Sample Magazine

Contents

Fall 2022 | Volume 6 / Issue 4

In the News

4 | Que PasaOurSeniors.net: Have You Heard What’s Up? Well, Que Pasa, USA!

5 | Que Pasa OurSeniors.net: Did You Know?

Community

14 | Election Day Is Coming

15 | Brunch & Learn

Entertainment

16 | OurSeniors Comedy/ Word Search

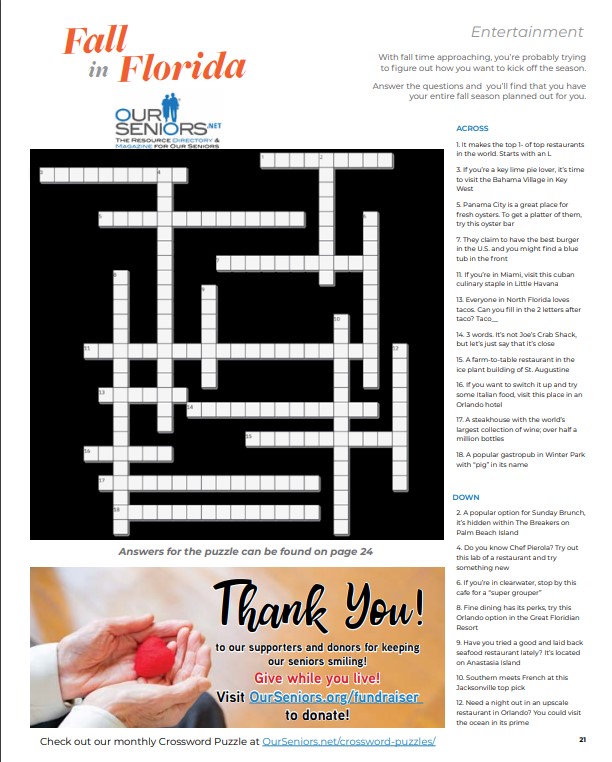

21 | Crossword Puzzle

Finance & Retirement

12 | The BMG Money Loans for Retirees Program

Fraud & Security

11 | How Seniors Are Being Targeted with Fraud in 2022

Health & Wellness

6 | Hearing Aids Entering a New Era of Technology & Telehealth Services

Inspirational

18 | Amazing Seniors – An Interview with Ana Margarita Menéndez. Remembering “Que Pasa, USA?”

19 | Amazing Seniors – Qué Pasa, USA?: Connie Ramirez, A Look Back in Time at a Cultural Jewel

20 | The Old Man Is Dead

Insurance

8 | Medicare Open Enrollment 2022

Legal

10 | Think And Plan Ahead For The Unexpected

Don’t miss another edition by donating! Visit OurSeniors.org/donate

Disclaimer: The information published in this magazine and our website is intended for residents of the USA. The opinions, beliefs and viewpoints expressed by the various authors in this magazine and on this web site do not necessarily reflect the opinions, beliefs and viewpoints of OurSeniors.net Magazine or official policies of OurSeniors.net Magazine, OurSeniors Radio, OurSeniors Discounts, OurSeniors.org, Inc. and or its related entities. It may contain general information about medical conditions, public and private health service organizations and other third-party information including but not limited to testimonials. The information is not advice (legal, medical or otherwise) and should not be treated as such. Consult your licensed Professional such as Attorney and or Doctor etc. for further advice. No claim is made as to the accuracy, authenticity or completeness of any information and, is often provided in a generalized or summarized format for brevity. OurSeniors.net Magazine, LLC and or its subsidiaries, does not accept any liability for the information (nor for the use of any information) provided by this magazine and or website. The information presented by this magazine and website is provided on the basis that all viewers undertake responsibility for assessing the relevance and accuracy of the data related to their circumstances. Thank you for reading our magazine and visiting www.OurSeniors.net and please contact us if we can be of further assistance. All real estate advertised in OurSeniors.net is subject to the Federal Fair Housing Act. This federal law makes it illegal to advertise any preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preferences, limitation, or discrimination. We will not knowingly accept any advertising for real estate which violates the law. All persons are hereby informed that all real estate advertised in OurSeniors.net is available on an equal opportunity basis. Information contained herein has been furnished by community owners, managers and agents. OurSeniors.net and or OurSeniors.online, OurSeniorsDiscounts.net and or OurSeniors.org, Inc. and OurSeniors.net Magazine, LLC do not make any representations as to opinions and facts. All terms and conditions of rentals are subject to change. OurSeniors.net reserves the right to refuse advertising space to anyone deemed unsuitable for placement in this publication. OurSeniors.net, OurSeniors.online, OurSeniorsDiscounts.net and or OurSeniors.org, Inc., and OurSeniors.net Magazine, LLC retains all rights reserved by copyright 2023 OurSeniors.net, and or OurSeniors.net Magazine, LLC. This publication or parts thereof may not be reproduced in any form without the written permission of the publisher. For further Disclaimer information please visit https://ourseniors.net/ and click Disclaimer on the footer of the website. Please note that websites and links are referenced in the magazine and you may have complete access to our online version by visiting. www.ourseniors.net/editions.

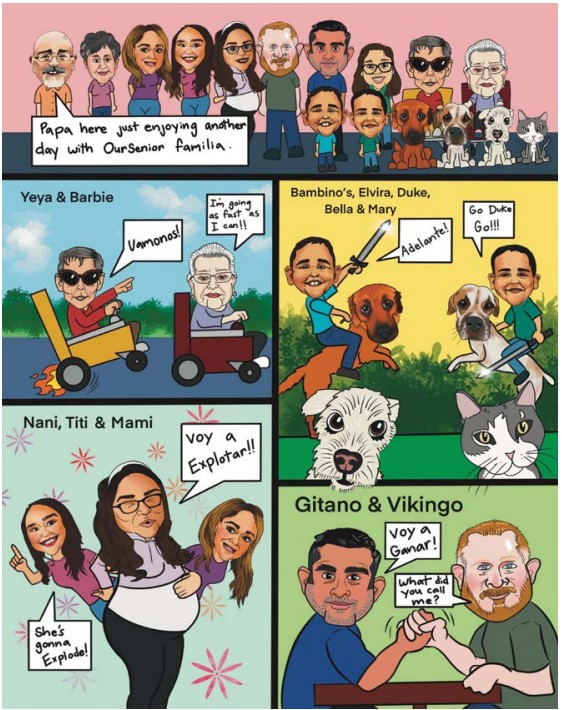

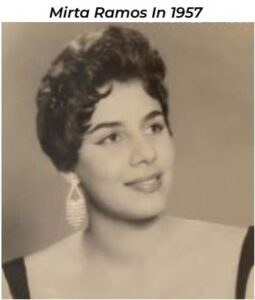

Dear Readers, Subscribers and Donors, I would like to start by announcing that this Edition Is being dedicated to an Amazing Senior and Patriot Mirta Ramos, RIP 1936-2022. She was truly someone who lived thru Marxism, Socialism, and yes Communism firsthand thru the takeover of Cuba by the “I am not a Communist,” Fidel Castro. Like Ms. Ramos expressed many times, I am also very grateful to have had the opportunity to come to the greatest Country in the World, yes, the USA! It’s time for America to wake up, yes Que Pasa USA? As Ronald Reagan once stated “Freedom is never more than one generation away from extinction. We didn’t pass it to our children in the bloodstream. It must be fought for, protected, and handed on for them to do the same, or one day we will spend our sunset years telling our children and our children’s children what it was once like in the United States where men were free.” For more information about Mirta and other Amazing Seniors please visit https://ourseniors.net/amazing-seniors-2022/ . Now with the holidays on the horizon, there’s no better time to not just think of or send a card to, but physically be with family, friends, and neighbors, especially those seniors who might be aloneif if possible. If you didn’t already know, one in every nine Americans, or 11%, have spent winter holidays alone. The percentage is even higher for New Year’s Eve and New Year’s Day at 16%. With that, think about how difficult it might be for seniors to see all of their families if they don’t live nearby. The holidays are for enjoying time with your loved ones and doing things to make each other smile. Aside from togetherness, many people can escape the exhaustion of their job, achieve some well-deserved relaxation, and have something to look forward to. Nearly 28% of people over 50 have said that they’ve felt lonely during a holiday and that’s what we want to prevent. If you are unable to physically be with your loved ones, there’s no need to worry. When getting creative is an option, there is never the need to feel discouraged. Virtual calls including zoom or Facetime, shipping gifts and opening them at the same time on camera, or hosting a “remote” event can promote love and togetherness just as much as a physical visit can. Of course, it will be a different feeling than really being there in person but it’s the thought and the effort that counts. With all of the excitement around gearing up for the holidays, we do have an early surprise for you! If you speak Spanish as a primary, secondary, or even a third language, or you’re just intrigued by reading something in another language, you’re in luck. Que Pasa OurSeniors is being released and what’s special about this edition is why and how it’s made. Using Que Pasa USA, a brilliantly-done bilingual sitcom, as our muse, we think we’ve crafted something that will not only inspire our Spanish-speaking audience but honor what the show has meant to its viewers, just as we hope to do with our readers. This edition was crafted by our bilingual team and we’re excited about this release because we get to honor our roots in a part of the way we started….with the Hispanic population within South Florida. Que Pasa USA was a diamond among lost treasures of sorts. The show used a comical medium and real-life obstacles of Cuban-Americans to help viewers better relate to the stories portrayed in the episodes. It’s safe to say that the tactic worked and people today are still watching or reminiscing about the 1977 show. That type of reaction…that type of connection, is what we hope to give our readers. With all of the talk about holidays and fun announcements, you’d think there wouldn’t be anything left to say but we do have one more thing for you. OurSeniors is dedicated to catering to the senior population of Florida, and other areas where we can extend our care. We work hard to provide seniors with useful resources, information, and guidance when it’s needed. We also do what we can to cater to our readers through the content we curate, the giveaways that we secure, and the vendors that we work with. Everything we do and everyone involved whether directly or indirectly, all come together to create what you know as OurSeniors Magazine. If you enjoy our content, whether, through a digital or a paper copy, we’d love to hear from you. Remember, things only get better when there are voices behind ideas, questions, and comments, and we’d like to welcome them all. You are the reason we strive and the reason we can reach the communities we serve and that will never go unnoticed. With the issue of the new magazine being released and all of the hard work that’s been poured into its creation, we want to invite you to give us your honest opinion and let us know what you think. If it made you excited, we’d be glad to hear what you liked best. If it made you feel inspired, we’d love to know in what way. And if it makes you feel empowered to learn something new, we’d love to know what. Overall, if you’re enjoying following, reading, or supporting our magazine….or all of the above, consider pledging a donation as it will help us to continue what we do and how many more people we can reach.

Take care,

Julian G. Cantillo, L.P.N, President and Founder of OurSeniors.net Magazine

Disclaimer: The views and opinions expressed in this letter are those of the author and do not necessarily reflect the official policy or position of OurSeniors.net Magazine and or its related entities.

OurSeniors.Net, its webpage, its printed magazine for seniors, and its online magazine for seniors try hard to be your go-to resource for senior living in Florida. In each issue, we bring you useful information about topics that are important to seniors and their families. Senior housing news, Social Security and Medicare information and resources for elderly living are all common topics as we try our best to be your senior living resources library.

Our printed magazine has grown in scope and circulation to cover most of the state. To provide better local coverage, this magazine for seniors now publishes several regional editions, each aimed at seniors in a specific area of Florida. We feel that this is the best way to meet our goal of serving the needs of all seniors. But there has been one big hole in our coverage: Spanish-speaking seniors! We have not been with them in their preferred language.

That is changing! Starting in October, the Southeast Edition of our magazine for seniors will be printed in both English and Spanish. This area of Florida includes Miami-Dade, Broward, and Palm Beach Counties, a very large Spanish-speaking service area. Future editions of your favorite magazine for seniors will expand this feature to include other areas of the state. We know that senior living in Florida is great, and OurSeniors.Net strives to serve the Hispanic senior community as it serves all seniors.

Both Spanish and English-speaking seniors will find this new edition useful. It will be a unique, two-sided publishing approach with English text on one side of a printed page and Spanish on the other. Useful for both communities. Your favorite senior online magazine, OurSeniors.Net Magazine will also be available in both Spanish and English versions.

Our bilingual edition launches a few weeks in the future, but right now let’s have some fun recalling a past event. That event bears some relationship to our upcoming Spanish-English debut. It was the groundbreaking TV series Que Pasa USA, the first bilingual situation comedy in the U.S.

Cuban citizens began to pour into South Florida in the early 1960s, but for many years they fully expected to return to the Cuba they loved. As the years passed and these hopes faded, they began to assimilate into their new home. As with all groups, the process of assimilation was not always easy for Cuban Americans. Older Cubans often clung to the customs, social habits and language of their native land. Younger Cubans had come to the U.S. as very young children or were born here, and they grew up in a bilingual world. The two cultures were bound to have some conflicts, and Que Pasa, USA treated these skirmishes with humor and understanding.

Today’s seniors may well remember this well-produced and written show. It was a class act; in fact, it was funded by the National Council on Fine Arts. The show was bilingual, just as Miami, South Florida, and many other American communities were becoming. It’s story-line related to the relationships in and around the family of Pepe Peña, who immigrated from Cuba in the 1960s and settled in Miami. With him, he brought his wife, her parents, and a young son. A daughter was later born in Miami.

Que Pasa, USA delved into the tribulations of three generations of family members as they struggled to fit into a new country and language. Critics loved the show for the way it accurately depicted family life in Miami’s Little Havana in the 1970s. Its bilingual script earned it both English and Spanish-speaking followers.

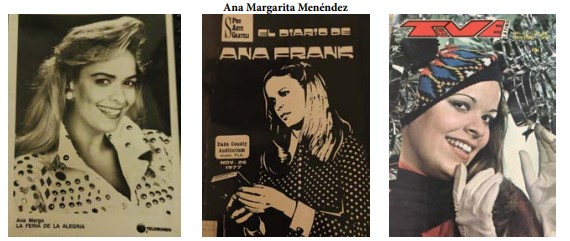

When our bilingual edition launches in October, it will feature an interview with Ana Margo Menendez, the actress who played the part of Carmen Peña, the daughter who was the first Peña born in the USA. Ana (Carmen) will share her remembrance of the show and her extensive career. Ana is still very much a part of the South Florida scene.

Be on the lookout for this exciting addition to the OurSeniors.Net Magazine. Our hard-copy senior living magazine and our on-line senior living magazine are here to serve the needs of seniors.

Here is some great news! Starting with the Fall Edition of OurSeniors.Net Magazine, we will begin to publish a bilingual-English and Spanish edition. At first, this innovation will be available in only the South Florida Edition, but we intend to expand this format to all our coverage areas.

OurSeniors.Net has always understood the importance of Spanish-speaking seniors to the state of Florida, and the U.S. We now cover all of Florida, but our roots go way back to south Florida and its Hispanic population. It is natural for us to want to be the number one senior living resource magazine for both English and Spanish-speaking seniors.

This bilingual edition will serve the needs of readers and advertisers alike. It’s a great idea, a way to reach a much wider audience, but it is not new. In the late 1970s, Miami television station WPBT came up with a great innovation- a bilingual sitcom. The show was titled “Que Pasa, USA,” and it quickly became a big hit in Miami and national syndication. It won sponsorship from the National Council for the Arts, and for five seasons, the show told the story of the Pena family. It sympathetically related to their struggles in trying to adapt to their new home, America. This show appealed to a wide audience, but especially to America’s Cuban American population. Que Pasa, USA accurately reflected the experience of many Cuban families.

Young Cuban Americans had little or no remembrance of life in Cuba. They had very different ideas and social behaviors, leading to inevitable conflicts with parents and grandparents. These situations also supplied opportunities for a lot of laughs as the Pena family transitioned to American life. It was a great show, so try to find some episodes on YouTube or another source.

Here is some more great news- OurSeniors.Net is adding a second identity. We call it QuePasaOurSeniors.Net, and it will enlarge our reach to include the hundreds of thousands of Floridians who prefer to be addressed in Spanish. Like “Que Pasa, USA,” it will serve a big need. In this case, we are striving to serve the needs of Spanish-speaking seniors. We are really excited about this new project. It allows OurSeniors.Net to reach hundreds of thousands of new readers and viewers. Our bilingual staff is already up and running, eager to jump into this venture.

Now, imagine this. You are hiking in the mountains of North Carolina when you pass a family you have never met. As they pass, one of the party points at you and asks, “Are you Carmen from Que Pasa, USA?” Exactly that happened to Ana Margo (Ana Margarita Menéndez), one of the cast members, and it happened years and years after the show had ended. That’s how beloved the show was. Viewers recalled it for years.

Ana played the part of Carmen Pena, the young daughter of the Pena family. She still recalls the show, its cast, crew and writers with great affection. Playing Carmen Pena was a natural part for that young Ana Margo because she had lived the story. Born in Cuba, she began her theatre career at a young age but left Cuba soon after the Communist Revolution.

On August 16, 2022, the U.S. Food and Drug Administration (FDA) issued a final rule to improve access to hearing aids which will in turn lower costs for millions of Americans suffering from hearing loss. This law establishes a new category for over-the-counter (OTC) hearing aids, enabling consumers with perceived mild to moderate hearing loss to purchase hearing aids directly from stores, online retailers, clinics and pharmacies without the need for a medical exam, prescription or a fitting adjustment issued by an audiologist.

Over 30 million adults in the U.S. could benefit from hearing aid use. “Today’s action by the FDA represents a significant milestone in making hearing aids more cost-effective and accessible,” said Health and Human Services Secretary Xavier Becerra.

The Law has been imminent for some time, since in 2017 Congress passed the legislation with bipartisan support. The Biden Administration made the rule a priority for it to be implemented in conjunction with the passing of the Inflation Reduction Act.

As early as mid-October, consumers over the age of 18 will have the ability to purchase hearing aids over-the-counter. The rule is expected to lower the cost of hearings aids, stimulate competition and improve the accessibly to hearing care services and solutions. It is designed to assure the safety and effectiveness of OTC hearing aids while fostering innovation and competition in the hearing aid technology marketplace.

The specifications and criteria of what a hearing aid is are being defined, all with the consumer’s hearing health being a top priority. The central requirements are that the volume level must be able to be adjusted by the user, the amplification level is limited to prevent accidental ear damage, lowering the maximum sound output to reduce the risk of over-amplification, limiting the insertion depth of the device in the ear canal and simplifying the phrasing throughout the required device labeling to ensure it is easily understood. The final rule also includes performance specifications and device design requirements specific to OTC hearing aids.

Specific information in hearing aid labeling is essential for consumers to identify conditions that either may pose a threat to health if left undiagnosed or avoid unnecessary and inappropriate hearing aid use. The consumer needs to review the label of the device and understand and claims the seller is making before making a purchase.

You may have seen Personal Sound Amplification Products (PSAPs) in stores or online, like Amazon. These are not alternatives to hearing aids. The FDA is aware of confusion in the marketplace when the consumer is considering a hearing aid or a PSAP to assist with their hearing loss.

PSAPs are not intended to compensate for hearing loss and cannot be labeled as hearing aids. They are intended to accentuate sounds in specific listening environments. Examples of situations in which PSAPs typically are used include hunting, bird watching, listening to lectures with a distant speaker, and listening to soft sounds that would be difficult for normal-hearing individuals to hear. PSAPs are not intended to diagnose, treat, cure, mitigate, or prevent hearing loss

Currently, the average price of a pair of quality hearing aids costs over $3,500. A small percentage of this cost comes from the components, manufacturing and the cost of overhead. A large slice is associated with obtaining hearing aids and having them fitted by an audiologist. The new law should also remove the predatory and deceptive marketing and selling practices used by Audiologists and others to sell hearing aids. You also can’t rely on your health insurance to pick up the costs either. There is no hearing aid coverage through Medicare parts A or B.

While you may see “hearing aids” for as low as $99 on Amazon or through other online retailers, these haven’t passed through any serious medical muster. As great as the price may look, it’s probably too good to be true. Simply put, buyer beware. Before purchasing a pair of hearing aids, be sure to contact the seller to ensure their trustworthiness. Also inquire about their warranty, customer service and if they have licensed hearing specialists on staff.

RxHearing delivers a comprehensive suite of hearing care services to identify people who may be suffering from hearing loss and then offers them an affordable hearing aid solution. RxHearing provides free professional online hearing tests, evaluates via free licensed hearing care consultations, then ships medical-grade hearing aids directly to their customers. Saving them hundreds of dollars.

If you are suffering from hearing loss, seek advice from your primary physician.

Summer is still on, but it’s time to think ahead about your Medicare coverage. Every year, Medicare beneficiaries have the opportunity to change healthcare options. The Medicare Open Enrollment Period (also called the Medicare Annual Election Period) runs from October 15 to December 7 each year. It is possible to make changes outside of this period, but the process is much easier during Open Enrollment. This is an opportunity to rethink the insurance plans you have chosen, either Original Medicare with Part D coverage or Medicare Advantage.

Why Consider a Change?

There are several possible reasons to consider changing Medicare coverage. The most common may be that your circumstances have changed, making your old coverage now inadequate. Most people join Medicare at age 65, a relatively young and healthy senior. By the time they reach age 75 or 80, this situation can change. They may need to see new specialists, take different drugs, or have specialized care.

Patients who have chosen Original Medicare with a Part D Prescription Drug plan probably have no vision or dental coverage. Many Advantage plans offer some vision and dental benefits, along with other programs not provided by Original Medicare. This added coverage may motivate you to change to an Advantage Plan. Advantage Plans often offer out-of-pocket savings compared to Original Medicare plus Plan D insurance premiums. With inflation biting at everybody’s budget, changing might make sense. However, you should investigate the details of any new plan before changing.

If you are already a member of an Advantage Plan, you will want to make sure that the providers (doctors, hospitals, pharmacies, etc.) you favor will continue to be “in-network” members of the plan. Going out of network can be costly to Advantage Plan members, and each year the network may add or drop providers. By investigating other Advantage Plans in your area, you may find a plan that better meets your needs.

What Do You Do Now?

Starting early in October, you will be showered with printed and broadcast material inviting you to join a given Medicare plan. Some of this advertising can be confusing, misleading, or inappropriate for your situation. To make the best choice, you need to begin thinking about this decision now; gather some essential information you will need. Here are some basic suggestions-

• Make a list of the providers you use. This should include physicians, labs, hospitals, pharmacies and any special services (i.e., physical therapy) that you use.

• Determine how much you have paid out-of-pocket for these services in the past year. This will include deductibles, co-pays, out-of-network charges, etc.

• Make a list of all the drugs you take and estimate your out-of-pocket expenses for each of those medicines. Are you taking any new medicines and are they on your plan’s drug formulary?

What Can You Do During Open Enrollment?

During Open Enrollment, you can easily make these choices –

• Change from Original Medicare to an Advantage Plan. You must live in the Advantage Plan’s service area and be enrolled in Parts A and B to join an Advantage Plan.

• Move from one Medicare Advantage plan to another.

• Change from an Advantage Plan to Original Medicare plus a Part D plan, and probably a Medigap Supplemental plan.

• Switch between Part D plans.

• Drop your Part D coverage altogether (you won’t be able to re-enroll until the following year’s Open Enrollment Period, and a late enrollment penalty may apply when you eventually re-enroll).

• Enroll in a Part D plan if you didn’t enroll when you were first eligible. A late-enrollment penalty may apply if you have not maintained other creditable coverage.

Think Carefully About Any Change You Make

Using the personal information, you have gathered, think about the changes you are considering. Do not act solely on the advice of a well-meaning friend. Find out what each option means for you. What drugs are covered, what doctors are in the network, and what perks or extras are included? Here are a few key points to remember-

• All Medigap letter plans (Medigap Plan A, B…N) provide the same coverages, but they may cost significantly more or less. A Medigap Plan N sold in New York City has the same coverage as one sold in Gainesville, Florida, but it may cost more. There can even be price differences in identical plans sold in the same locale, so shop if a Medigap plan is your choice.

• Many people confuse the terms “Initial Enrollment Period” and “Annual Open Enrollment Period,” and there is a critical difference. During Initial Enrollment (first-time Medicare enrollment), you are guaranteed acceptance into any Medigap letter plan without any question. If you drop out of that Medigap plan to join an Advantage Plan, this may not be true. After your Initial Enrollment has expired, an insurance company may decline to write a Medigap policy or require a medical exam before doing so.

• Part D Prescription Drug Plans vary widely, so be sure to compare closely.

• Advantage Plans are local organizations with specific sets of in-network doctors. Many Florida seniors spend considerable time out of the state. This may make Original Medicare plus Part D coverage a better choice.

• Advantage Plans vary widely. All Medigap letter plans are the same, but not so with Part C or Advantage Plans. There can be significant differences in-network providers, drug coverage and plan extras. Shop and compare.

Where Can I Get Help and Answers to My Questions?

Medicare maintains its official website with up-to-date information and answers to your questions. Go To Medicare.gov (the Official Medicare Site) to start navigating to the information you need. These two shortcuts might get you the answers you want a little faster- Find Medicare Providers Near You and Find Health and Drug Plans Near You.

Stay Tuned!

Yes, keep coming back to OurSeniors.Net for the kind of information that helps you make the best choices. As your senior living magazine and online senior living magazine of choice, we will continue to inform you about topics like senior housing news, living in Florida, Social Security issues, and Medicare options.

Thanks for reading our blog and have a great day!

Responsible seniors understand the importance of planning ahead and making certain that their wishes are known and honored, even when they cannot express those wishes themselves. OurSeniors.Net has often written about the importance of the timely, up-to-date legal documents that all seniors should have.

Unfortunately, these documents are not maintained by most seniors. A recent Gallop poll found that only about 50% of Americans have a will. Seniors, aged 65+ scored better at about 75 %. However, we suspect that other vital documents like a Living Will (Advanced Medical Directive) or a Medical Proxy/Power of Attorney for Health Care are far less common. A Power of Attorney for Health Care document assigns a “medical proxy” to make critical decisions if a senior is unable to. This can be a vitally important document. OurSeniors.Net knows this from experience.

Recently, one of the OurSeniors.Net staff members was involved in a situation where there was no designated medical proxy. Life and death decisions had to be made, and no one was clearly in authority to do so. Eventually, this situation was resolved, but only after great effort. This very difficult situation can be avoided if you plan and understand the important differences in end-of-life legal documents.

Many responsible seniors have already created a Durable Power of Attorney, and they think that this document will suffice for healthcare decisions. It will not. A Durable Power of Attorney grants someone the ability to make financial decisions for the principal, the maker of the document. It does not give the holder the right to make vital health decisions. Hospitals caring for incapacitated patients are not going to accept the Durable Power of Attorney (DPOA) as valid for making these decisions.

The proper document for granting the authority to make medical decisions is the Medical Proxy/Power of Attorney for Health Care. This document assigns a “medical proxy,” a person you trust, to make medical decisions if you are unable to do so for yourself. It is important to not confuse these two important documents. They serve completely different functions.

Without a proper Power of Attorney for Healthcare, critical decisions about care may have to be made by a court, or a court-appointed person not chosen by the patient. Most states have laws that direct courts to appoint medical proxies in a defined way—spouses first, then children, then other relatives, etc. This is a situation you want to avoid. It could cause unneeded conflict if there are differing opinions about what is to be done.

It is wise to check the status of all your legal documents regularly. Make sure they are up-to-date, properly stored, and that locations are known to your family. Do not confuse the Durable Power of

Attorney for financial matters with the Medical Proxy or Power of Attorney for Healthcare. If you have not made one or both of these documents, now is the time to do so. Think especially hard about who you want as a medical proxy and discuss this with them. Many people would not want to make this decision, and you should not put this burden on them.

If you chose a healthcare proxy years ago, is this person still able to fill this role? As people age, their capacity to deal with these decisions may change. Make certain that your healthcare proxy is still the person you would choose right now. You should also designate a backup or secondary proxy in case the primary choice is unable to fulfill the role. Doing this now can make a huge difference to your family if you are unable to make your wishes known. It is a good idea to review all your legal documents periodically. This review should include your personal will, Living Will (or Advance Medical Directive) and Powers of Attorney for both financial and healthcare matters.

The OurSeniors.Net Pro Team has several members who are uniquely qualified to assist you in keeping these documents up to date. Ms. Wendy Mara, J.D., M.B.A, and Mr. Andrew Grant, Esq. are both experts in these matters. They will be happy to assist you in creating, updating, and maintaining these vital documents. Click on OurSeniors ProTeam to see their contact and bio information.

The Pro Team is just one of the many services and features offered by OurSeniors.Net. You can look to OurSeniors.Net for the kind of information that helps you make the best choices. As your senior living magazine and online senior living magazine of choice, we will continue to inform you about topics like senior housing news, living in Florida, Social Security issues, Medicare options, and legal advice for seniors.

Thanks for reading our Magazine and please subscribe and share with others.

The people at this senior online and print magazine want you to imagine this scenario: You get an important message from your financial institution seeking to verify you have transferred hundreds of dollars to a dummy organization made to look like the IRS or some other agency you believed was legitimate just a day or two before. You were certain that you had “fixed” whatever issue you had over the phone by providing the friendly representative with personal and financial information on the spot.

You thought you had done the right thing and would not have to worry about this issue again. You now realize, unfortunately, that you fell for a scam and are now one of the thousands of victims specifically being targeted because of age. Seniors and retirees fall prey to fraudsters each day and sometimes it’s not just a few hundred dollars that is lost – in many cases it can be thousands of dollars. It is estimated that over $40B is stolen from the senior and retiree communities each year.

Here are some things to look out for when identifying a scam by phone or online:

• In the world of Public Health, contact tracers are individuals that will reach out to you unsolicited by phone, text, and email to determine whether you have been in contact with a person that may be carrying an infectious disease or illness. During the pandemic, this allowed many fraudsters to steal information from unsuspecting individuals.

You should know that contact tracers will never ask for money in any form (credit card, gift card, bank account, etc.). They will never ask for your social security, Medicare, or Medicaid numbers. They will also never ask you to fill out forms via email or links as they may come with malware that can steal your personal and financial information from your computer or phone.

• Grandparent scams are becoming more popular each year. They are carried out by phone, text, or email and usually involve a relative (usually a grandchild, nephew, or niece) requesting emergency financial assistance for legal, medical, educational, rental, and even automotive support among other situations.

In many cases, these fraudsters have your name and basic information regarding family information to convince you within a few minutes that they are who they claim and will instruct you on how you can help by transferring money you will never see again. It’s a good idea to hang up and call back using the contact information they provide. It is also essential you check with another family member to verify that what you are being told is true.

• SPAM Emails (Sweepstakes and Lottery Winners, Cost Savings, etc.). One of the biggest reasons scammers target seniors and retirees is that people in these communities may feel disconnected from friends and family and are more likely to engage with fraudsters. People who are less technically savvy are also willing to take the “authoritative” advice that comes from scammers on the other end.

Seniors and retirees should be leery of “exciting news” that promises them windfalls of cash. Many scams ask potential victims to pay a fee to collect on winnings. Scammers often take blind guesses and assume their victims are on fixed incomes and would quickly jump at the opportunity to save money on prescription medications, bank loans, and more if they are told they are lucky winners of once-in-a-lifetime opportunities.

If you feel you are a victim of a scam, you are encouraged to do the following: 1) file an incident report with your local police precinct or Florida’s attorney general. Get the incident on record to help with the investigation process. Most financial institutions are willing to work with law enforcement to ensure both sides have as much information as possible to prevent future crimes committed by those involved and will expedite any claims you have in your favor, and 2) File a complaint with the Federal Communications Commission (FCC) and/or the Federal Trade Commission (FTC). Both organizations share reports with law enforcement partners to facilitate investigations that help you and hundreds of seniors and retirees that can also fall victim to sophisticated phone and online scams targeting the senior and retiree communities.

OurSeniors.Net has been serving the senior and retiree communities in Florida with valuable senior living resources since 2016. Each quarter, we distribute a senior publication tailored to different regions in the state and regularly publish informative articles in our senior online magazine. Starting in October, we will publish a bilingual edition of our print magazine for the Southeast region and will eventually expand to provide bilingual editions for all the other regions we serve. We encourage our readers to subscribe and donate to assist us in our efforts to provide entertaining and helpful content to senior and retiree communities throughout our great state.

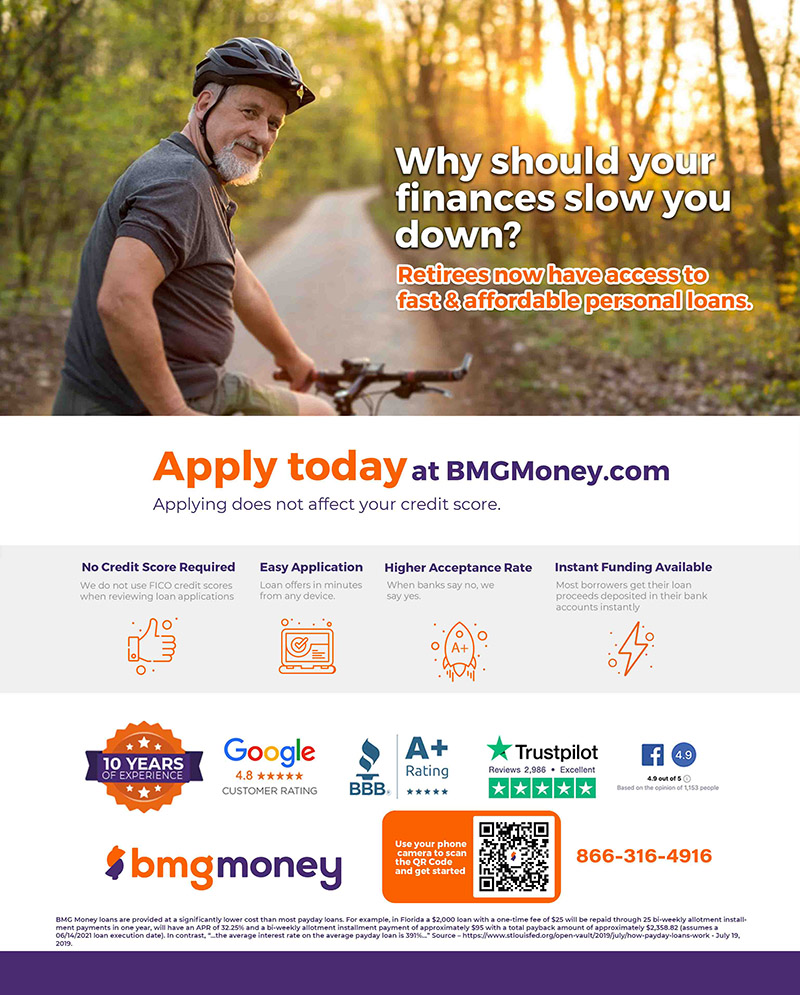

Inflation is hurting everyone, but it is especially hard on some seniors. Many retired people are living on fixed incomes and cannot control some important expenses. Medical costs, insurance premiums, and high gas and food prices are making life difficult for so many seniors. Rising interest rates are increasing the cost of borrowing and keeping an unpaid balance on bank credit cards. It can become a vicious cycle, charging expenses, building a larger balance, then paying ever-higher interest rates.

Financial news sources are predicting that interest rates will continue to climb during the coming year. This will mean higher interest charges for unpaid balances on bank credit cards and other debt. How can consumers, especially seniors, avoid falling into this trap?

OurSeniors.Net and Our Senior living magazine are here to help. One of our service-to-seniors partners, BMG Money, has been serving the needs of consumers since 2006. BMG Money is based in the senior-friendly state of Florida, but since its founding, it has grown to offer services in 42 states and the District of Columbia. BMG Money is a solid financial lending and education institution with high marks from rating sources like the Better Business Bureau and Trust Pilot. It carries a 4.9 (out of 5) GOOGLE customer rating.

When a senior is faced with unexpected expenses or financial difficulty, it may be hard to know where to turn for help. This means not only a loan but also financial advice and education. Seniors may not have the knowledge, time or energy to search through the many options found on a web search. Advice from friends or family is well-meaning, but it may or may not be accurate.

BMG Money is there to help with good advice, counseling, and a loan that is both affordable and quickly available. Best of all BMG offers several special programs aimed at retirees. Seniors are sometimes those who need these services most. BMG believes creditworthiness should not be governed by looking only at often misleading credit scores. Visit BMG Money Loans for Military Retirees or Loans for Federal Retirees to find out more.

Here are some great facts that seniors should know about BMG Money’s services and loans:

• BMG Money does not require a credit score in its application process. Unlike many lenders, BMG does not consider FICO scores when considering loan applications. You will not be asked for this information or for permission to check it.

• Applying for a BMG Money loan does not affect your credit score with credit rating agencies or with other lending organizations.

• BMG Money makes loans ranging from 500 to 10,000 dollars with easy convenient repayment options.

• BMG Money loan applications have a higher acceptance rate than banks. They like to say, “When banks say no, we say yes.”

• BMG Money loan applications are both easy and fast. You can start the loan application process online by visiting BMG Money. In many cases, loan offers will be available online in minutes.

• Instant funding is often available. Many borrowers get their loan proceeds deposited in their bank accounts the same day loans are approved.

• A BMG Money loan can help to build your credit history, offering a competitive Interest rate with affordable and automated payments.

BMG’s financial team members have many years of work experience at leading banks and other organizations. They share a goal of helping seniors to borrow responsibly, meet emergency needs, and improve their financial standing. BMG Money is one of OurSeniors.Net’s valued partners. Together we serve the needs of seniors in every way possible.

Thank you for reading the OurSeniors.Net blog and learning about the ways we and our partners serve the needs of seniors. Our website, our senior living magazine and our online magazine for seniors all strive to be the best senior living resources you can find.

Election Day, 2022 is just around the corner. Tuesday, November 8 is Election Day, and Tuesday, October 11 is the last day to register to vote if you have not already done so. This is the General Election, so your party affiliation does not matter. All good citizens should show up to vote, and we know that OurSeniors will turn out.

This “off-year” election is very important. Florida voters will choose a governor, a United States Senator, Representatives in the U.S. House and numerous local and state officials. These local officials determine what your zoning laws will say, how much you pay in sales or real estate taxes and how most local questions are decided. In addition, there will be three proposed amendments to the state constitution, all of which could affect seniors.

Proper Registration

Florida law requires citizens to be properly registered before voting in either primary or general elections. If you are a new voter or have changed your address since the last election, you need to register or update your registration information. Floridians who are already properly registered do not need to take any action.

If needed, registering or updating is easy. It can be done entirely online at RegisterToVoteFlorida.gov. If you prefer, you may use Your County Supervisor of Elections Office- Click the link to find yours. These offices can assist you online, by mail or in person. You will need your Florida driver’s license or a current Florida ID card, and the last four digits of your social security number. You will also need the issue date that is on your Florida driver’s license or Florida ID card.

Important Dates

September 29 to October 6- Supervisors of Elections send out vote-by-mail ballots to those voters who already have requests on file. If you have voted by mail in the past, you should receive a 2022 ballot early in October.

October 11- The last day to register or to correct registration information.

October 29- The deadline to request that a vote-by-mail ballot be mailed to a voter. This may be important to seniors who are home-bound or wish to vote-by-mail for the first time. If you voted by mail in the last (2020) election, you should automatically receive a 2022 vote-by-mail ballot from your county Supervisor of Elections’ Office. If you are in any doubt, check with your county Supervisor of Elections’ Office ASAP to verify that you will receive this ballot.

October 29 to November 5- Polls are open for early voting. These dates may vary by county, so check with the Elections Office in your locale. You may vote in any of your county polling locations during this period.

November 8- Election Day. Polls will be open until 7:00 PM local time. If you vote in person on Election Day, you must do so at your home precinct polling location.

November 8- Vote-by-mail ballots must be received in the Supervisor of Elections office by 7 PM to be counted.

When You Vote

If you vote by mail, be certain to read and follow the instructions. Date and sign your ballot and be sure to mail it in time for it to be received by the November 8 deadline. If you vote in person, either on Election Day or during early voting, be sure to take a current and valid photo ID with a signature. Accepted IDs include a Florida driver’s license, a Florida identification card issued by the Department of Highway Safety and Motor Vehicles, a United States passport or Military identification.

Thank You in Advance

OurSeniors.Net does not endorse candidates or political causes. However, we have got to say, “Thank you, Florida for making the voting process so senior-friendly.” With three ways to vote, Election Day voting, early voting and vote-by-mail ballots, there is no excuse for not doing your duty.

Florida is a very senior-friendly state and OurSeniors.Net is your go-to source for information about the senior lifestyle Florida, senior housing news, and all things senior and Florida. As we urge you to vote, we strive to be the best senior living magazine online. Thanks for reading our blog and get ready to vote! If you know a senior who has mobility issues, volunteer to help them to the polls! Keep America Free!

Ana Margarita Menéndez has lived a wonderful life. In many ways, it has been the “American Dream” with a Cuban accent. It has also been an adventure, a journey that led Ana from her family’s former home in Cuba to a new life here in the United States. Along the way she has been involved in almost every part of the entertainment industry.

Today, Ana is a public relations specialist, working for a health care organization in south Florida. As a young woman, she was an important cast member in the pioneering TV show, “Que Pasa, USA?” If you grew up in Miami in the 1970s (as many of OurSeniors did), you may very well recall this highly original and still very funny sitcom. In the late 1970s, Miami television station WPBT came up with a great innovation- a bilingual sitcom. The show was titled “Que Pasa, USA?,” and it quickly became a big hit in Miami and national syndication.

It won sponsorship from the National Council for the Arts, and for five seasons, the show told the story of the Pena family. It is sympathetically related to their struggles in trying to adapt to their new home, America. It appealed to a wide audience, but especially to America’s Hispanic and Cuban American population. Que Pasa, USA? accurately reflected the experience of many Cuban families, telling the story of three generations of a Cuban-American family living in 1970s Miami.

Ana played the part of Carmen Pena, the young daughter of the Pena family. She still recalls the show, its cast, crew, and writers with great affection. Playing Carmen Pena was a natural part for that young Ana Margo because she had lived the story. Besides, the theatre was in her blood. Born in Cuba, she left soon after the Communist Revolution. Her father and mother had both been active in Cuban entertainment and TV before the revolution.

Young Cuban Americans had little or no remembrance of life in Cuba. They had very different ideas and social behaviors, leading to inevitable conflicts with parents and grandparents. These situations also supplied opportunities for a lot of laughs as the Pena family transitioned to American life. “Que Pasa” treated these situations with humor and sensitivity, never making fun of, or demeaning any group.

In an interview with the OurSeniors.Net staff, Ana shared her memories of the show’s history. It ran for five seasons and a total of 39 episodes, all filmed before a live audience in WPBT’s studio. Ana remembers the high quality of the scripts and the sensitivity shown to the very real challenges faced by newly immigrated Cubans. The location was authentic, the “Calle Ocho” or “Little Havana” area of Miami. It was ahead of its time, a bilingual show that could be understood by both English and Spanish speakers.

The young actress was a natural for playing the part of Carmen, the somewhat Americanized young daughter of the Pena family. Carmen Pena was sometimes a little sassy, but she always exhibited the affection and respect that is common to Cuban families. All the show’s characters are well remembered. Imagine this-

You are hiking in the mountains of North Carolina when you pass a family you have never met. As they pass, one of the party turns, points to you, and asks, “Are you Carmen Pena from Que Pasa, USA?” Exactly that happened to Ana Margo, and it happened decades after the show had ended. That’s how beloved the show was. Viewers recalled it for years. People Magazine called Pepe and Juana, Carmen’s parents, the Latin versions of “Ozzie and Harriot.” Four decades later, in 2018, the cast reunited for a brief theatrical performance of “Que Pasa, USA TODAY.” It played to sold-out audiences in the Adrienne Arsht Center, Miami’s home for the performing arts.

Ana was eager to share her memories of this ground-breaking show, but also to express her love for her adopted home, the United States of America. OurSeniors.Net salutes Ana and the entire cast and crew of “Que Pasa, USA.” It is an important part of the history of south Florida and our Hispanic community. You can still find complete episodes of the series on the show’s official website. Watch a few and relive the Miami of the 1970s and 80s. Thank you, Ana! They are still great shows.

OurSeniors.Net works hard to be the best senior living resource magazine online and in print. To help us continue this, we are taking a page from the “Que Pasa, USA?” playbook. Starting with the Fall Edition of OurSeniors.Net Magazine, we will publish a bilingual edition. At first, this will be available only in south Florida, but we plan to expand it in the future.

Again, thank you Ana, the cast and crew of “Que Pasa, USA?” and to the readers and viewers of OurSeniors.Net!

Qué Pasa, USA?, is a pinnacle of happiness, humor, and enjoyment for Cuban-American families everywhere, but mainly in Miami, FL. Featuring a close representation of the life and culture of the Cuban-American population throughout Miami, the show was brilliantly created and provided an appreciated turn in direction on television.

What was once the start of an interesting and humorous journey of the Peña family, remains a treasure for Miamians today although the show has been off of the air since 1980, it is still a fan favorite.

The First of the Things That Mattered

As the first bilingual sitcom to hit the screens of families across the nation and to be produced by PBS, the show brought fans together in a way that only true connections can. In a way, this well-loved and well-known show was like an extension of your own family. It offered comfort, warmth, and genuine laughs. It also brought audiences closer to what it was like to cherish and hold Cuban heritage and values in your heart while struggling to overcome identity crises and the worry of losing oneself. Qué Pasa, USA? while portrayed as a comedy, still offers a raw sense of what a look back in time was like.

As we follow the Peña family through the ups and downs that living in a society mainly made up of Anglo Americans comes with, we learn something from each character, we form bonds with them and we learn the real meaning of tradition along the way.

Connecting With the Characters

With the natural frustration that language barriers can bring and the comedy that can arise while breaking down those barriers of both language and culture, the characters in this sitcom connect with us in more ways than one during the 4 seasons the show aired. Not too many viewers can say they haven’t connected with a Qué Pasa, USA? character just like the actors themselves are sure to have felt an attachment to their role. There are just some shows that are worthy of being binged or watched more than once in one sitting and Qué Pasa, USA? was exactly that.

Let’s take a trip down the binge-worthy memory lane and meet not just the characters of the show we love but the people that beautifully portrayed them.

Meeting Connie Ramirez as Violeta

Ms. Ramirez, or as we know and love her, Violeta was Carmen’s sassy and outspoken friend. Connie actually auditioned for the role of Sharon first so, you might be wondering how she was cast for the role of Violeta and we have to say that it’s by great judgment that she ended up with the part that she did. The crew wanted to see another version of her and how that could be transferred into another character and with that, Violeta’s personality came to life.

A Look Into Connie’s Own Story

Connie Ramirez, today, is 67 years old and in her life as herself and not her character, Connie has one younger sister who served as a great source of support during her Qué Pasa, USA? journey. She lived in Havana, Cuba with her sister and her parents until she was 14 and her family immigrated to Los Angeles, California where she also attended high school.

You may be wondering, where did Connie find her passion for acting and portraying positive messages on stage? Well, due to her mother’s line of work as an endocrinologist, her family decided to move to the Miami area where she began to flourish at the start of her acting career. While Connie attended the University of Miami, it was the Miami Dade Community College where Connie first found out about casting calls for Qué Pasa, USA?

While Miami marked the start of her journey with the show, it wasn’t with a light heart or an easy task that Violeta became the sassy character that we started to know her as once the show aired. During live filming, she knew that viewers were paying for tickets to see the cast, and with that, she knew that she had to do well, and that’s what drove her into a successful role and time on the show, on and off the air.

Today, she offers specialty services in voice work and although 42 years have passed, she is still remembered for her excellent and true-resemblance acting that she gifted so many with as she helped to steer the direction of the cultural favorite we are delighted by time and again, Qué Pasa, USA?.

Remembering Some of the Best Times Through Television

Qué Pasa, USA? follows three generations of the Peña family throughout their lives in Miami’s Little Havana. While following closely through hard times, great times, and confusing times, this comical cultural masterpiece is like a capsule of a time that was disrupting the cultural norm and inspiring while educating others on the trials and tribulations that Cuban-Americans had to navigate, solve, and adapt to.

As we learn new ways to celebrate and cherish personal values and Cuban heritage, we will always have one familiar place to turn to when we want to laugh, smile, and witness the true meaning of family, cultural strength, and the journey of finding new things for the better.

There are a lot of people who use terminology about their old man being dead but also say that he resurrects every morning. This is because they continue to identify with their fallen, sinful nature. That is detrimental to Christian growth.

The Scripture says in Proverbs 23:7, “For as he thinketh in his heart, so is he.” If you think you’re still dead in trespasses and sins—and that you’ve also got a new nature—then you’re as good as schizophrenic. It’s just a matter of time until that old nature dominates you because that’s who you think you are. But that’s not the case for a born-again child of God.

You don’t have a part of you that’s separated from God. If you’re born again, your nature has been completely changed! The only thing compelling you to still live the way you did before you were born again is the fact that you haven’t renewed your mind.

When I first started ministering, I spent some time ministering in the local jails. I recall talking with one of the men through the bars. I was saying, “If I had the power to free you, and I just opened the door and said, ‘You’re free!’ you’d be free. But that doesn’t mean you’d be free. You’d have to believe you were free and then act on it by getting off your bunk and walking out the door.”

A similar thing happened when Abraham Lincoln announced the liberation of slaves in 1863. The Confederate states didn’t think it applied to them, so they didn’t even tell their slaves about the Emancipation Proclamation. Then, on June 19, 1865, Texas slaves heard from Union soldiers that they had been freed over two years earlier. Imagine how they must’ve felt hearing that they had been freed all along—they just didn’t know it.

This same concept applies to us. Jesus has totally set us free. When we were born again, the old man died with Christ. Born-again believers do not have a sinful nature (Rom. 6:6). We’ve been freed! But if you somehow or another still believe that you are by nature a sinner, then you’ll still let that sin nature influence you.

It is because the old man is dead in the believer that Paul can give the exhortation in Romans 6:12: “Let not sin therefore reign in your mortal body, that ye should obey it in the lusts thereof.” The word therefore means it’s referring to the previous things that were said—which is that your old man is dead. And because you are no longer enslaved to the old man, you can do what Romans 6:13 says:

Neither yield ye your members as instruments of unrighteousness unto sin: but yield yourselves unto God, as those that are alive from the dead, and your members as instruments of righteousness unto God.

Jesus only died once for sin, and you only die once to your old sin nature. The Bible says your old man is dead, and he does not rise every morning. If you really understood that it’s not your nature to live in sin anymore, then you would be free from sin.

God gives you His nature when you are born again, and you become a new creature (2 Cor. 5:17). As you renew your mind to the truth, your old man’s programming gets updated and your new nature compels you to live a holy life, just like your old sinful nature compelled you to live a sinful life.

Man, this is really simple, but that’s exactly what the Bible says. These are some of the most foundational and liberating things that you could ever learn. And I’m not saying that because it’s my teaching. It’s just the truth!

If you’ve been blessed by this teaching, I encourage you to visit awmi.net, where you’ll find a wealth of free resources to help you grow in your walk with the Lord. Also, if you’re in need of prayer, just call my helpline at 719-635-1111 to speak to one of my trained prayer ministers. They will stand in agreement with you for God’s perfect will in your life.

We love you!

Andrew and Jamie

Wommack