy bars and potato chips. Be sure to check those labels and don’t assume something is healthy because it is labeled as such.

Prepare and Eat a Healthier Breakfast – Avoid sugary breakfasts as much as possible. They lead to all-day sugar cravings that can wreak havoc on your health. Think about your breakfast options ahead of time and think about using natural sugar sources instead of substitutes to add flavor.

Incorporate More Natural Sugars – Numerous senior living resources suggest swapping smarter sweeteners like stevia in recipes for your favorite foods and drinks. We recommend you go a step further and use natural sugar foods like dates, bananas, beets or cinnamon to sweeten your recipes.

Any dietary changes you are considering should be discussed with a qualified medical professional. There are numerous pros and cons to reducing sugar intake in your diet and need to be carefully monitored to ensure you remain healthy. At OurSeniors.net, we aim to bring helpful information to enhance the quality of life of our senior community. Check out our website, Facebook page, and senior living magazine for great content to help you and your loved ones lead happier and fuller lives.

Disclaimer: The information provided in our Magazine or on our website is intended for informational purposes only. It should not be construed as a substitute for professional medical advice. Always consult your physician or healthcare provider for medical advice. For additional Disclaimer information please visit https://ourseniors.net/disclaimer/

If you feel like you see more people with pets these days, it’s not just your imagination! In 2023, 66% of households reported owning a pet compared to 56% in 1988 (Forbes). As a senior online and print magazine that covers senior lifestyle tips, we thought it would be fun to share some reasons you might consider joining the 66%. Because, as it turns out, having a pet is rather beneficial for your health. Here are the perks of having a pal with paws:

Having a pet (particularly a dog) gets you out more. Procrastinating getting in your daily exercise? Well, your dog won’t take no for an answer! He’s ready to go for a long walk. Go get your steps in and show your pet the beauty of where you live–whether that’s a tree-lined neighborhood, a rustic retired community, or a cozy assisted living home. Your pet will make sure you get moving throughout the day–and they might even make it fun!

Pets help reduce your stress. Sounds too good to be true, right? Actually, studies show that being around animals reduces your cortisol levels (Animal Health Foundation). This is why some universities bring puppies to campus around the time of final exams. Having the chance to pet and interact with an animal during a stressful time can be healing. If you’re feeling stress in your life dealing with insurance, medical issues, relationships, home care, or any number of life’s problems, it might be worth a visit to your local pet store (even just to look!)

Your pet can help you make new friends. If you’ve ever walked a dog before, you know it’s a wonderful conversation starter. People will stop you in the street and ask for your dog’s name, age, and breed. This can be a good way to get to know other animal lovers. Additionally, if you take your pet to the dog park, you can chat with the other owners about your furry pals while they play. Who knows? Maybe you’ll hit it off with another pet owner and make dog park visits a weekly tradition!

Having a pet can alleviate anxiety (National Institutes of Health). Some researchers theorize that this is because animals live in a state of mindfulness. They are not caught up in worrying about the future or panicking about their circumstances. They are ready to focus all of their attention and love directly on you. Perhaps being in their presence helps you to channel that mindfulness in your own life.

Pets can help you age better. A recent study of adults living in long-term care facilities revealed that animal-assisted therapy (basically, regular interaction with animals as a form of therapy) helped reduce symptoms of depression and boosted cognitive function (One Health). It turns out that, in addition to being adorable and getting into all of your balls of yarn, your kitten is actually helping your brain health. Who would have thought?

If you’re not quite ready to make the plunge and purchase a pet of your own, there are still ways to benefit from interactions with animals. You could offer to walk a neighbor’s dog or stop by the pet store sometimes to watch the hamsters play. However, if you’ve thought about buying an animal, there are lots of reasons why it’s a great choice. Not only is owning a pet sure to be a fun adventure—it also means better health, improved happiness, and a friend to stick by you through thick and thin.

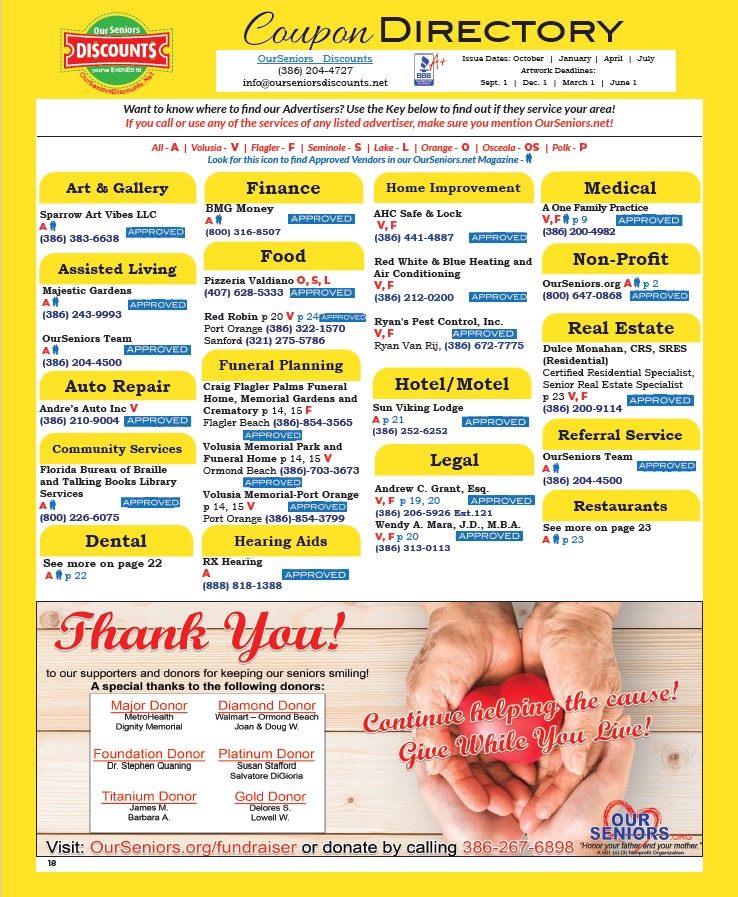

The team at OurSeniors.net strives to build relationships with trusted vendors and service providers throughout the state. Since 2016, our senior online and print magazine has established meaningful partnerships by carefully vetting businesses that adhere to our Code of Ethics before they make our Approved Vendors Directory. Check out all our partners’ discounts and coupons in our quarterly senior publication which is now available entirely in Spanish and you can see it online here:

https://ourseniors.net/editions/