Nothing is more important to seniors than Social Security and Medicare, the two most popular programs run by our government. With that in mind, let’s look ahead to some changes coming to those programs in 2019.

Nothing is more important to seniors than Social Security and Medicare, the two most popular programs run by our government. With that in mind, let’s look ahead to some changes coming to those programs in 2019.

For Social Security Benefits, there will be an increase of 2.8% in 2019. This is the most significant cost-of-living adjustment (COLA) in several years. According to the AARP, the average single Social Security recipient will receive a benefit of $1,461 per month in 2019. This affects household income for about one in five Americans, including Social Security beneficiaries, disabled veterans and federal retirees.

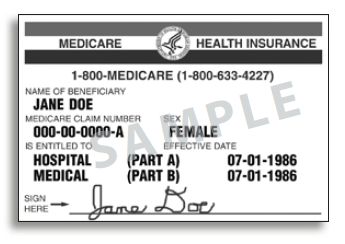

For Medicare Part A (in hospital expenses), here are the changes: About 99 % of Medicare beneficiaries pay no Part A premium at all, since they have at least 40 quarters of Medicare-covered employment. The Part A inpatient hospital deductible will be $1,364 in 2019, an increase of $24 from 2018. Additional costs are incurred after 60 hospital days.

For Medicare Part B (doctor visits, outpatient hospital services, certain home health services, etc), here are the changes: The monthly premium for most Medicare Part B beneficiaries during 2019 will be $135.50. This is an increase of $1.50 per month over 2018. Some Medicare enrollees will pay less than the full Part B standard monthly premium amount in 2019. This is because of the “hold harmless” rule which limits the increase in their Part B premiums to an amount that is no greater than the increase in their Social Security benefits.

Higher income seniors, about 5% of people with Medicare Part B, will pay higher Part B premiums. The total premiums for high income beneficiaries for 2019 (income of $85,000+) are shown in the following table:

| Joint Filers | Single filers | Adjustment | Total Premium |

| Less than $170,000 | Less than $85,000 | $0.00 | $135.50 |

| $170,000 to $214,000 | $85,000l to $107,000 | $54.10 | $189.60 |

| $214,000 to $267,000 | $107,000 l to $133,500 | $135.40 | $270.90 |

| $267,000 to $320,000 | $133,500 to $160,000 | $216.70 | $352.20 |

| $320,000 to $750,000 | $160,000 to $500,000 | $297.90 | $433.40 |

| $750,000 + | $500,000 + | $325.00 | $460.50 |

The Medicare Part B annual deductible, the amount a senior must pay before Medicare begins to apply, will be $185 in 2019 (an increase of $2 from the annual deductible in 2018).

Your Medicare Part D Prescription Drug coverage (either through a standalone Part D plan, or a Medicare Advantage plan) will change a little in 2019. In 2018, Part D prescription drug coverage has been divided into three classes, based on out-of-pocket expenses. When a beneficiary had personally paid $3,750 for prescription drugs, they entered the famous “donut hole” of reduced coverage until they had reached the “Catastrophic Coverage” category of personal spending ($5,000).

In 2019, once in the donut hole, your share of costs will decrease to 25% (10% less than last year) for covered brand-name prescriptions, 44% for covered generics. Drug manufacturers will pay 70% of your costs while in the donut hole or 20% more than in 2018. When your drug expenses reach $5,100 in 2019, you will pay no more than 5% of the cost of any covered prescriptions for the remainder of the year.

All of this is an improvement to Medicare’s Rx drug coverage, but it is also complicated and confusing to many seniors (and their loved ones). One of the OurSeniors.net‘s vetted partners in the Approved Vendor Program is the Daytona Beach Office of Humana Health. You can reach a Humana representative by calling one of these numbers:

- Humana toll free English – 855-567-9358

- Humana toll free Spanish – 855-622-5419

- Humana Daytona Office – 386-200-4191

Do not wait to take care of this; the Open Enrollment period for 2019 Medicare coverage ends on Saturday December 7, 2018!

The premiums for Medicare Advantage plans are set by individual insurance carriers and very from plan to plan and by location. One of the OurSeniors.net Approved Vendors, Humana Health Care is a well-known name, especially in senior care. The Medicare Open Enrollment period is the perfect time to talk to them about your Medicare options. Humana’s Daytona Beach office is located at 1500 Beville Road. Seniors can call the office at 386-200-4191 to get full information about the many choices open to them.

If you have not investigated the extras provided by Medicare Advantage Plans, now is the time to do so. Do not put this important decision off. The choice you make by December 7 will determine your health care options for 2019, so talk to a Humana representative today by calling the office at 386-200-4191.

The pros at Humana can help you with your Medicare and health insurance choices. For help with any senior life challenge or problem, you can contact an OurSeniors.net Advisor by phone at 866-333-2657 (se habla Español), or by using Contact Us. Check out our website at Ourseniors.net and take an online look at our senior living magazine, OurSeniors.net Magazine. You can view the entire OurSeniors.net Directory of Approved Vendors.