Sometimes it pays to review basic information. This is certainly true when it comes to Medicare; a survey conducted by the Medicare administration revealed that a majority of seniors could not name or describe the four parts of the Medicare system. This is information that every senior should have at hand, especially when signing up as a new Medicare beneficiary or during the annual open enrollment period. You must understand your Medicare choices and pick your coverage carefully; how you do so will determine your benefits, who you get them from, and it can affect your out-of-pocket costs.

Sometimes it pays to review basic information. This is certainly true when it comes to Medicare; a survey conducted by the Medicare administration revealed that a majority of seniors could not name or describe the four parts of the Medicare system. This is information that every senior should have at hand, especially when signing up as a new Medicare beneficiary or during the annual open enrollment period. You must understand your Medicare choices and pick your coverage carefully; how you do so will determine your benefits, who you get them from, and it can affect your out-of-pocket costs.

Medicare has four major elements, Parts A, B, C and D. The first two (A and B) are often called “Original Medicare.” This is the most basic coverage you can obtain. Part C and Part D are available through private health insurance plans. They enhance your coverage if you want more than Original Medicare offers. This situation is sometimes confusing because Part C is often called “Medicare Advantage,” a plan that combines hospital, doctor fees and drug coverage into one package. Right now, let’s keep it simple and go through Medicare elements one-by-one, starting with Part A.

Part A is coverage for hospital costs (charges incurred when a beneficiary is admitted to a hospital), a skilled nursing facility, limited home health services and Hospice care. To be eligible for Part A benefits, the patient must be admitted to a hospital. Emergency room visits, outpatient lab tests or outpatient physical therapy costs are not covered by Part A, even if they took place in the hospital building.

Part A is unique because it is an entitlement, not a premium-supported benefit. There is no premium for Part A if the senior has met the work requirements – at least 10 years (or 40 quarters) and paid Medicare taxes during that time. This is why Part A is so incredibly valuable to seniors and so important to us at OurSeniors.net. If it were not for Medicare Part A, many members of the OurSeniors.net Family could not buy hospitalization insurance at any price, even if they could afford the premiums. Their preexisting conditions would shut them out of the market.

There is no doubt that the free Part A coverage is the best deal in the health care market today. Seniors who have not met the work requirements for Part A eligibility will pay up to $437 each month. That’s how valuable it is!

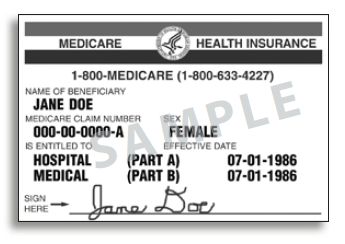

Part B is the second half of “Original Medicare.” A senior qualifies at age 65 for Part B coverage if they are a U.S. citizen or have been a legal resident for five years. It does not matter how long they have paid Social Security or Medicare taxes, but Part B coverage requires a monthly premium payment. Understanding Parts A and B is important because you need this knowledge to make intelligent decisions about additional coverage, like “Medigap” or “Medicare Advantage” plans.

Here are some examples of services covered by Medicare Part B:

- Doctors’ fees whether in a hospital or as an outpatient, including primary care doctors and specialists of any kind who provide a Medicare-approved service.

- Wellness exams.

- Non-hospital surgical centers (day-surgery centers).

- Lab testing such as blood or urine tests.

- Emergency room visits to hospital ERs. Even though they are physically in a hospital building, ER visits are covered by Part B, not Part A.

- Ambulance services.

- Diagnostic tests like EKGs, X-rays, CT scans or MRIs.

- Dialysis treatments.

The list goes on further than this article can cover, but you can see that Part B coverage is quite broad. Part A is free while there is a premium charged for Part B. However, this charge is remarkably low considering the broad coverage and the age group. These programs (Parts A and B) are the basis of medical care for America’s seniors. Without them, most seniors would not be able to afford medical insurance even if they could find a carrier willing to write the policy.

Part C is also known as “Medicare Advantage,” and this term often causes some confusion. The other Medicare parts (A for hospital bills, B for doctor and outpatient costs, D for prescription drugs) cover specific areas of medical expenses, but Medicare Advantage or Part C is a program that combines coverage for hospital, doctor, outpatient services and prescription drugs into one package.

These plans are offered by private insurers who take the premium funds that would otherwise have gone to cover Part B and assume responsibility for overall medical insurance coverage. Medicare Advantage plans have grown in popularity in recent years as they make dealing with health insurance needs simpler. However, there is great variance in the quality and coverage options from different Advantage plans and seniors should shop carefully from trusted providers (see below).

Part D is prescription drug coverage, offered through private insurers as part of a Medicare Advantage plan or as a supplement to Original Medicare Parts A and B. These supplements to Parts A and B are commonly called “Medigap” plans, and like Advantage plans the quality and coverage level offered can vary widely by plan.

Here are some key points to remember:

- Parts A and B are the “Original Medicare” plans. Part A is free, there is a premium for Part B. Medigap plans offer supplemental coverage to fill in the gaps in Original Medicare.

- Part D is prescription drug coverage offered through private insurers via Medigap or Advantage plans.

- Part C is not actually a “part” so much as it is a combination of hospital, doctor, outpatient services and prescription drug coverage. These Advantage plans are sold by private insurers.

That is a very concise description of a subject that is both extremely important and very complicated. There are no topics that are of greater interest to seniors than the Social Security system and the Medicare program. Many of our blog articles address this topic, and the OurSeniors.net Family includes a number of fine organizations that can be of assistance in dealing with healthcare challenges.

- Humana Health Care – Medicare Insurance plans. Phone 386-200-4191.

- Murray Insurance Agency/Florida Blue – Medicare Insurance Plans. Phone 321-233-2424.

- Plan Life Care Daytona – In-home healthcare services. Phone 386-267-6898.

- Partners in Healthcare (Orlando) – In-home healthcare services. Phone 407-604-4510