Medicare offers several coverage options for seniors who have special needs. These include programs for people with certain chronic conditions like diabetes, patients who are in institutional care and those who are eligible for both Medicare and Medicaid programs. Medicare calls these programs “Chronic Condition SNPs” (C-SNPs), “Institutional SNPs” (I-SNPs) and “Dual-Eligible SNPs” (D-SNPs). The availability of these programs may vary from state to state and even among coverage areas within the same state. All Medicare SNPs are a type of Medicare Advantage plan, meaning that each of them has its own local network of physicians, pharmacies, and other providers. Special Needs Programs offer an extra level of care and specialized attention. For example, patients who suffer from diabetes might join a C-SNP (chronic condition SNP) that focuses on the management of diabetes and its complications. This plan is likely to include more of the medical specialists who treat diabetes, and the drug formulary will contain medicines commonly used by diabetics.

Chronic condition SNPs may be designed for patients with chronic lung disease, congestive failure, stroke, dementia, and several other conditions. Many Medicare patients suffer from one or more of these chronic illnesses, and their care should be coordinated between the primary and specialist providers who see them. Medicare C-SNPs provide insurance coverage for all the medical services that are likely to be needed by a chronic disease patient. They combine hospital, medical, and prescription drug benefits, sometimes specialized benefits not covered by other plans. Often, these plans provide a care coordinator, a person who makes sure that the patient gets all the preventive care and treatments required by good medical practice. A second type of SNP is the Institutional Special Needs Plan (I-SNP). This plan restricts enrollment to individuals who have (or are expected to have) a need for 90 days or more of intermediate care. Intermediate care facilities include skilled nursing facilities, long-term care nursing facilities, inpatient psychiatric care and facilities for patients with intellectual disabilities. You should contact an insurance counselor to find out what programs are available in your area. An excellent source of free advice may be the SHINE (Serving Health Insurance Needs of Elders) program. This is a free program offered by the Florida Department of Elder Affairs. SHINE’s trained volunteers can assist you with your Medicare, Medicaid, and health insurance questions. The Dual-Eligible Special Needs Program (D-SNP) is the remaining member of the special needs group. This program is aimed at lower-income individuals who are entitled to both Medicare and a state Medicaid program. To qualify for a D-SNP, you must receive both full Medicaid benefits and Medicare Parts A and B. Dual Special Needs Programs may include benefits not found in Medicare or Medicaid alone. These may include some dental, vision and hearing benefits and a personal care coordinator.

Others might offer telehealth options, credits to buy health products, and even transportation assistance. All of these plans offer different benefits and have

different eligibility requirements, so be sure to look at what is available where you live. Once again, help from Florida’s SHINE program or an OurSeniors.Net

Approved Vendor (see below) may be especially useful. Once you are eligible for Medicare coverage, you may elect to join an SNP. For most people, this will be the Medicare Initial Enrollment Period which includes the month you become 65 and the three months immediately before and after.  If you now meet the SNP qualifications but decided on another plan in the past, you may switch to one of the available Special Needs Programs during the Annual Election Period (October 15 to December 7 of every year.) During that annual period, you can switch plans, disenroll from a current plan, or enroll in a Special Needs Plan for the first time. All of this is easily said but doing it correctly may be complicated. If you are currently seeing a given specialist, say for diabetes care, you may want to make sure that this provider is a member of the SNP you are joining. Likewise, if you are taking a prescribed set of medications, you would want to find out if these drugs are on a given formulary. All of this requires specialized local expertise. Remember that SNPs are Advantage Plans and are, therefore, local organizations.

If you now meet the SNP qualifications but decided on another plan in the past, you may switch to one of the available Special Needs Programs during the Annual Election Period (October 15 to December 7 of every year.) During that annual period, you can switch plans, disenroll from a current plan, or enroll in a Special Needs Plan for the first time. All of this is easily said but doing it correctly may be complicated. If you are currently seeing a given specialist, say for diabetes care, you may want to make sure that this provider is a member of the SNP you are joining. Likewise, if you are taking a prescribed set of medications, you would want to find out if these drugs are on a given formulary. All of this requires specialized local expertise. Remember that SNPs are Advantage Plans and are, therefore, local organizations.

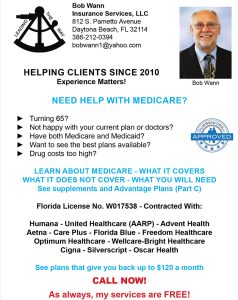

In the Daytona Beach-Volusia County area, you can count on Bob Wann Insurance Services, LLC. This fine organization, a member of the OurSeniors.Net family of Approved Vendors, has the expert advice you need to get the best possible coverage in the area. You can reach Bob at 386-212-0394, and Thank You for reading our blog and our senior magazine! We strive to bring you important news for seniors about subjects that matter. We like to cover Social Security and Medicare news, senior housing news, and state related news such as the pros and cons of living in Florida, the cost of living in Florida or resources for elderly living alone. Both in print and as a senior living magazine online, our organization exists to serve the needs of seniors and their families.