The Villages Florida, Summer 2022

Contents

Summer 2022 | Volume 6 / Issue 3

To OurSeniors.net Readers, Subscribers and Donors, As we celebrate the 4th of July, the birth of our great country, let us reflect on what this holiday means. For many of us, the 4th of July is a time to come together with family and friends, enjoy the outdoors and celebrate all that makes America great. It is an opportunity to remember our country’s history and to instill patriotic pride, togetherness and appreciation of courage and hard work in future generations.

This year, the 4th of July may look a little different in some places than in years past. Many traditional celebrations may undergo some restructuring due to the pandemic. However, with things having slowed down, many celebrations will have the opportunity to go on as they usually do. In addition, there are additional ways that you and your family or those closest to you can celebrate the holiday. Here are some ideas:

• Have a patriotic-themed picnic in your

backyard or at a nearby park and stay in tune

with what the holiday stands for

• If you can’t be with your family, host a virtual

4th of July party with them or join in on the

festivities through FaceTime

• Watch or light fireworks from your home or

attend a public fireworks show

• Participate in or organize a bike parade and

ride for recognition of the holiday

• Attend a public speech, festival or ceremony

in honor of the holiday and take the entire

family

Whatever you do this 4th of July, take the time to appreciate all that our country has to offer beyond the firework displays. Holidays Are Important But So Is Family The 4th of July is a holiday that is all about coming together and celebrating. It’s a time to enjoy good food, fireworks, and each other’s company. While it’s important to take the time to celebrate our country’s birthday, it’s also essential to remember the importance of spending time with our loved ones in general. Take the time to go over and teach your children and grandchildren and other young people the history of our Founding Fathers and how this Country was founded. Grandparents play an important role in the lives of their grandchildren. They provide wisdom, love and support. They are also a link to the family’s past. Spending time with our grandchildren can help them to learn more about their family and experience a sense of togetherness by spending this time together. In today’s fast-paced world, it can be difficult to find time to spend with our families as much as we’d like. However, it is important to make the effort because no one knows what can happen in a day. Research has shown that spending time with grandparents can have a positive impact on grandchildren’s mental and emotional health. It can also help them develop a stronger sense of self-identity. Imagine the positive effects that it can have the other way around? So, for this 4th of July, take the time to also enjoy your family, neighbors, and friends, and especially the younger family members who can benefit the most from family time. Spend some time with them and create memories that will last a lifetime. With that, there are actually some pretty good reasons why family time is so important. Top 5 Positive Effects That Family Time Has If you didn’t already know, family time, especially with grandchildren, can present multiple positive effects on both the grandparent and the grandchild. Did you know that at least 54% of grandparents spend more time with their grandchildren than they spent with their children when they were in their youth?

There is just something about being able to spend time with and teach your grandchildren that is different. Spending time with family can actually do a few things and these are only a few of the many reasons time with those closest to you are so important:

• Decreases risk of behavioral issues

• Boosts self-confidence

• Promotes the importance of resiliency

• Creates lasting memories

• Can have a positive impact on both the

grandparent’s and grandchild’s mental and

emotional health

Enjoy Summer

With Summer here to stay for a while, we hope that you enjoy our Summer Magazine Edition, spending time with family and everything that Florida weather has to offer. From the entire OurSeniors team, have a great Summer and do what makes you and others smile.

Thank you all for

your support and

yes, Give while

You Live!

Warmest regards,

Julian G. Cantillo,

L.P.N., President

and Founder of

O u rS e n i o r s . n e t

Magazine

Don’t miss another edition by donating! Visit www.ourseniors.net/subscribe

Disclaimer: The information published in this magazine and our website is intended for residents of the USA. The opinions, beliefs and viewpoints expressed by the various authors in this magazine and on this web site do not necessarily reflect the opinions, beliefs and viewpoints of OurSeniors.net Magazine or official policies of OurSeniors.net Magazine. It may contain general information about medical conditions, public and private health service organizations and other third-party information including but not limited to testimonials.

The information is not advice (legal, medical or otherwise) and should not be treated as such. No claim is made as to the accuracy, authenticity or completeness of any information and, is often provided in a generalized or summarized format for brevity. OurSeniors.net Magazine, LLC and or its subsidiaries, does not accept any liability for the information (nor for the use of any information) provided by this magazine and or website. The information presented by this magazine and website is provided on the basis that all viewers undertake responsibility for assessing the relevance and accuracy of the data related to their circumstances.

Thank you for reading our magazine and visiting www.OurSeniors.net and please contact us if we can be of further assistance. All real estate advertised in OurSeniors.net is subject to the Federal Fair Housing Act. This federal law makes it illegal to advertise any preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preferences, limitation, or discrimination.

We will not knowingly accept any advertising for real estate which violates the law. All persons are hereby informed that all real estate advertised in OurSeniors.net is available on an equal opportunity basis. Information contained herein has been furnished by community owners, managers and agents. OurSeniors.net and or OurSeniors.online, OurSeniorsDiscounts.net and or FindingAssistedLiving.com, LLC. and OurSeniors.net Magazine, LLC do not make any representations as to opinions and facts. All terms and conditions of rentals are subject to change. OurSeniors.net reserves the right to refuse advertising space to anyone deemed unsuitable for placement in this publication.

OurSeniors.net, OurSeniors.online, OurSeniorsDiscounts.net and or FindingAssistedLiving.com, LLC. and OurSeniors.net Magazine, LLC retains all rights reserved by copyright 2019 OurSeniors.net, and or OurSeniors.net Magazine, LLC. This publication or parts thereof may not be reproduced in any form without the written permission of the publisher.

For further Disclaimer information please visit https://ourseniors.net/wp-content/uploads/2016/06/disclaimer-privacy_policy-terms_of_use-1.pdf. Please note that websites and links are referenced in the magazine and you may have complete access to our online version by visiting. www.ourseniors.net/magazine only if you are a subscriber.

What exciting news we have to tell you! OurSeniors.Net has been recognized as a Volusia-Flagler County SCORE Non-Profit Client of the Year for 2021. The winners were announced on May 18, 2022, and featured numerous 501c3 non-profits and for-profit organizations. It was a great team effort to earn this award and is a testament to our dedication and service to providing valuable resources

and insightful information to our senior and retiree communities. Founded in 2016, OurSeniors.Net has earned 5-star customer ratings on sites like Facebook and Google, and is A+ rated and accredited by the Better Business Bureau. Our mission is to be the number one resource for helping seniors and retirees living in Florida meet their unique needs, to be their single source for information, professionals and providers, and opportunities for personal assistance. The SCORE Program recognizes OurSeniors.Net for our work in providing seniors with information and resources—such as news and events, blog, crossword puzzles, books by seniors and OurSeniors Radio—to ensure they lead happier and fuller lives as well as guiding them toward trusted service providers that will not rip off the vulnerable. We partner with a variety of well-respected professionals like doctors, dentists, contractors and other experts

in their fields. No matter what type of assistance you may need—from home repair to finance to buying or selling a home to considering assisted living—OurSeniors.Net is here to help. Our carefully vetted and approved vendors meet

our exceptionally high standards and adhere to the OurSeniors.Net Code of Ethics. You can have the peace of mind and confidence that we have done our homework and only partner with trusted service providers and businesses.

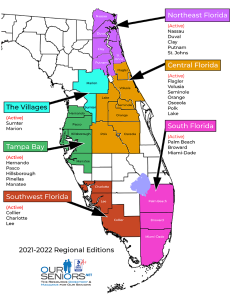

To find out more about the SCORE VolusiaFlagler Counties Program and its services which can help small business owners, entrepreneurs, and non-profit organizers to find a mentor, take a workshop or browse the library, visit https://volusiaflagler.score.org/. OurSeniors.Net now produces magazines for

older adults in six different regions serving 25 counties disseminating more than 130,000 print magazines and resources with our senior online magazine and Facebook page. We would love to keep our senior and retiree communities happy and ask that you consider donating to our non-profit organization by

visiting https://www.ourseniors.org/fundraiser/ to learn about our Spring Fundraiser or by calling 800-647-0868. Help us reach our quarterly goal so that we can continue distributing our publications and resources for free to our senior and retiree communities throughout Florida.

OurSeniors.Net is proud of its in-print and online magazine for seniors. We try hard to be one of the best magazines for  seniors available in the state of Florida. Wherever you live in our great state, the chances are that OurSeniors.Net and our services are available to you. To better serve the needs of seniors and their families, we have always divided the wider area that we serve into several smaller service areas. This enables our staff to better serve the needs of seniors who reside in each of these locations. We recognize that the interests and concerns of South Florida seniors may be different from

seniors available in the state of Florida. Wherever you live in our great state, the chances are that OurSeniors.Net and our services are available to you. To better serve the needs of seniors and their families, we have always divided the wider area that we serve into several smaller service areas. This enables our staff to better serve the needs of seniors who reside in each of these locations. We recognize that the interests and concerns of South Florida seniors may be different from

those living in Central Florida or the Villages area. Recently, we have made a few additions and changes to those service areas. Here is a complete rundown on our new configuration, each with its custom edition of our senior living magazine. Northeast Florida includes Duval, Nassau, Clay, Putnam, and the newly added St. Johns

County. This is a great place for seniors to visit or live. The city of St. Augustine is home to many unique attractions. In fact, St Augustine is an attraction itself; it is the oldest city in the U.S. Stop some time and visit the oldest schoolhouse in the nation. Seniors find the golf, beaches, and historical sites to be among the best in Florida Central Florida has added Lake County to its group, which also includes Volusia, Orange, Seminole, Flagler, Osceola, and Polk. Of course, Orange County is the home of SeaWorld, but Volusia and Flagler offer miles of beautiful beaches, while this group’s other counties are home to a growing number of Our Seniors.

Recently, OurSeniors.Net won the VolusiaFlagler County SCORE Non-Profit Client of the Year for 2021. This was a team effort that speaks to our dedication to delivering valuable resources to the senior and retiree communities.

The recognition motivates our group to continue the good work for years to come. The South Florida edition of our senior living magazine is aimed at seniors in the Miami-Dade, Broward, and Palm Beach Counties. The Miami-Dade area is the home of one of our nation’s largest and most diverse concentrations of Hispanic and Caribbean

cultures. Of course, our senior living magazine, OurSeniors.Net Magazine has been previously published in a Spanish language version. Charlotte, Lee, and Collier Counties make up the Southwest Florida coverage area. This area offers a wide range of attractions and amenities for seniors. Many of these places have become world-famous attractions for seniors and young adults alike. Consider a bike ride on Sanibel Island for nature lovers, or a visit to the Ringling Museum of Sarasota for art connoisseurs. The Tampa Bay group includes Hernando, Pasco, Pinellas, Hillsborough, and Manatee Counties. Beach vacations are meant to be barefoot, and Clearwater Beach is set up perfectly for a car-free experience. In urban Tampa, the Ybor City area offers a glimpse into the Cuban, Spanish, and Italian heritage of the state. It is filled with the authentic cuisine of these cultures. Lastly, Sumpter and Marion Counties now comprise The Villages coverage area. This area is known nationwide as the home of senior communities and activities. The Villages consist of over 70 smaller units, or “villages,” ranging in size from about 100 to 1600 homes. Maybe the best way to get around the Villages is by golf cart, and that fact gives you a clue to

the lifestyle and the senior living resources found here.

OurSeniors.Net’s service areas and the regionalized coverage editions of the OurSeniors.Net Magazine are designed to better serve the needs of seniors. That is what we do. Our senior living magazine covers important news for seniors, the pros and cons of living in Florida, finding senior living resources, resources for elderly living alone and many other topics of interest to seniors. If you are a business or professional service provider and want to market your product or service before a targeted audience of seniors, please see our Contact Page or phone us at 866-333-2657 ext. 2. Thanks for reading our blog, visiting our website, and patronizing our Approved Vendors. Drop by one of our Lunch and Learn events to meet some of the OurSeniors.Net staff in person.

If you haven’t looked into hearing aids in the last couple of years due to cost or appearance, or have been putting off your hearing health due to accessibility constraints, it’s time to discover what’s available in the market for you today. Just like all technology that we rely on in this world, hearing aids have progressed to be faster, smaller, more sophisticated and more affordable. In terms of services, and the onset of remote working, people are demanding a more seamless way to interact with their physicians and licensed health professionals without having to leave the comfort of their homes. Chances are you or someone you know has hearing loss. The National Institute on Deafness

states that one in three people in the US between the ages of 65 and 74 have hearing difficulties, and nearly half of those older than 75 suffer from hearing loss. This is not just a baby boomer epidemic, hearing loss affects all age groups. A WHO report forecasted that 1.1 billion teens and young adults will permanently injure their hearing due to excessive use of headphones and attending loud social events. The good news is that nearly 95% of people with common hearing loss can be treated with a simple solution: hearing aids. Now, what technologies and features are available, and what is being developed to make them “cool” for everyone to use? In the last 5 years, hearing aid technology has improved significantly. Standard features now include rechargeable batteries, directional microphones to reduce background noise,

feedback cancellation for an easier listening experience, they’re more comfortable and discreet to wear and most are Bluetooth enabled to make self-adjustments through your smartphone. The most advanced devices keep

track of your physical health, monitor your heart rate, stream the audio from your television, and even connect with your smartphone to take calls. Modern technologies used for monitoring vital signs in wearables, like smartwatches, will soon be applied to hearing aids. Soon hearing aids will monitor one’s blood pressure, identify heart attacks and include fall detection capabilities. During these emergencies, your smartphone that is connected to the hearing aids will contact first responders with your location and share your status with them. Before you go out and purchase a $5,000 pair of hearing aids, consider your options in the market and what features you want. Most people who have bought the most expensive, cutting-edge hearing aids end up not using most of these enhanced features. For the non-tech savvy, too many features can be unnecessary and overwhelming to use. Also, most health insurance policies and Medicare do not cover the cost of hearing aids or hearing evaluations from Audiologists. Since the pandemic, primary care and licensed hearing specialists

are utilizing telehealth as a replacement for office visits. This is mostly driven by the increased willingness and demand of their clients and patients to try telehealth. With the onset of Zoom and other virtual services to connect people “face to face”, it seems as though everyone has utilized these tools and are comfortable with using them. This is especially true for those that live in assisted care facilities, retirement communities or are dependent on in-home care. It can be challenging for these individuals and the facilities themselves to schedule off-site appointments because of transportation barriers, skilled labor shortages or managing the potential liability that comes with safeguarding a high-risk population. If you just want to hear better and your priorities are value, convenience and customer service. There are hearing aid companies that now provide a comprehensive suite of telehealth services and solutions directly to

the consumer, saving them thousands of dollars. Some provide free professional online hearing tests and consultations with licensed hearing specialists to evaluate your hearing needs. When seeking these services, be sure to ask about their free licensed hearing care consultations, if they offer free warranties with their hearing aids, free trial periods, and loss and damage coverage. A rapid shift to telehealth hearing care services could also be a great equalizer for a generation of people and socioeconomic status who are finding it more challenging to access affordable hearing care solutions, like hearing aids. Some 28.8 million Americans could benefit from wearing hearing aids, however, fewer than 16% wear them. And of those age 70 and older who could benefit from wearing hearing aids, fewer than 30% have ever used them. These depressing

statistics can be reversed with the onset of quality telehealth hearing care services and affordable hearing aid solutions that are available in the market today. There are solutions and if you are interested, there is a Special Offer

just for OurSeniors just visit here: ourseniors.net/rxhearing-aids-incspecial-offer-just-for-ourseniors/

Any donation would help us tremendously as we continue to produce the magazines for older adults and provide free resources to seniors across Florida.

Please visit https://www.ourseniors.org/fundraiser/ to see more about what you can do to help or call at 800-647-0868. OurSeniors.org also provides a senior living magazine online full of great resources at no cost as a part of our non-profit services.

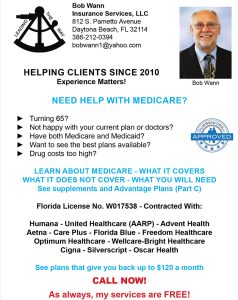

Medicare offers several coverage options for seniors who have special needs. These include programs for people with certain chronic conditions like diabetes, patients who are in institutional care and those who are eligible for both Medicare and Medicaid programs. Medicare calls these programs “Chronic Condition SNPs” (C-SNPs), “Institutional SNPs” (I-SNPs) and “Dual-Eligible SNPs” (D-SNPs). The availability of these programs may vary from state to state and even among coverage areas within the same state. All Medicare SNPs are a type of Medicare Advantage plan, meaning that each of them has its own local

network of physicians, pharmacies, and other providers. Special Needs Programs offer an extra level of care and specialized attention. For example, patients who suffer from diabetes might join a C-SNP (chronic condition SNP) that focuses on the management of diabetes and its complications. This plan is likely to include more of the medical specialists who treat diabetes, and the drug formulary will contain medicines commonly used by diabetics. Chronic condition SNPs may be designed for patients with chronic lung disease, congestive failure, stroke, dementia, and several other conditions. Many Medicare patients suffer from one or more of these chronic illnesses, and their care should be coordinated between the primary and specialist providers who see them. Medicare C-SNPs provide insurance coverage for all the medical services that are likely to be needed by a chronic disease patient. They combine hospital, medical, and prescription drug benefits, sometimes specialized benefits not covered by other plans. Often, these plans provide a care coordinator, a person who makes sure that the patient gets all the preventive care and treatments required by good medical practice. A second type of SNP is the Institutional Special Needs Plan (I-SNP). This plan restricts enrollment to individuals who have (or are expected to have) a need for 90 days or more of intermediate care. Intermediate care facilities include skilled nursing facilities, long-term care nursing facilities, inpatient psychiatric care and facilities for patients with intellectual disabilities. You should contact an insurance counselor to find out what programs are available in your area. An excellent source of free advice may be the SHINE (Serving Health Insurance Needs of Elders) program. This is a free program offered by the Florida Department of Elder Affairs. SHINE’s trained volunteers can assist you with your Medicare, Medicaid, and health insurance questions. The Dual-Eligible Special Needs Program (D-SNP) is the remaining member of the special needs group. This program is aimed at lower-income individuals who are entitled to both Medicare and a state Medicaid program. To qualify for a D-SNP, you must receive both full Medicaid benefits and Medicare Parts A and B. Dual Special Needs Programs may include benefits not found in Medicare or Medicaid alone. These may include some dental, vision and hearing benefits and a personal care coordinator. Others might offer telehealth options, credits to buy health products, and even transportation assistance. All of these plans offer different benefits and have

different eligibility requirements, so be sure to look at what is available where you live. Once again, help from Florida’s SHINE program or an OurSeniors.Net

Approved Vendor (see below) may be especially useful. Once you are eligible for Medicare coverage, you may elect to join an SNP. For most people, this will be the Medicare Initial Enrollment Period which includes the month you become 65 and the three months immediately before and after.  If you now meet the SNP

If you now meet the SNP

qualifications but decided on another plan in the past, you may switch to one of the available Special Needs Programs during the Annual Election Period (October 15 to December 7 of every year.) During that annual period, you can switch plans, disenroll from a current plan, or enroll in a Special Needs Plan for

the first time. All of this is easily said but doing it correctly may be complicated. If

you are currently seeing a given specialist, say for diabetes care, you may want to make sure that this provider is a member of the SNP you are joining. Likewise, if you are taking a prescribed set of medications, you would want to

find out if these drugs are on a given formulary. All of this requires specialized local expertise. Remember that SNPs are Advantage Plans and are, therefore, local organizations. In the Daytona Beach-Volusia County area, you can count on Bob Wann Insurance Services, LLC. This fine organization, a member of the OurSeniors.Net family of Approved Vendors, has the expert advice you need to get the best possible coverage in the area. You can reach Bob at 386-212-0394, and Thank You for reading our blog and our senior magazine! We strive to bring you important news for seniors about subjects that matter. We like to cover Social Security and Medicare news, senior housing news, and state related news such as the pros and cons of living in Florida, the cost of living in Florida or resources for elderly living alone. Both in print and as a senior living magazine online, our organization exists to serve the needs of seniors and their families.

It is estimated that 1 in 10 people are victims of online scams each year. Advancements in internet usage that are meant to make people’s lives easier have made it an opportune hunting ground for savvy cyber criminals to prey on vulnerable groups of people, especially the senior and retired communities. Cyber criminals are becoming more inventive and are finding efficient ways to trick people into providing sensitive information that can leave thousands to deal with dire situations. For a long time, people were encouraged to look out for online scams during tax season, but it’s become apparent that online scams happen year-round. And they are a booming business. Look for the Tell-Tale Signs There are specific patterns that online scammers follow to steal your identity or money. Knowing how to spot these patterns is a great way of avoiding the nightmare that may come from dealing with fraudulent and nefarious groups and individuals: 1) Gaining Your Trust One of the easiest ways to scam somebody is to gain their trust in person or online. Anyone can gain trust by pretending to be a respected official, community member, business owner and

more. You must take the time to verify someone’s credentials. Google is a great resource that allows you to find out if someone legitimately is who he or she

claims to be.  2) Tugging on Your Fears Messages like “Respond to this message or the IRS will place alien against your home” or “Act now to avoid wage garnishment” are used by scammers to instill fear in you and trick you into

2) Tugging on Your Fears Messages like “Respond to this message or the IRS will place alien against your home” or “Act now to avoid wage garnishment” are used by scammers to instill fear in you and trick you into

logging into a fake website that is set up to skim your username and password. Scammers will then use your information to log onto a real website and steal your money. 3) Contacts You Randomly When you receive an SMS, email,

phone call or a letter that you did not expect, you must proceed with caution even when the message that you received seems innocent. Scammers are looking for you to take action by responding to something you believe is legitimate. Find the accurate contact by checking the web and take your own action. 4) Asks for Your Information If you are asked to provide your personal information (address, social security, driver’s license, PIN, etc.) you need to also treat it with caution. Social security scams are on the rise and becoming more sophisticated. They cost U.S. taxpayers billions of dollars each year. A great piece of advice is to think about who initiated the contact. If they contacted you first, don’t provide any information until you are certain of their legitimacy. 5) Promises Compensation One of the most popular scams out there involves compensation and then a request for a refund. For example, a scammer can

provide you a cash payment in advance (for goods or services) and then reach out to you indicating that they overpaid. You return a specific sum of money

and then later find that the original payment to you has been canceled. 6) Pretends to Be a Family Member Another popular online scam involves social media or email in which a scammer contacts you and pretends to be a family

member in need of emergency financial assistance. These scams involve two parts – the first part is setting up a fake account (e.g., Facebook or email) and then contacting you from this account asking for help. Unfortunately, many people fall for this scam, wiring money only to find out later on that your actual family member was home safe and didn’t need any assistance at all. 7) Provides Wire Transfer Info Whenever possible, avoid wire transfers altogether. Any time

someone asks you to transfer money by wire, the funds will be untraceable. As soon as it’s picked up on the other end, the money is gone. Some credit cards will allow you to dispute a fraudulent charge for up to 60 days, but this could be

troublesome in many cases and require you to provide proof. If you feel you might have been a victim of an online scam and need guidance in filling out forms to get your money back, we encourage you to reach out to attorneys Wendy Mara (https://ourseniors.net/legal/florida/ormond-beach/business-law/

wendy-a-mara/) and Andrew Grant (https://ourseniors.net/legal/florida/daytona-beach/business-law/andrew-c-grant/), members of the OurSeniors.org Senior Transition Pro Team. You can also report any suspicious online activity to one of several offices that serve counties in Florida (https://www.fbi.gov/contactus/field-offices) or (https://www.ic3.gov/Home/ComplaintChoice). Even if you are uncertain whether you or someone you know has been victimized by an online scam, you can be of tremendous help by alerting the authorities to assist in

preventing others from falling prey to these attacks. Since 2016, OurSeniors.Net has been providing the senior and retiree communities in Florida with excellent resources to help enrich lives with content from our talented and dedicated staff as well as our trusted partners. Check out our quarterly senior living magazine, follow us on Facebook, or read our blog for up-to-date information on mental & physical health, social life, economy and legal issues as they relate to your

well-being. We look forward to you becoming a part of our community and encouraging others to be a part of our thriving group.

Florida home insurance premiums are increasing at an astronomical rate. The insurance market is suffering due to increased costs in claims, attorney fees and fraud. Many companies are not writing new policies and are canceling policies, forcing Floridians to have to look for new coverage. Although the State Legislature held a special session last month, there are no quick fixes to the situation. This could not happen at a worse time. Hurricane Season has just

started. Agents are struggling to find replacement coverage for their clients. Companies have tightened their underwriting requirements and many people

cannot meet them. If the home qualifies, they are now being written with Citizens Insurance, the State of Florida Insurance Company. Known as the insurer of last resort, Citizens has become the “go-to” company for agents in

Florida. They do have limits and restrictions on some coverages. But it might be the only solution. To help the insured prepare to “shop” their insurance, they

should be prepared for a 4-point inspection and mitigation inspection. These inspections are used to qualify the property for discounts that might be available

on the policy. These inspections look at the age of the roof, electric and plumbing. They also provide the insurance company with an idea of what mitigation has been done to the house. These include hurricane shutters, roof tie-downs, and how the roof was constructed. The safer the structure the better

chance one has of receiving a quote from more than one insurance company.

During the special legislative session, the state tried to come up with ideas to stabilize the market. Over the past 5 weeks, more than 5 companies have been sent to receivership and are basically out of business. This flooded the market with people looking for insurance and is putting a strain on the market capacity. One of the solutions the legislature passed was to stop canceling policies based on the age of the roof. Under the new law signed by Governor DeSantis, companies cannot cancel a policy just for having a roof for over 15 years. They do require the roof to have at least five years of life left. The legislature also set aside money incentives for homeowners that make storm-related improvements to their homes. It’s unknown if these new laws will help the market. Until the fraud and the limit on attorney fees come under control, it will be hard to see any relief. Reviewing your coverage with an agent to make sure you have the proper limits and coverages can help. With inflation affecting the price of everything, the insured will need to make sure they are protecting their home properly. OurSeniors.Net strives to bring valuable resources to seniors and retirees through our senior online and print magazine www.ourseniors.net also check us out on Facebook. Steve Clein is an insurance agent with over 30 years of experience. He is the owner of C & C Insurance located in Pembroke Pines and is the current Chairman of the Florida Association of Insurance Agents (FAIA ). www.CandCInsurance.com; steve@candcinsurance.com.

When most people think of a homestead in Florida their first and only thought is of Florida’s property tax exemption for homesteads. While that is a good and valuable aspect of Florida’s homestead laws, it is only one part. Florida really has three different types of homesteads, and each functions differently in operation and effect. The three types are: homestead for property tax purposes;

homestead for creditor exemption purposes; and homestead for inheritance purposes. Florida’s homestead for property tax exemption purposes can provide significant savings for Florida homeowners. The base exemption is $50,000 deducted off the assessed value of the homestead, but the better benefit is the cap that is imposed on how much the assessed value can increase each year. That cap means that even as the value of the homestead increases each year the property appraiser can only increase the taxable value a little, and over time that beneficial disparity can mean large property tax savings. Further, the capped assessed value can be transferred to a new homestead if the old one is sold. To get the homestead property tax benefits the owner must be a permanent Florida resident and apply with the county Property Appraiser. The Appraiser then determines whether the applicant is a permanent Florida resident by considering some factors including: where the applicant is registered to vote; where the applicant works; whether the applicant has a valid Florida driver’s license or state-issued identification; whether the applicant has a vehicle registered in Florida; and the address the applicant uses to open bank accounts.

Once granted, the exemption is in place and there is no need to do anything to renew each year so long as it remains the Florida owner’s primary residence.

Less commonly known, or understood, is the Florida homestead that is exempt from creditors. To qualify for this the owner needs to be a permanent Florida resident (meaning Florida is the owner’s home and whenever he or she leaves they intend to return here). If that’s the case, then the owner has a Florida

homestead that is exempt from almost all creditors. There’s nothing else that needs to be done; it just is as a matter of law under the Florida Constitution. There are limitations, however. If the homestead is outside a municipality, then the exemption applies only up to 160 acres of contiguous property. If the homestead is in a municipality, then the exemption applies only up to one-half of an acre. The protection from creditors is almost absolute with a few notable exceptions. Homesteads are not protected against creditors who have a direct interest in the property, like a bank that holds the mortgage or a worker who files a lien for unpaid work performed on the property. Homesteads are also not protected from the IRS for unpaid federal taxes. Finally, homesteads may not be

protected if they are held in a revocable trust and the grantor enters into bankruptcy. The exemption from creditors also means that the Florida homestead does not count against the owner for determining Medicaid eligibility

so long as the owner intends to return to it and it isn’t rented to a third party while the owner is in a care facility. The homestead also is not a probate asset subject to the owner’s creditors provided the person inheriting the property is

a qualified heir under Florida law, such as a surviving spouse, children, grandchildren, or more distant relatives. If the inheritor is not a qualified heir, or if the deceased owner expressly directs the sale of the homestead in his or her will, then the property will be a probate asset subject to the owner’s creditors.

The third type of Florida homestead puts restrictions on how the property passes at the death of the owner. If there is only one owner, and if the owner is married, then only the homestead can only be left to the surviving spouse. If the owner has minor children, then the property cannot even be left to the surviving spouse. The spouse automatically gets a lifetime right to reside on the property

and the children get the right to own the property after the spouse dies. Most married couples co-own their homestead, so the issue does not come up very often, but it bears mentioning especially for couples in blended families with children from different marriages. Florida homestead laws are fairly unique compared to other states. On the one hand, Florida grants generous property tax exemptions and creditor protections. On the other hand, it can direct how the homestead passes at the owner’s death despite what the owner may wish. To properly prepare a Florida estate plan, it’s important to be aware of the different homestead types and to consult with a professional who understands them.

As people get older, they must remain physically active to prevent many of the health and mental issues that come with age. But regular physical activity does not have to be limited to vigorous exercise. Many people find ways to stay active by giving back to the community. It’s a great way to meet other people with shared interests and strengthens social bonds. A great opportunity to give back is just around the corner. Election season is here! And it’s never too early to register to vote and to get involved with the Florida election process in one of many roles. While casting votes in the primary and general elections is the most common way for seniors and retirees to contribute to the democratic process, many choose to volunteer to become poll workers. In fact, according to a Pew Research Center study of the 2018 General Election, approximately 58% of poll

volunteers were 61 years of age or older. There is a tremendous need for volunteers to ensure election integrity is maintained across the nation and seniors can help by volunteering to volunteer for one of the numerous positions for the upcoming election. In Florida, a variety of assignments are available throughout Election Day, but there are also several opportunities in the days leading up to the election, including clerk, assistant clerk, machine manager, inspector, and precinct deputy. What Are the Responsibilities for Each Position?

Clerk – The clerk’s main responsibility is to oversee all operations at a polling location. In the days leading up to the election, the clerk must contact all workers, pick up supplies, and help to set up polling equipment, tables, and chairs. The clerk Is also responsible for verifying voter eligibility, updating addresses, administering provisional ballots, and transmitting ballot totals after

the polls close. Assistant Clerk – The assistant clerk reports directly to the clerk

and serves as a backup for any of the other worker positions. He or she will also help set up voting equipment, work with the call center to verify voter eligibility,

make sure all required forms are filled out correctly, and assist in closing down the polling location after the polls close. The assistant may also be assigned special duties by the clerk. Machine Manager – This is a specialized role that requires technical responsibility. While each position requires some training before Election Day, people that apply for machine manager generally have prior technical experience. The machine manager’s main responsibility is to set up voting equipment and provide onsite technical support. In addition to setting up and taking down equipment, the manager is also responsible for transporting the ballots to a designated site after the polls close. Inspector – The inspector’s main responsibility is to “check-in” voters through the use of an Electronic Voter Identification Device (EVID). The inspector is likely the first person voters will

speak to upon arriving at a polling location and will verify voter eligibility, provide documentation so that a voter receives his or her ballot, and assist with the takedown activities at the end of the day. Precinct Deputy – The role of the precinct deputy is to maintain order at the polling location. The precinct deputy designates the “no political activity” outside of the polling location, distributes

supplies on Election Day, and ensures the polling place is compliant with the Americans with Disabilities Act (ADA). In rare cases, the precinct deputy will

have to inform law enforcement to help maintain order at a high traffic polling location. As you can see, the election process is a group effort with many overlapping responsibilities. But it’s certainly a great way to stay active and get involved in the community while ensuring election integrity. Poll workers are

paid for each class they attend for their training, but the selection process can be competitive from one precinct to the next.

Election dates for 2022 are:

• August 23, 2022, for the

Primary Election.

The registration deadline is

July 25, 2022.

• November 8, 2022, for the

General Election. The registration deadline is October 11, 2022.

But it is never too early to send in your application to volunteer to work the election. Check with your county office for more information. Remember this is a

great way to answer the call of civic duty and have fun while doing so! The team here at OurSeniors.Net aims to bring useful and entertaining information that

enhances the quality of life for our senior and retiree communities. Check out our senior living magazine online, our Facebook page, or our quarterly senior

lifestyle magazine for great content to help you and your loved ones lead happier and fuller lives.

OurSeniors.Net strives to be a go-to resource for seniors, serving their needs in all possible ways. For many seniors, one of their most important requirements is to attain affordable help in dealing with hearing loss. With that in mind, OurSeniors.Net is extremely pleased to welcome Rx Hearing Aid to its family of senior-friendly services, products, and professionals. Rx Hearing Aids and OurSeniors.Net are a perfect fit. Our two organizations share common goals and missions. Both are devoted to serving the needs of seniors and improving their wellbeing and quality of life. For OurSeniors.Net, this means our publications, websites, social media and service activities. For Rx Hearing Aids, it means applying today’s modern technology to a market where, in the past, high prices and complex procedures have often locked seniors out. Hearing loss affects about 48 million people in the United States, and seniors are especially

vulnerable. About one-third of seniors aged 65 to 74 have some loss of hearing and one-half of those older than 75 have hearing difficulty. This disability has serious consequences, affecting both emotional and physical health as well as quality of life. Numerous studies have confirmed that hearing loss is associated with an increased risk of developing dementia, Alzheimer’s disease, cognitive disorders, and balance problems. For decades, the market for high quality, medical-grade hearing aids has been dominated by a small number of companies who kept prices artificially high. Not only were the prices for hearing

aids themselves high but medical grade hearing aids could be obtained only after a series of medical and audiological exams. These examinations often involved numerous in-person office visits and sophisticated tests. For many seniors, the path to a quality hearing aid was too complicated and too expensive. This procedure was mandated by government regulation, but now that has ended. Now, Rx Hearing can offer a complete off-the-shelf package of

professional services and medicalgrade hearing aids at savings of up to 80%. This includes free hearing tests that once required visits to an office with audiometry equipment. Rx Hearing allows these audiometry hearing tests to be

done online, using the same tonal testing to determine if a customer’s hearing is within normal limits. This testing will diagnose the faintest tones a person can hear at varying pitches or frequencies across the range of human speech. Using this information, Rx Hearing’s in-house licensed hearing specialists provide free

consultations with the customer to determine their hearing needs. They will discuss different types of hearing loss, answer questions about their hearing aids, and then make an expert recommendation based on the client’s hearing

needs. This is all done remotely via Zoom or phone. Their hearing aids are not merely sound amplifiers, they are FDA Registered, preprogrammed hearing aids that will meet the needs of those with mild to moderate hearing loss. A single-point telehealth hearing care solution enables Rx Hearing to provide these free

comprehensive services throughout the country.  Their long-term relationship with hearing aid manufacturers can also save their customers money while getting the latest technologies and advancements in hearing aids. These services can help both current hearing aid users and first-time users. If you’re a current hearing aid user, the Rx Hearing Aid professional staff can offer you a free second opinion. If they feel that your symptoms require further medical care, they will refer you to the proper audiologist or ear, nose and throat medical

Their long-term relationship with hearing aid manufacturers can also save their customers money while getting the latest technologies and advancements in hearing aids. These services can help both current hearing aid users and first-time users. If you’re a current hearing aid user, the Rx Hearing Aid professional staff can offer you a free second opinion. If they feel that your symptoms require further medical care, they will refer you to the proper audiologist or ear, nose and throat medical

specialist in your area. These services come without the difficulty, frustration, and expense of repeated office visits. The sophisticated electronics and components in their devices are identical to hearing aids that cost over $3,000 in the market today. They also include many of the new features available in modern hearing aids like Bluetooth connectivity, rechargeable batteries, and smartphone apps to adjust the hearing aids settings and contact customer support with a touch of a button. Rx Hearing Aid provides outstanding follow-up services including a free two-year warranty, free two years of consultations

and care, and two years of loss and damage replacement coverage. All of this comes in one low-cost package, helping seniors to feel secure and confident in this important part of senior life- good hearing! Thank you and welcome aboard,

Rx Hearing Aid, Inc! The OurSeniors.Net family is proud to have you as its newest member. We share the core values of helping seniors in every way possible. Your innovation in the hearing aid market is going to make affordable and professional hearing care accessible to thousands of seniors who could

not otherwise access it. It is truly a modern-day miracle, made possible by technology, innovation, and a desire to serve our seniors!

seniors available in the state of Florida. Wherever you live in our great state, the chances are that OurSeniors.Net and our services are available to you. To better serve the needs of seniors and their families, we have always divided the wider area that we serve into several smaller service areas. This enables our staff to better serve the needs of seniors who reside in each of these locations. We recognize that the interests and concerns of South Florida seniors may be different from

seniors available in the state of Florida. Wherever you live in our great state, the chances are that OurSeniors.Net and our services are available to you. To better serve the needs of seniors and their families, we have always divided the wider area that we serve into several smaller service areas. This enables our staff to better serve the needs of seniors who reside in each of these locations. We recognize that the interests and concerns of South Florida seniors may be different from