Southeast Florida, Spring 2022

Southeast Florida Spring 2022 Edition – OurSeniors.net Magazine

Hola Miami, are you aware that Oursenors.net Magazine Southeast Florida Spring 2022 Edition is now available and live, yes just visit www.ourseniors.net

Contents

Spring 2022 | Volume 6 / Issue 2

Dear OurSeniors.net Readers,

We hope this letter finds you all well. We hope you’re all doing things that make you happy and that you’re staying safe. In these uncertain times, it’s more important than ever to spend time with our loved ones. Whether you live together or apart, spending time with family is a great way to stay connected and feel supported. At OurSeniors, we understand how important it is to have that sense of connection and support. That’s why we’re dedicated to providing resources, information, and articles that promote healthy aging and provide ideas for spending quality time with family members of all ages. While so many people have been left feeling uncertain, and hopeless as we shift through different phases of COVID-19, we wanted to encourage our readers to continue

being yourselves, doing what you love, and laughing just for the joy of it. As President and Founder; I have survived both COVID and the Omicron variant. The first round was certainly tough, especially when you are quarantined for 15 days. Yes with all symptoms, but I still thank God and my beloved wife for helping along the way. I can attest to you it was tough compared to the Omicron version. This is amazing as although I still have a high antibody count and no vaccine. Again, extremely grateful for the ongoing support and yes I am fully recovered without any symptoms. This goes to show that no matter how bad things seem, there is always hope. Hope is what drives the things that we do, that we enjoy, and that we make us feel like ourselves. While we may not feel like it every day, always take a moment to think about what makes you happy or feel joyful. Hold onto that feeling and cherish it and yes Thank you, Lord Almighty. We encourage all of you to spend time with your families and loved ones. Enjoy each other’s company as much as possible, because you never know how long anyone has with one another. Hug those closest to you, tell them that you care for them, and enjoy every moment you have together. The support of OurSeniors Magazine is more important than ever as we gain momentum

in supporting our digital and print copies, and coordinating more events. We enjoy working together to bring our communities information that could change how they see tomorrow, how they see their health, and how they see themselves. We strive to shine a light wherever it seems dark, and we enjoy causing smiles in those that need one. We wouldn’t be able to do any of this without the support of our readers and we are always grateful and proud of the work that we all can accomplish. Please continue to donate so that we can keep informing our seniors about the latest news, events and resources. Thank you all for your support and yes, Give while You Live! Warmest regards, Julian G. Cantillo, L.P.N., President and Founder of OurSeniors.net Magazine

Don’t miss another edition by donating! Visit www.ourseniors.net/subscribe

Disclaimer: The information published in this magazine and our website is intended for residents of the USA. The opinions, beliefs and viewpoints expressed by the various authors in this magazine and on this web site do not necessarily reflect the opinions, beliefs and viewpoints of OurSeniors.net Magazine or official policies of OurSeniors.net Magazine. It may contain general information about medical conditions, public and private health service organizations and other third-party information including but not limited to testimonials.

The information is not advice (legal, medical or otherwise) and should not be treated as such. No claim is made as to the accuracy, authenticity or completeness of any information and, is often provided in a generalized or summarized format for brevity. OurSeniors.net Magazine, LLC and or its subsidiaries, does not accept any liability for the information (nor for the use of any information) provided by this magazine and or website. The information presented by this magazine and website is provided on the basis that all viewers undertake responsibility for assessing the relevance and accuracy of the data related to their circumstances.

Thank you for reading our magazine and visiting www.OurSeniors.net and please contact us if we can be of further assistance. All real estate advertised in OurSeniors.net is subject to the Federal Fair Housing Act. This federal law makes it illegal to advertise any preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preferences, limitation, or discrimination.

We will not knowingly accept any advertising for real estate which violates the law. All persons are hereby informed that all real estate advertised in OurSeniors.net is available on an equal opportunity basis. Information contained herein has been furnished by community owners, managers and agents. OurSeniors.net and or OurSeniors.online, OurSeniorsDiscounts.net and or FindingAssistedLiving.com, LLC. and OurSeniors.net Magazine, LLC do not make any representations as to opinions and facts. All terms and conditions of rentals are subject to change. OurSeniors.net reserves the right to refuse advertising space to anyone deemed unsuitable for placement in this publication.

OurSeniors.net, OurSeniors.online, OurSeniorsDiscounts.net and or FindingAssistedLiving.com, LLC. and OurSeniors.net Magazine, LLC retains all rights reserved by copyright 2019 OurSeniors.net, and or OurSeniors.net Magazine, LLC. This publication or parts thereof may not be reproduced in any form without the written permission of the publisher.

For further Disclaimer information please visit https://ourseniors.net/wp-content/uploads/2016/06/disclaimer-privacy_policy-terms_of_use-1.pdf. Please note that websites and links are referenced in the magazine and you may have complete access to our online version by visiting. www.ourseniors.net/magazine only if you are a subscriber.

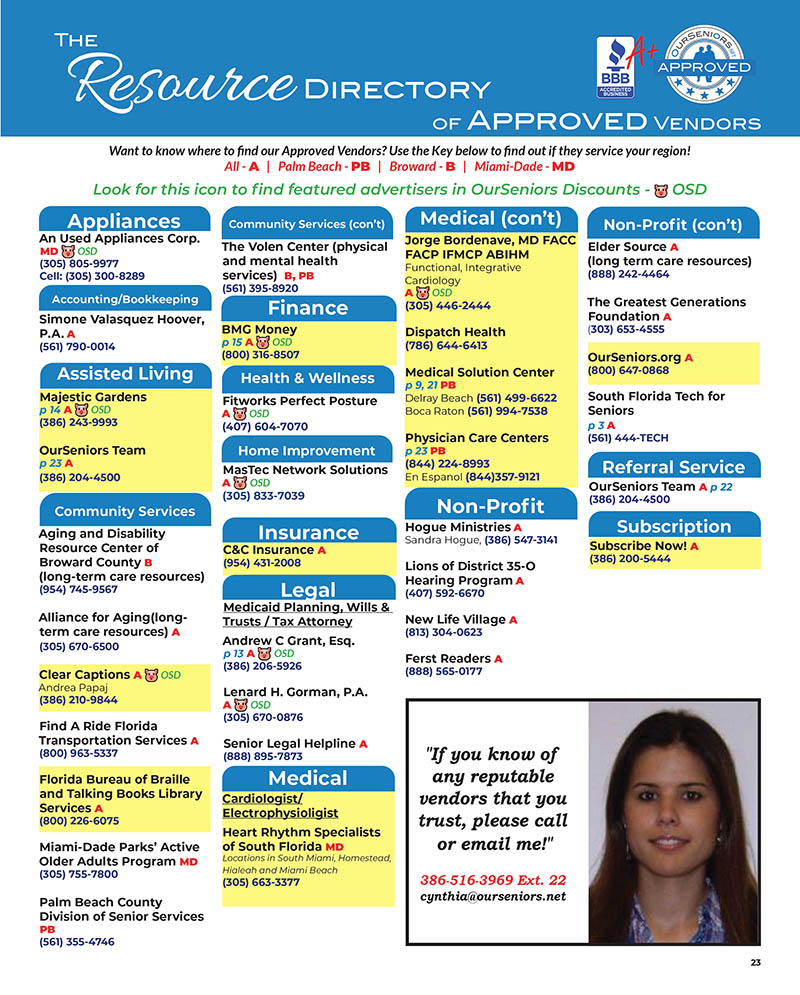

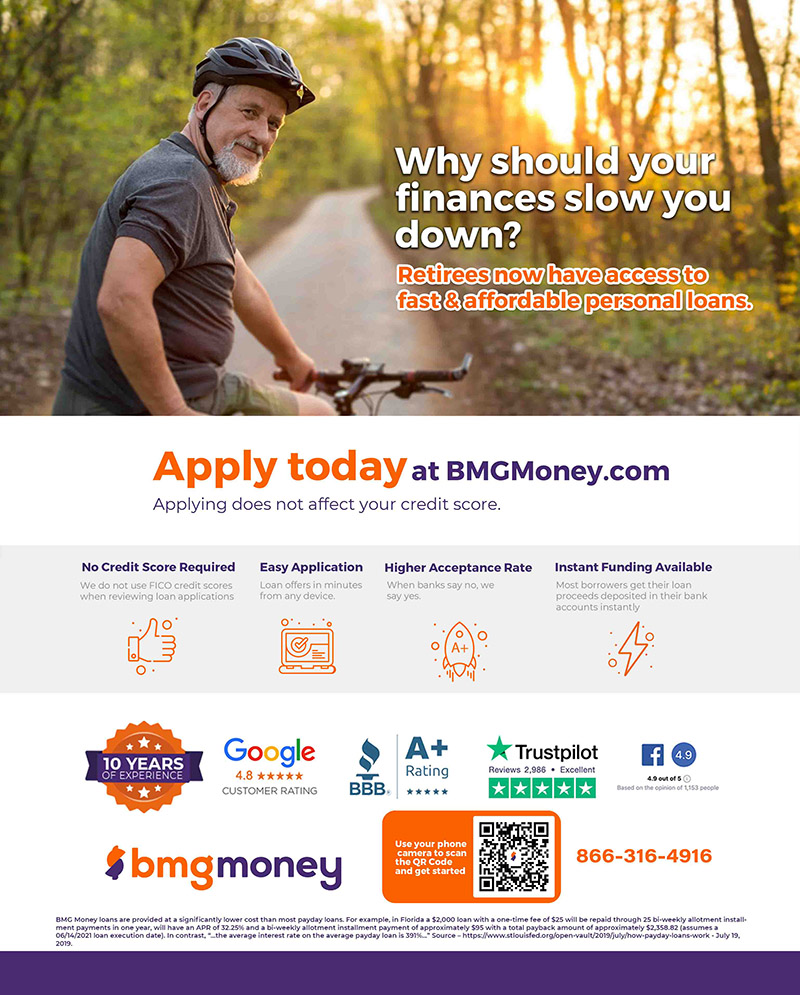

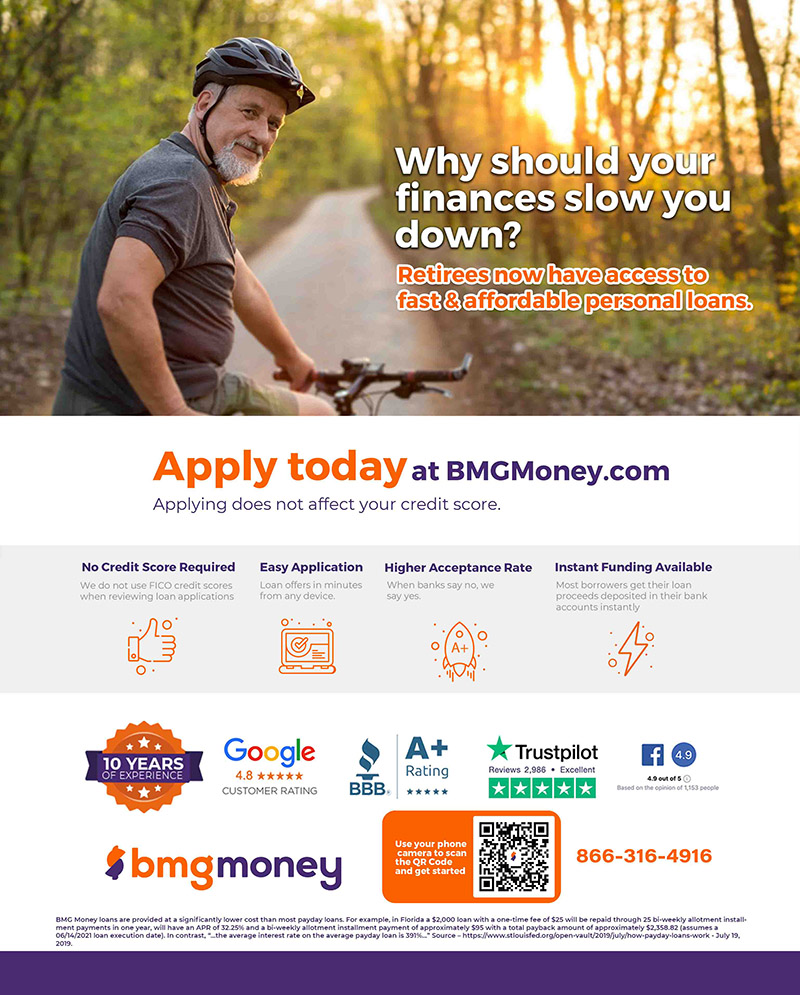

OurSeniors.net Welcomes Our Newest Approved Vendor; BMG Money

BMG Money Works to Make Financial Assistance Possible for Communities

BMG Money breaks down barriers between community members and the funds they need. Known as a great source of financial aid and wellness, BMG money creates financial solutions that challenge the misconceptions of money lending and loan qualification.

Miami, Florida: February 28, 2022 – BMG Money works tirelessly to create loan programs addressing the different needs of the employed and retired populations. BMG Money offers loan programs that help people manage unexpected expenses. These loan programs allow employees and retirees to borrow responsibly, and repay the debt over time, with fixed, affordable installments regardless of their credit score.

The company was founded in 2009 to enhance the financial wellness of under-served consumers. BMG Money provides credit monitoring solutions, financial education, and emergency loans so that retirees and employees can make better financial decisions. Those that are served are public sector, federal and non-profit employees. In addition, there are programs for retired veterans and retired federal employees.

It’s not only BMG Money’s expertise that allows them to grow throughout the community, it’s their dedication to those that they know they can help that sets them apart from similar businesses. With simple and easy-to-navigate applications, offers within minutes, and instant funding availability, the company works to streamline the loan process for everyone, and not just those with high credit scores.

What’s featured about BMG Money is that they have higher acceptance rates with faster responses. Simply put, when banks or credit unions say no, BMG Money works for you and gets to know your needs so that they can say yes.

Vice President of BMG Money, Jose Patino, explains, “Loan eligibility depends on current income – not credit history – a needed relief for consumers who have low credit scores or are otherwise denied by traditional lenders and shut out of the financial mainstream.”

BMG Money is changing the game and it’s only possible because of advocates like you. Spread the word about this company that is working to make a real difference in your community. Let them know how much you appreciate what they’re doing.

With over 10 years of experience, BMG Money is changing the finance game by making financial assistance possible for all members of the community. This company is committed to providing access to education and emergency funds for those who need it most. With BMG Money, you’re more than just a number.

For more information about BMG Money and its services, please visit https://www.bmgmoney.com/.

About BMG Money:

Launched in 2009, BMG Money is a customer-focused loan provider for retirees and employees. The company provides better loan offers, better repayment rates, and better resources for what you need. With a passion for providing better options that satisfy the need for security, financial emergency response, and client satisfaction, community members can expect to receive a personalized and compassionate experience. For more information about BMG Money and the services they offer, please visit https://www.bmgmoney.com/ or call 866.316.4916.

OurSeniors.org Selected as a Beneficiary of the 2022 Fight For Life Golf Series

ORMOND BEACH, Fla. – January 2, 2022

The OurSeniors Family, including our seniors magazine, is proud to announce that the Joan L. Kidd MD Fight For Life Golf Series has chosen us to be one of the not-for-profits that will benefit from its golf tournaments in 2022.

Chipd In Golf addresses the need for golf enthusiasts of all skill levels to play a round of golf on their time and schedule from any course across the U.S. Participants can support their favorite not-for-profits throughout the year. Golfers sign up to play to the Fight For Life Golf Series through their chosen not-for-profit designated webpage, pay a one-time fee, create a profile (includes their handicap index) and download the Chipd In app. Players select and play a round of golf for each weekend event and can follow along with a live national leaderboard so each participant can see how they are doing against golfers from all over the United States.

The golf series is powered by Chipd In Golf and is scheduled in two Series Events and a National Championship at Rosen Shingle Creek Resort, Orlando, Fla. The Spring Series preseason starts the weekend of March 18th, 19th, and 20th with six more weekends going through the Spring Championship on June 3rd, 4th, and 5th. The Summer Spring Series starts June 17th, 18th, and 19th with five more weekends going through the Summer Series Championship on August 26th, 27th, and 28th. The top 50 players from each series will be awarded an expenses-paid trip with his or their golf buddy to the National Championship October 14 – 16, 2022.

Prizes are awarded for each Series Event, which includes several random raffle drawings. There is a one-time entry fee of $150 for each Series Event of which a significant portion will go to the designated not-for-profit, but there are no entry fees for any of the regular season events. Golfers have a three-day window to play one round at each event. Points are awarded at each event and accumulated to determine the top 50 players selected to move onto the Series Championship.

The National Championship in Orlando, Fla. will invite the top 100 players (top 50 players from both the Spring and Summer Series) to compete in an 80 NET scoring two-day tournament. Players finishing outside of the top 100 will be designated alternates. Participants will enjoy an official pairing party and reception, a Fight For Life Concert with world-class entertainment, special golf events (hole in one, closest to the ping, long drive and putting competitions) and will receive tournament packages and special tee gifts. Numerous grand prize events include a Dream Golf Resort Destination Trip for 2 to Bandon Dunes, Sand Valley or Cabot Cape Breton.

You can learn more about the 2022 Fight For Life Golf Series at the following website https://www.fightforlife.com/golfseries and find out about how you can support OurSeniors.org by signing up at the following website https://chipdin.com/pages/our-seniors, by checking our senior magazines Florida and our Facebook page.

Our mission at OurSeniors is to be the go-to resource for senior citizens in Florida that will research the right vendors for any service. We want to make sure that seniors are not ripped off by people who take advantage of the vulnerable. If we can help even just one person, we are happy. Knowing that we diverted a bad situation, which has happened many times, is what keeps us growing and expanding our services around Florida. We are now in 25 counties with a distribution of more than 130,000 and have an online presence with an even larger reach.

If you are a subscriber to our senior lifestyle magazine Florida, you know that we provide a variety of resources with advice from professionals like doctors, dentists, contractors and other experts in their fields. Our magazine and website provide articles free of charge and we also have an email newsletter that includes newsworthy items and advice. Our Brunch & Learn events have panel discussions with individuals who are knowledgeable in what they do and want to give free information live and in our complementary magazine for seniors. There are many outlets where you can find information and we enjoy providing it.

OurSeniors.org also works to assist seniors by visiting those living in nursing homes and providing immediate and continuing care and comfort for those that are isolated. Knowing that only 5 to 10 percent of all seniors in nursing homes, rehabs and assisted living facilities receive visitors, the team tries to change this by gathering gifts, blankets, jackets, stuffed animals and cookies to make them feel cared for.

Any donation would help us tremendously as we continue to produce the magazines for older adults and provide free resources to seniors across Florida.

Please visit https://www.ourseniors.org/fundraiser/ to see more about what you can do to help or call at 800-647-0868. OurSeniors.org also provides a senior living magazine online full of great resources at no cost as a part of our non-profit services.

How to Stay Healthy and Motivated after 65

One of the biggest challenges people face as they age is staying mentally and physically motivated to lead healthy lives. There are many factors that get in the way, including thoughts about security, independence, health, and social activity. There are currently about 49 million U.S. citizens that are 65 and older and it is projected that many can lead healthy lives into their 80s. The biggest hurdle is their desire and dedication to stay active socially and physically in as many ways possible to improve their quality of life.

Safe Ways to Get Started Being Active

You may want to jump right into an activity that will get you moving. But you need to consider taking things slow. Even if you feel you have the physical ability to take on a challenge without harming yourself, you may have underlying risks that could lead to injury. Start with shorter sessions a few times a day, a few days a week. Starting slow can prevent muscle strains, ankle sprains, and falls. Aim to reach at least 30 minutes of physical activity per day and then increase your sessions incrementally over a couple of weeks. No matter what activity you choose to start with, pacing yourself will help you make safe transition toward leading a healthier lifestyle.

Great Ways Seniors Can Make Exercise Fun

One of the ways for seniors to look forward to starting an exercise routine is to do so in groups. Some activities can be done with just one other person (walking, hiking, tennis, etc.) but there are numerous activities that would be more fun with groups of people. Working out with at least one other person can improve your mental health because you can feel connected through conversation. You can cheer each other on, challenge one another, and make better commitments toward meeting up the next. If you work out in a group, you may get to meet new people which can make exercising even more beneficial.

How to Stay Motivated and On Track

You may have heard the saying “Variety is the spice of life.” This is true for most activities people do throughout the day. Exercise is no different. Try doing something different each day. If you are working out with a partner or in a group, you may find that you can enjoy different activities with different people. This is a great way to socialize and increase your circle of friends. Try to set goals for yourself and others, celebrate with rewards, and be flexible when it comes to when and where you will exercise. Adding variety will keep your routine from becoming stale. You’ll enjoy your time and feel like you are experiencing new things each time you meet up.

Exercises to Get Started With

Getting regular exercise a few times a week is important for seniors. But it can be difficult to know where to start. If it’s been a while since you have been regularly active, you need to start slow with a few safe exercises and be aware of how your body responds and recovers. Here are a few that can be done alone or as part of a group exercises you might want to consider:

- Chair Stretching / Yoga – These are low-impact activities that have many benefits. They can improve balance and flexibility, mobility, and muscle strength. It can also improve your mental health, sleep quality, and lower stress levels. You can do these alone at home or you can sign up for a class. The latter is much more fun because you get to meet new people while getting fit.

- Resistance Band Workouts – If you are unable to lift weights but still want to incorporate resistance workouts into your routine, resistance bands are great. Resistance band workouts are particularly good for beginners and are quite cheap. There are different resistance levels that can help you strengthen a variety of muscle groups in your body. Some of the most popular and safe exercises for seniors include: bicep curls, triceps presses, pull aparts, lateral raises, and leg presses.

- Water Aerobics – This is a great type of exercise for people of all ages, but it’s particularly beneficial for seniors because there is a relatively low risk of injury while still able to help improve balance, flexibility, and strength. Exercising in the water puts less strength on the joints which makes it great for anyone experiencing joint pain due to certain types of arthritis or injury.

It’s a good idea to check with a physician before starting an exercise routine. Always follow your physician’s advice and make sure you discuss how your body reacts to determine whether you are ready to increase the amount of activity you do regularly.

Thank you for following our OurSeniors.Net website, Facebook page, and blog. Our goal is to give you informative content we hope will enrich you. We encourage you to explore our other articles to learn more about the benefits of leading a healthier and more fulfilling life.

Seniors Caring For Elderly Parents: How Does It Work?

You may be a senior who also has the responsibility of taking care of your parents. Or you may just be aware that you, yourself are getting older and you’re curious about how it all works; when you’re aging and possibly having to take care of aging parents. It is not only important to be aware of the resources and benefits that are available to you when taking care of aging parents but also the other aspects involved with providing them with care.

To help your aging parents you must enable them to openly communicate how and when they would like you to help them, be patient and respectful as reversed dependence can often be shocking and take time to get used to, and always prioritize their overall well-being. About 17% of adults usually end up providing care for their aging parents so it is important to have a long-term plan for your parents that may need long-term care.

Here you’ll find out just how common it is for seniors to have the responsibility of taking care of their aging parents, you will become more aware of benefits and resources that are available to you as current or potential caregivers and you’ll get an overview of how to properly take care of your aging parents. Keep reading to find out the most important things to consider throughout this process.

How Common Is It For Seniors To Take Care of Elderly Parents?

It is not uncommon for seniors to have to take care of their elderly parents. That is just the cycle of life. women are more likely than men to provide primary care to elderly parents. Individuals that aren’t married are about 8% more likely than those that are married to provide primary care for an aging parent. It’s important to note that if you are not able to offer your aging parents adequate care and assistance that it may be best to hire professional caregivers to act in your place. Always keep this in mind if your aging parents have serious medical conditions that require a significant amount of attention and coordination.

So yes it is very common for seniors to find themselves in the situation of taking care of their elderly parents. Not all seniors are physically able to accommodate what elderly parents mini so it is always important to be able to recognize when you may potentially be biting off more than you can chew. Stay aware of the health conditions of your aging parents and knowledgeable about useful assistance if needed.

How Do You Care For Those Older Than You When You’re A Senior?

How you care for someone older than you when you are a senior yourself is quite simple. The actual job isn’t simple in itself but the general guidelines are. When faced with having to take care of aging parents you always want to assess their initial needs. You want to make sure that you can accommodate the care that they require.

You also want to determine whether or not they can live alone anymore or if they would have to live with you and if that’s the case whether or not you have the space within your home to give them. There are multiple factors involved when you alter your life as you know it to allow someone to be dependent on you again. Recognize the top opportunities that you may be presented with as a caregiver.

If you have an aging parent that is unable to drive or does not have a lot of social exposure, take an interest in their socialization, and sign them up for an adult day program or a club with people that share the same interests as they do. Possibly research volunteer senior companion programs within your area and look into hiring in-home caregiving if you have the space to offer your aging parents and don’t feel comfortable putting them into a nursing home or retirement community.

The key here is to care for your parents as they did for you because the cycle will continue and your children will have to do the same for you at some point. Being able to properly take care of your aging parents is accepting the cycle and approaching it in the way that you would want someone to approach it if you were in the same position; with comfort, openness, guidance, and reliability.

Useful Resources For Seniors Caring For Seniors

Everyone needs help now and again. Taking care of your aging parents as a senior can show to be quite challenging at times, especially in terms of finances. If you are caring for an elderly parent there are a few key resources that you should consider to assist with managing any costs of care. A few of these resources are:

- Meal Services

- Frequent Home Monitoring

- Available Benefits

- Support Groups

- Utilizing Other Family Members

Finding yourself in a financial bind when taking care of multiple family members or households can be taxing. Thankfully there are several beneficial resources that you can easily access to assist with any related situation. Taking care of elderly parents can sometimes be seen as a burden but they don’t have to be. You must know when to hand over the reins to another caregiver if you are not able to provide what they need.

Due to the high levels of stress that taking care of an older loved one can cause on a person, you should consider support groups or appropriate therapeutic methods to keep yourself grounded. Depending on where you live you may qualify for some form of financial aid or benefits to assist with the finances involved with taking care of aging parents.

Now You’re More Prepared

The longer that we live the more likely it is that we will end up caring for our parents who obviously would be older than we are as seniors ourselves. This is just a natural staple of life and it is essential to have a primary care plan for your aging parents if you are aware that you may become a potential caregiver. At least 10% of adults between the ages of 60 and 69 whose parents are still alive often operate as their primary caregivers. About 12% of adults who are caregivers to older parents are 70 or older.

Keep in mind, that you do not have to forfeit the rest of your life to take care of an elderly parent. There are numerous resources that you can take advantage of to keep from stretching yourself or your family too thin. Never underestimate the significant amount of help that utilizing other family members can provide and if you don’t have to do it alone, don’t.

As you age, your parents will age, and providing them with adequate care may be challenging but, if you take proactive steps into planning Their assisted care opportunities you can make the process more simple for you in the long run.

Health Insurance When Traveling

As the Covid pandemic recedes, the spring of 2022 is bringing good news! Medical authorities are saying that it is now safe to resume “near-normal” life, especially if you are immunized and take reasonable precautions. One of the blessings of this return to near-normal is the freedom to travel. This choice is particularly relevant to members of the OurSeniors.net family here in Florida.

There is a good chance that those folks have moved to Florida from out-of-state locations, having left family and long-time friends behind. Social distancing has meant that travel was not an option, even for weddings, birthdays or other important events. Now, that is changing, but do you know and understand the status of your health insurance when you are traveling?

While traveling, health insurance coverage can vary, depending on your insurance policy, length of stay and destination. In some cases (especially travel outside the United States), purchasing travel health insurance is a very wise precaution. Generally, Medicare does not cover medical expenses you might have when traveling outside of the U.S. and its territories like Puerto Rico. This means you could be exposed to considerable expense if you became ill or got injured while on a foreign vacation.

There are other factors to consider. If you are not yet covered by a Medicare plan (Original Medicare or an Advantage policy), your healthcare coverage depends on your policy. Traveling within the U.S., your coverage will usually include emergency care, regardless of your plan’s type (PPO, HMO, POS, etc.) or its local provider network. Non-emergency care may be a different story. Away from home, your insurance plan may or may not have “in-network providers.” Receiving care from an out-of-network provider could result in a denied claim that you have to pay.

Many individual plans have local networks that do not include nationwide (or international) coverage. The guiding principle here is simple: find out before you go! No one goes on vacation planning to wind up in a hospital, emergency clinic or needing some type of non-emergency care. Still, we know that these things happen, and they can be made all the worse if you discover that you are not covered.

Most OurSeniors.net family members are covered by Medicare. If you have Original Medicare, Parts A and B, that coverage is good anywhere in the United States as long as the provider has agreed to accept Medicare. The same is true of the private “Medigap” policies that seniors buy to fill in the gaps left uncovered by Medicare. In effect, all the providers who accept Medicare are one gigantic, nationwide network; there is no need to worry about being out-of-network. However, Medicare Advantage plans may be more problematic.

Advantage plans are always local organizations that have contracted with groups of local healthcare providers. Advantage plan members have to live in the service area covered by these providers, and insurance coverage outside that local network depends on the specifics of the plan. This is true, even inside the U.S. If you live in Florida, have an Advantage plan and plan to take a holiday or summertime trip, make sure that you understand the health coverage you have when traveling. A travel health policy is likely a wise investment.

This is even more important for travelers outside the U.S. Neither Original Medicare nor Part C, Medicare Advantage plans offer insurance coverage while you are in foreign countries. If you have Original Medicare with a Medigap plan, the supplemental (Medigap) plan may offer limited help, but do not count on this. Find out before you go! Healthcare insurance while traveling is especially wise for seniors; they are more likely to experience illness or injury during trips. Here are some pointers to keep in mind when shopping for travel health insurance policies –

- Many well-known companies like John Hancock, AIG, or Nationwide offer travel health policies. Coverage and cost may vary substantially; several websites offer tools for comparing different policies. Do a Google search for something like “senior travel health policies,” and you will find one.

- Pay careful attention to what is (and is not) covered. Many travel policies exclude pre-existing conditions. To get coverage for existing chronic problems like cardiovascular or orthopedic conditions, you must purchase a waiver. Coverage for pre-existing conditions is critical for seniors.

- Look for substantial benefits for emergency medical evacuation. Seniors are at higher risk of illness, falls or other injuries that require immediate attention and transportation to medical facilities. This can be quite expensive.

- You can often get combined trip insurance and travel health insurance in one policy. This covers you for medical care when traveling and also for unplanned trip disruptions. These disruptions were very common in the last two years, as many countries simply closed their borders to tourists. If you had pre-paid for a trip, this insurance would cover your loss.

- If you have a Medigap policy, check out its foreign coverage benefits. You may already have coverage for emergency care only. This is probably not enough for cautious people, but be aware that it is there.

- Keep in mind that the cost of travel health insurance is related to age and destination. An 80-year-old senior who wants to visit Kenya is a greater risk than a 65-year-old who wants to spend a week in the Bahamas. It is wise to consider this before choosing a travel destination.

- “Look before you leap” is good advice. Knowing your health insurance status while traveling may make you think carefully about travel destinations. If you are going to be outside your coverage area, shop for adequate insurance.

Thanks for reading the OurSeniors.net blog and articles. This organization exists to serve the needs of seniors in every way we can. If this article spares a senior from an unpleasant experience while traveling, we have done our job.

Fraud & Security

Social Security and Medicare Scams

by an OurSeniors.net Staff Writer

Social Security and Medicare Scams

Scammers don’t always knock on your door with a “too-good-to-be-true” deal on a new roof or house painting. That does happen, but scammers also use email, the Post Office, phone calls and other means to cheat seniors.

One of the most common ways scammers take advantage of seniors is through their concerns over Social Security and Medicare accounts. A common scammer tactic is to impersonate an employee of Medicare or the Social Security Administration by phone. The scammer will tell seniors that their social security number was issued in error, has been suspended or used in some type of crime. Then they ask the victim to verify that they have the correct number and use this information to commit other frauds.

There are many variations of this tactic. Sometimes scammers claim that they can fix a problem or “reactivate” the Social Security number for a small fee. They may ask for a senior’s Medicare ID number to cross-check identity or for bank account numbers to prevent fraud. These are tricks to get money directly from the victim or to obtain personal data for use in future crimes.

An especially cruel trick is to tell the victim that they are entitled to new benefits, or that they have a windfall of unpaid benefits just discovered by the Social Security Administration. To get this bonanza, the senior should verify their direct deposit information, birth date, Social Security number and other personal data. This data is a treasure chest for unscrupulous swindlers who can use it to transfer benefits to their accounts or as a basis for future frauds.

The misuse of Medicare information is less obvious, but it is still a serious crime. Scammers can use this information to cheat the Medicare system by filing fraudulent claims for benefits. This often involves claims for durable medical equipment like walkers or wheelchairs that were not ordered or needed. These false claims were one of the main reasons Medicare stopped using Social Security numbers as Medicare IDs. While these dishonest claims do not cost the senior directly, they cheat the Medicare system of resources needed to pay legitimate benefits.

Unfortunately, these types of scams are very common. The Social Security Administration Office of Inspector General (the OIG) is responsible for investigating many types of Social Security-related fraud. In the first nine months of 2021, the OIG received approximately 340,000 reports of Social Security impersonators. T-Mobile, a private industry provider of cell phone service estimates that in 2021 there were more than 2 billion scam calls that involved some type of Social Security scam.

Here are some warning signs and precautions you can take to avoid becoming a victim or helping to facilitate Social Security and Medicare-related frauds –

- Be skeptical of any unsolicited call from someone claiming to work for the SSA or Medicare. Do not give out your Social Security or Medicare numbers over the phone or by text. You will not get a call from Social Security or Medicare unless you have already been in contact with the agency.

- Do not respond to threats like loss of benefits or suspension of your Social Security or Medicare accounts if you do not pay some fine.

- If you know that your Social Security or Medicare number has been stolen, contact the Federal Trade Commission to file an identity theft report. Go to https://www.identitytheft.gov to start this process.

- If you have any doubts or questions about a Social Security-related matter, call Social Security’s customer service line at 800-772-1213. They can confirm whether a communication purporting to be from SSA is real.

- If you suspect Medicare fraud, call 1-800-MEDICARE to report it. Take a look at this informative YouTube presentation from Medicare- Medicare & You: Preventing Medicare Fraud.

- Install a robocall-blocking app on your smartphone, or sign up for a robocall-blocking service from your mobile network provider. Look at ROBO KILLER for Androids or ROBOKILLER for iPhones.

- Get a My Social Security Account online and check it every month for signs of anything unusual.

- Do not call a phone number left on your voice mail by a robo caller claiming to represent Social Security or Medicare. If you want to contact SSA or Medicare, call the customer-service lines at 800-772-1213 (SSA) or 1-800-MEDICARE.

- Beware of “spoofing,” the technology that fools caller ID systems. A caller in some foreign country can “spoof” their call to make it appear to come from Washington DC or some other in-country spot.They are beyond the reach of American law enforcement, but make you think they are in the U.S.

Remember to carefully guard all of your personal data and identification documents. If you are contacted by an unsolicited caller, by text, email or any other means, be very skeptical about them and any requests they may make. The Social Security Administration and Medicare already know your identifying data. They do not need to ask you for it.

Come back to OurSeniors.net frequently. We try hard to provide you with information that is both entertaining and useful. Thanks for reading our blog and patronizing our supporters.

As one of the best online magazines for seniors, OurSeniors.net works to provide our readers with truly inspiring stories from our “amazing seniors”. When we feature our amazing seniors, we are allowed to share their stories with the hope of encouraging others. We decided to take a look at two amazing military veterans that have done everything they could to show those that looked up to them, and those around them that anything is possible, and that if you can be anything that you strive to be—if not more. OurSeniors.net presents:

Colonel Juan Armando Montes

Born in Cuba on October 27, 1936, Colonel Juan Armand Montes dedicated close to 30 years of his life to the Army. He fought valiantly in combat as a ranger and rose through the ranks, becoming one of the most highly respected officers in the military. His destiny was to command and lead hundreds of troops, and that is exactly what he did during his illustrious career.

Colonel Montes got to witness the dedication and hard work of his father at a young age. His parents encouraged him to be a scholar, and he did exactly that; graduating magna cum laude with a B.A. from La Luz College in Havana, Cuba. He later received his Juris Doctor in Civil/Criminal law from St. Thomas Villanova Catholic University in Havana as well.

John Wayne pictures, and other war-time movies, inspired Colonel Montes to pursue a career in the military. As time went on, he was faced with the need to escape Cuba after Fidel Castro took control of the country.

As a Cuban immigrant, Colonel Montes found his calling in the U.S. Army when President Kennedy started the Cuban combat assault Brigade 2506. After arriving in the states, he dedicated his life to protecting and honoring the country that acted as a haven for him once living in Cuba was met with turmoil and difficulty.

The integrity, honor, and dedication that Colonel Montes had could never be questioned as he spent 25 years as part of the Green Beret Special Forces. As an incredible leader, he was honored with various awards including the Legion of Merit, the Joint Service Commendation Medal, and the Vietnam Cross of Gallantry with Palm for valor in combat in 1971.

As someone who has jumped out of airplanes to protect American freedom, and as someone that has been presented with various badges including the Combat Infantryman Badge that showed his participation and dedication during the 1965 invasion of the Dominican Republic that led to the successful freeing of Dominicans from Cuban-communist oppression. Colonel Montes served as a platoon leader during that time and his courage was of no question.

Colonel Montes is seen as an image of bravery, dedication, and strength. Throughout his life, he has shown those that looked up to him that no matter what life throws at you, you can always overcome it if you have enough courage and strength.

Jerry Krueger

Jerome “Jerry” Krueger was born in Miami, FL in 1922. He enlisted in the Army Air Corps and became a flight radio operator. After completing testing in Miami, he traveled to Sioux Falls, SD for radio school. Upon graduating, Jerry was assigned overseas to support the Flying Tigers in Kunming, China. Jerry flew more than 600 hours and received an Air Medal and a Flying Cross for his heroism. In addition to his military accolades, Jerry also received a medal from the Chinese government honoring his service.

Jerry is a man that has exemplified great determination and resilience. In 1945, the war had just ended and he only had two years of collegiate experience. However, that didn’t stop him from attending Rutgers University Law School. He was driven to achieve his goals and obtain his law degree. After working hard for two years, he met his wife Esther – a Cadet nurse who had also trained to be a registered nurse during the war. After meeting his match, Jerry and Esther began a relationship and friendship that would last more than 70 years.

After he worked in a law firm for two years, he decided to start a personal practice in Linden, NJ. What’s more, while he was actively working at his practice, he was asked to run for councilman of Linden, NJ. It’s safe to say that he won the position and he stayed within it for two years. Jerry is the type of person that goes above and beyond and he showed everyone exactly that after he was elected as the president of the city council.

He was also later elected to the state of New Jersey legislature for a year. Jerry gained unmatched experiences which led him to become the city attorney for the city of Linden. He stayed within his position for 30 years, all while maintaining his private practice. Jerry did not retire until he reached the age of 91. As the inspiration that he is, he and his wife Esther remained active within their community.

Jerry Kruger is someone to be celebrated and he’s the oldest surviving Jewish war veteran in the Daytona Beach area which he received an award for. Jerry and his wife Esther are perfect examples of strength, teamwork, and drive.

Jerry himself not only reached multiple milestones in his military career, but in his career in law, public policy, and his joy of being a family man. As of today when this article was written our young Jerry is only 97 years young, and his beloved wife Esther is only 95 years young.

OurSeniors.net knows that retirement can come with some unexpected financial challenges. Unplanned medical or dental expenses, home maintenance or car repairs can wreck even a carefully planned budget. Seniors living on fixed incomes are especially vulnerable to these financial mishaps. Unfortunately, seniors sometimes turn to high-interest, unscrupulous lenders to meet these needs, paying too much for the financial services they deserve.

There is an alternative, a much-needed service for seniors. BMG Money is an established, well-respected financial institution that provides valuable financial resources to seniors. BMG Money specializes in personal loans for retirees. While other financial institutions consider the senior market a risk, BMG Money embraces retirees. BMG Money’s “Loans for Retirees” program gives seniors access to emergency loans and financial resources they cannot get from other lenders. It is truly a financial safety net for retirees.

Founded in 2009, BMG Money has been protecting retirees from predatory loan operators for 13 years. BMG now operates in 36 states and Washington D.C. This fine company has earned a 5-star rating on Trustpilot, Google and Facebook, and BMG is accredited by the Better Business Bureau. Just as importantly, BMG Money has earned the confidence and gratitude of its clients, seniors who needed financial advice and services. Here is a comment from one of those clients:

“I had NO CLUE that I was eligible for refinancing, but the BMG Money phone representative induced awareness to satisfy a hidden need for additional funds. They stayed on the line with me while I completed the application, and a few minutes later, I was approved. WOW, WOW, WOW! He also created astute awareness regarding BMG’s referral program and a win/win for me and BMG.”

Please take time to learn about BMG Money’s Loans for Retirees program. BMG Money provides the tools and resources that seniors need to secure their financial wellbeing. BMG Money understands that retirees who have been rejected by banks or credit unions still need access to emergency loans and financial solutions. Consider these BMG Money advantages-

- It is Quick and Convenient. BMG Money services are accessible 24 hours a day through the BMG Money website. Retirees may apply by logging on to the website. It takes only a few minutes through any mobile or computer device. Once the needed forms are submitted, it takes 2 or 3 business days to review and get a decision.

- There is An Easy Application Process. The application process is short, taking about 10 or 15 minutes. Applicants will be asked for only 2 or 3 documents. These forms may be sent via email, text, or uploaded through the BMG Money website.

- BMG Money has great Customer Service. BMG phone support representatives are attentive to every call and every client. They are trained to communicate with seniors and retirees who may not be computer savvy or familiar with financial terms. BMG support representatives can even assist in installing WhatsApp, the free messaging and video calling app. This free program will provide both sound and video assistance to those who need it.

- Instant Funding is Available. After the needed paperwork is complete, the funds will be readily available within 1 to 2 business days. If the application is signed on a standard business day before noon Eastern Time, the turnaround for loan approval can be that speedy! Because there is no required credit score, the process is fast. Sometimes the money can be available as soon as the same day!

- No Credit Score is Required. BMG Money does not require a credit score at the time of loan application. This means fast, 24-to-48-hour approval for senior applicants. Jose Patino, Vice President of BMG Money, explains BMG’s policy this way-“Loan eligibility depends on current income – not credit history – a needed relief for consumers who have low credit scores or are otherwise denied by traditional lenders and shut out of the financial mainstream.”

- Easy Repayment Options are Available. Once qualified for a retiree loan, BMG Money arranges repayments directly from the deposited account. These scheduled payments benefit the retiree, preventing seniors from missing a payment and helping to improve credit scores.

- Referrals Can Help Pay Back Loans. Retirees can earn money through BMG Money’s referral program, helping others. There is no limit to the amount that can be earned through referrals. Retirees can earn additional bonuses based on the number of referrals sent to BMG Money. Sharing your great BMG Money experience with others helps them and you at the same time.

BMG Money makes applying to the Loans for Retiree program easy! These loans are available in amounts ranging from $500 to $5,000 and terms of up to 2 years. Interest rates are competitive and instant funding is available. Retirees can apply online from a smartphone, computer or any mobile device. Customer service representatives assist consumers Monday to Friday, 8:00 a.m. to 7:00 p.m. Eastern Time. Loan applications are available at www.bmgmoney.com, and client support is available at 866.316.4916. All loans offered are subject to eligibility, underwriting and approval. Terms and conditions apply.

Banks and credit unions may be unwilling to help, but BMG Money offers loan programs that manage unexpected expenses, allowing retirees to borrow responsibly and repay over time with affordable installments. It does this regardless of credit score. BMG Money is here to help retirees enjoy those years meant for family, leisure and fun.

OurSeniors.Net and BMG Money are happy to be collaborating, providing the financial services and knowledge crucial for retirement. As a leading financial institution, BMG Money offers an array of financial services to enrich the retiree community. Please stop by at www.bmgmoney.com and take the first step towards moving forward financially with BMG Money.

Entertainment

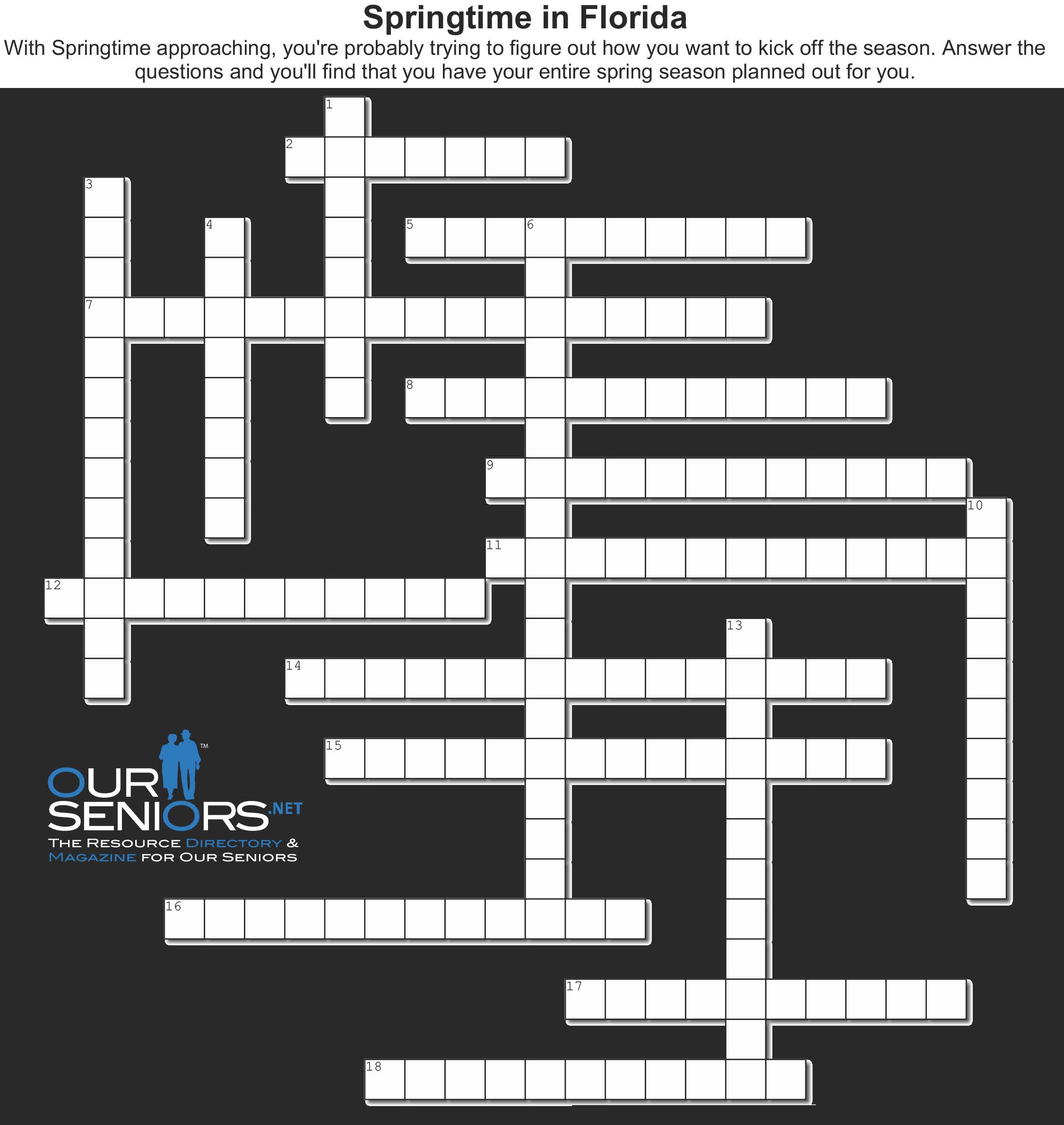

Springtime in Florida

Answers for the puzzle can be found on page 20

With Springtime approaching, you’re probably trying to figure out how you want to kick off the season. Answer the questions and you’ll find that you have your entire spring season planned out for you.

Check out our monthly Crossword Puzzle at https://ourseniors.net/crossword-puzzles/

Across

- If you start this drive in Miami and keep going nonstop you’ll end up in a beautiful place just four hours away.

- Have you heard of Salvador Dali…the artist? This place in St.Petersburg was dedicated to him.

- It’s a buoy near but not in the sea. It’s made of concrete and you can find it in Key West.

- A place in Tampa where you can expect to see over 1700 animals.

- Florida’s home of NASCAR racing, this place has a lot to offer for a fun day out.

- Visit the clearest swimming hole in the state.

- This place never gets old and would be fun for children and adults alike.

- This place really is known for its clear waters, white beaches, and intense sunsets.

- It’s a state park in Marianna with fun caves to explore.

- A safari park in the Tampa area that would excite everyone.

- What’s the name of the private reservation of the Miccosukee tribe? The surrounding shops are a great place to visit.

- Have you heard of Edward Leedskalnin? If so, do you know what he built between 1923 and 1951?

Down

- Want the aquatic version of Disney World to see ocean habitats up close?

- If you enjoy hunting for old items you’d love doing this activity in Acadia along the Peace River.

- Think in between Pine Island and North Cape Coral…what island would you find?

- Known as Orlando’s main tourist strip, this 11-mile drive would be worth it.

- If you like to fish, take a trip down to the ‘sportfishing capital of the world’.

- This pool can hold 820,000 gallons of spring water and was carved from a coral rock quarry 100 years ago

Uncle Tom, Matthew & Kratos, Forever in our Hearts