Central Florida, Winter 2024

Contents

Winter 2024 | Volume 8 | Issue 1

In the News

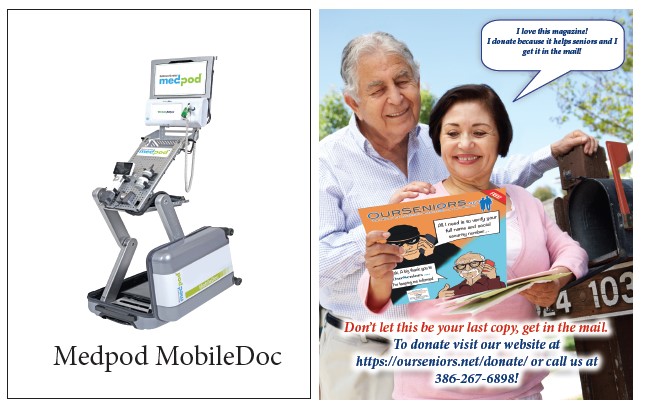

6. Better than Telemedicine without Leaving Home

Community

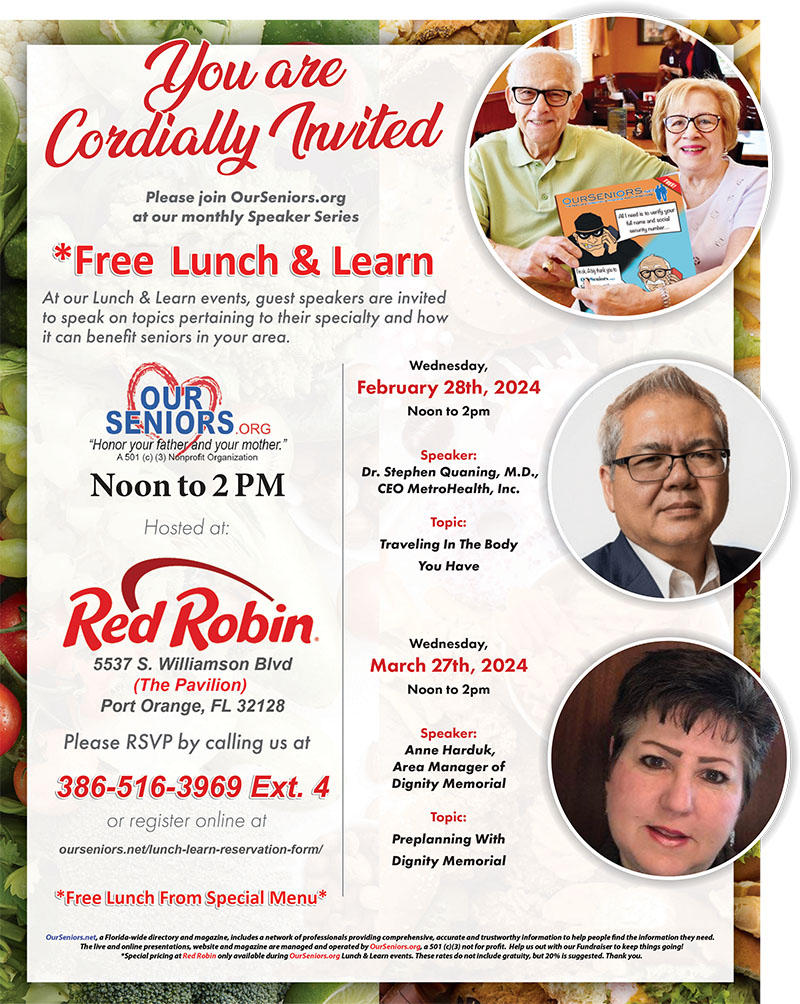

4. Lunch & Learn

Feb 28 & March 27

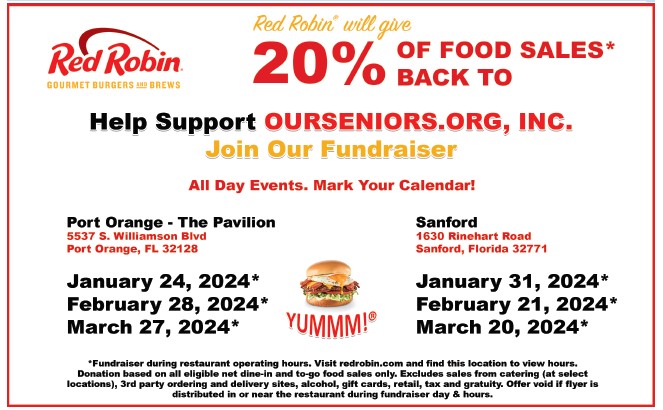

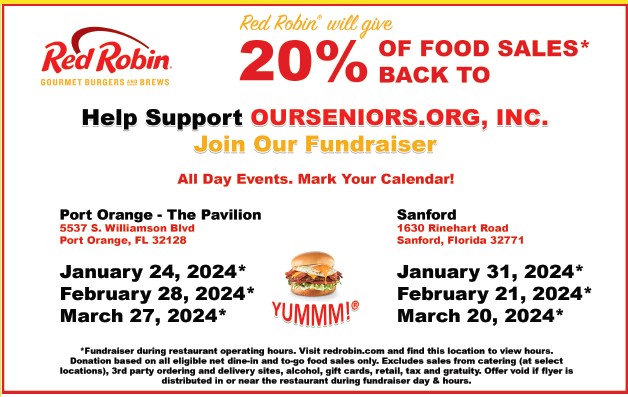

5. Red Robin Fundriaser Port Orange

Jan 24, Feb 28 & March 27

21. Red Robin Fundraiser Sanford

Jan 31, Feb 21 & March 20

Entertainment

11. OurSeniors Radio

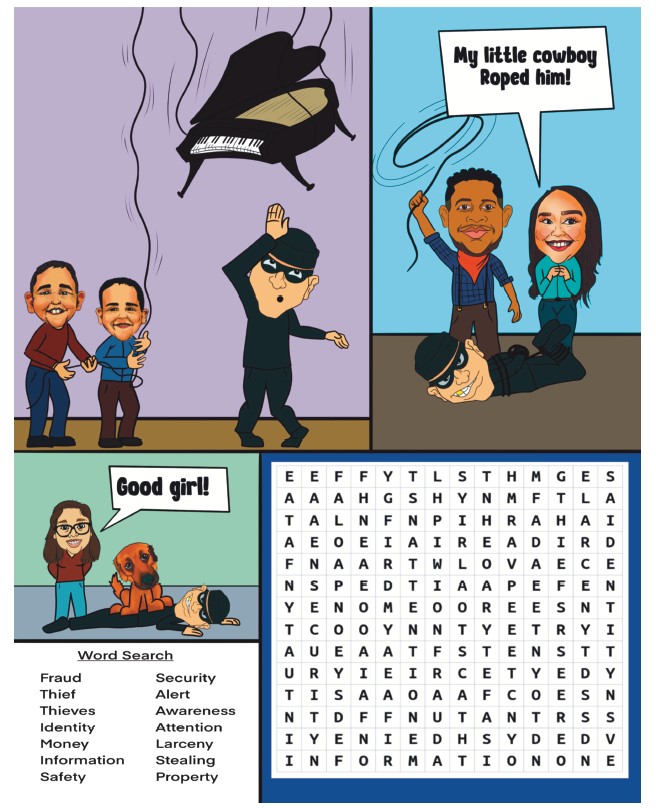

12. OurSeniors Comedy/ Word Search

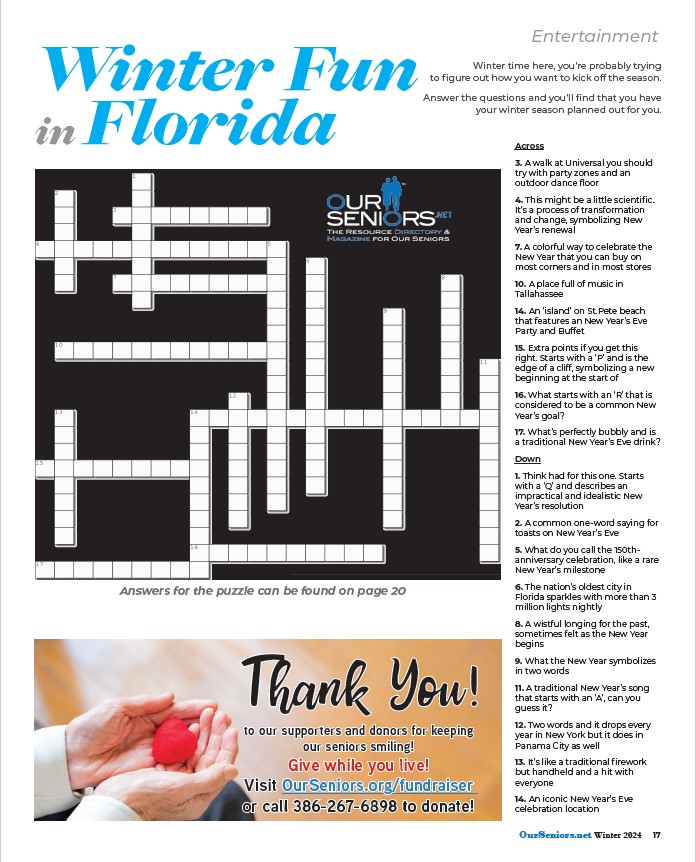

17. Crossword Puzzle

Finance & Retirement

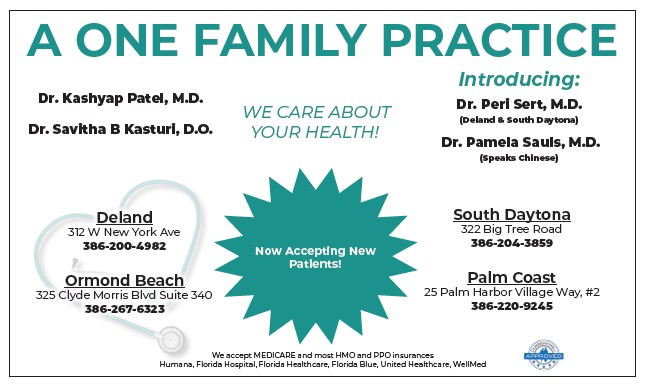

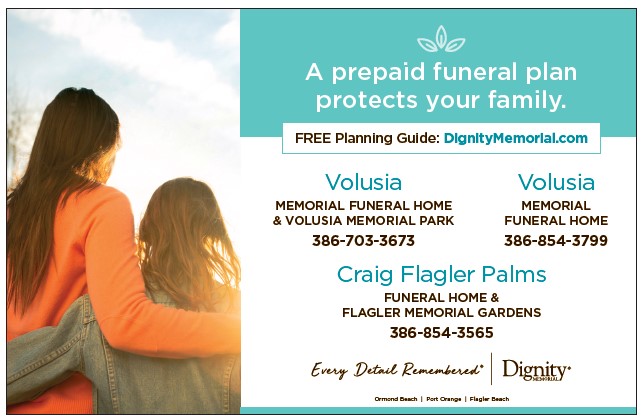

14. Preplanning With Dignity Memorial

Fraud & Security

7. Seniors Vs Crime, a Special Project of the Florida Attorney General

Health & Wellness

5. Ask Dr. Q

Inspirational

10. Mr. Lowell Ward, an Amazing Senior at 97

16. Living in the Balance of Grace & Faith

Insurance

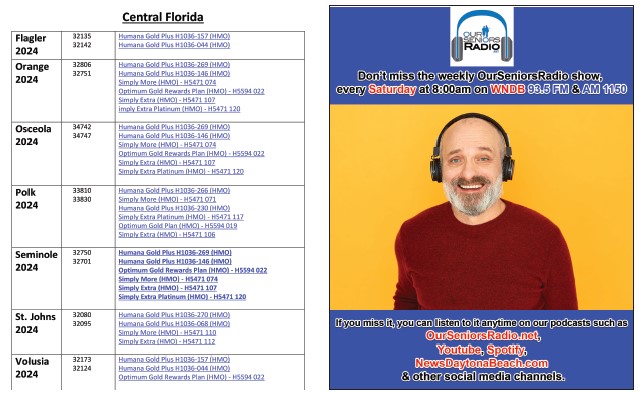

8. 5-Star Medicare Advantage Plans for 2024

Legal

11. Tax Tips: Not Just for the End of the Year

Don’t miss another edition by donating! Visit OurSeniors.org/donate

Disclaimer: The information published in this magazine and our website is intended for residents of the USA. The opinions, beliefs and viewpoints expressed by the various authors in this magazine and on this web site do not necessarily reflect the opinions, beliefs and viewpoints of OurSeniors.net Magazine or official policies of OurSeniors.net Magazine, OurSeniors Radio, OurSeniors Discounts, OurSeniors.org, Inc. and or its related entities. It may contain general information about medical conditions, public and private health service organizations and other third-party information including but not limited to testimonials. The information is not advice (legal, medical or otherwise) and should not be treated as such. Consult your licensed Professional such as Attorney and or Doctor etc. for further advice. No claim is made as to the accuracy, authenticity or completeness of any information and, is often provided in a generalized or summarized format for brevity. OurSeniors.net Magazine, LLC and or its subsidiaries, does not accept any liability for the information (nor for the use of any information) provided by this magazine and or website. The information presented by this magazine and website is provided on the basis that all viewers undertake responsibility for assessing the relevance and accuracy of the data related to their circumstances. Thank you for reading our magazine and visiting www.OurSeniors.net and please contact us if we can be of further assistance. All real estate advertised in OurSeniors.net is subject to the Federal Fair Housing Act. This federal law makes it illegal to advertise any preference, limitation or discrimination based on race, color, religion, sex, handicap, familial status, or national origin, or intention to make any such preferences, limitation, or discrimination. We will not knowingly accept any advertising for real estate which violates the law. All persons are hereby informed that all real estate advertised in OurSeniors.net is available on an equal opportunity basis. Information contained herein has been furnished by community owners, managers and agents. OurSeniors.net and or OurSeniors.online, OurSeniorsDiscounts.net and or OurSeniors.org, Inc. and OurSeniors.net Magazine, LLC do not make any representations as to opinions and facts. All terms and conditions of rentals are subject to change. OurSeniors.net reserves the right to refuse advertising space to anyone deemed unsuitable for placement in this publication. OurSeniors.net, OurSeniors.online, OurSeniorsDiscounts.net and or OurSeniors.org, Inc., and OurSeniors.net Magazine, LLC retains all rights reserved by copyright 2023 OurSeniors.net, and or OurSeniors.net Magazine, LLC. This publication or parts thereof may not be reproduced in any form without the written permission of the publisher. For further Disclaimer information please visit www.ourseniors.net and click Disclaimer on the footer of the website. Please note that websites and links are referenced in the magazine, and you may have complete access to our online version by visiting. www.ourseniors.net/editions.

To All OurSeniors Readers, Subscribers, Vendors, and Donors,

As we arrive at the end of the year and look towards a new year, the OurSeniors.net Team wants to extend gratitude, warm wishes, and encourage our readers. A new year gives us the opportunity to set goals, make plans, and try our best.

We are here to provide support to seniors and inspire our readers. We want to encourage all of you to help others, even the smallest gestures will make an impact on those around you. As we embark on another year remember we are all capable of doing remarkable things.

Even In Florida, We Have Winter

We do not skip winter in the sunshine state. While escaping a harsh winter season is one of the top reasons so many seniors flock to Florida, many do not realize that we have winter activities. Even on one of Florida’s picturesque beaches, you might experience seasonal traditions that you might not have thought you would see. With a mild, sunny climate, endless attractions, and welcoming communities across the state, there are a variety of ways to embrace the season that we do not want you to overlook.

From ‘Santa-seeing’ events and exploring the art in local areas, to cultural holiday food festivals, and holiday golf tournaments, it might be difficult not to find ways to stay festive as a Florida senior.

Don’t Forget About The Importance of a Support System This Season

While every season has its charms, we do understand that the winter months can sometimes bring a sense of isolation, especially for seniors. This is why we stress the significance of a dedicated support system. The thing is, not all seniors have this, and this is where the OurSeniors.net Team comes in. We want to encourage seniors to reach out to friends and family, stay connected with your community, and remember that there is a wide network of individuals who care deeply about you whether you know it yet or not.

As A Reminder, Stay On The Lookout for Signs Of Scams and Fraud

Whether you have been directly affected by something like this before or not, signs of scams and fraud are something to stay aware of even after the holiday season is over. Vulnerability can be present in any age group but is especially present within the aging population.

This is why awareness is essential and we want to encourage seniors to remain vigilant, be weary of sharing personal information, by telephone, computer or mail and reach out to loved ones or professionals for help, guidance, or advice when you need it. Just by answering “Yes” to a simple question on an unexpected phone call, your recorded voice and response may be used by delinquents doing fraudulent transactions. Do not be afraid to protect yourself.

As Always…

As always, the OurSeniors.net Team wants to remind you that our goal is to support the seniors of our communities and to help bridge the gap between seniors and what they need but do not have access to. We aim to raise awareness around seniors’ issues and to not only be their voice when needed but also to encourage our readers, supporters, and subscribers to join us in doing the same.

From our team to you, we want to wish you an enjoyable winter season and a happy new year.

-As always, you as a reader are part of everything that we achieve, and that will never go unnoticed.

OurSeniors.net Team

“Ask Dr. Q.” gives OurSeniors readers a chance to get expert answers to specific senior-related health questions. Dr. Steven Quaning is Medical Director and Chief Physician at Metro Health, a network of medical practices dedicated to senior care. He is Board Certified in Geriatric Medicine, medical care specifically aimed at seniors.

In our “Ask Dr. Q” feature, readers have an opportunity to get answers to specific senior medical questions. Here are some examples-

Q? Are families and friends important in providing geriatric care? Should they leave that care to medical professionals alone?

Answer- Families and friends are not important in the care of seniors, they are essential! Geriatricians provide comprehensive, holistic care that addresses the physical, mental, emotional, and social aspects of aging. This “whole person” care is much more difficult if families are not involved or present. Physicians treating seniors must consider the effect of aging on mood and behavior as well as standard “doctor things” like blood pressure or body temperature. Only families or close friends can give the attention and care needed to fill this need.

An important part of Dr. Q’s geriatric training came long before he entered medical school. As a young boy, he served as a caregiver for his grandfather; he learned from this experience. Now, he is one of the relatively few physicians who are board certified in geriatrics, the care of seniors.

Q? Between us, my wife and I have 11 different doctors- ophthalmologists, rheumatologists, endocrinologists, etc., etc. Does it really make sense to add a gerontologist?

Answer- Yes! A gerontologist is a general physician to seniors, specializing in the care of older adults. They are trained to manage numerous chronic conditions that affect seniors. These conditions require complex, coordinated treatment plans. The medications and treatments prescribed by different doctors can interact with each other in unexpected ways.

Gerontologists are trained to communicate effectively with older patients and their families, overseeing comprehensive care that addresses the physical, mental, social, and emotional aspects of aging. They cooperate with other health professionals to integrate the services and treatments seniors need. The aim is not to treat one specific problem, but to produce the best outcome for senior patients.

—–

Disclaimer. The information provided in Ask Dr. Q or on our website is intended for informational purposes only. It should not be construed as a substitute for professional medical advice. Please note that not all questions submitted may be answered. Always consult your physician or healthcare provider for medical advice. For additional Disclaimer information please visit ourseniors.net/disclaimer/

MetroHealth Geriatrician Office, renowned for its compassionate and comprehensive care for the elderly, is now taking its unique healthcare experience to the next level with the addition of the Medpod: The Ultimate Portable Practice. This innovative tool is set to further enhance MH’s already exceptional service, solidifying its reputation as a leader in geriatric healthcare.

At MetroHealth, the focus has always been on providing personalized, patient-centric care. Understanding the unique challenges faced by the elderly, MetroHealth has consistently sought out ways to improve access to healthcare for this demographic. The introduction of the Medpod MobileDoc is a testament to this commitment. This state-of-the-art portable medical system allows MetroHealth’s healthcare professionals to extend their reach beyond the confines of the traditional office setting, delivering top-notch medical care directly to the homes of their patients.

The MobileDoc is a marvel of modern medical technology. It’s equipped with advanced diagnostic tools that enable MH’s skilled team to conduct a wide array of medical assessments during home visits. From conducting EKGs and spirometry tests to providing hearing and vision screenings, the Medpod ensures that comprehensive care is delivered efficiently and effectively, right where patients are most comfortable.

What sets the MobileDoc apart is its capability for live, two-way televideo communication, allowing for real-time consultations with specialists. This feature is invaluable for MetroHealth’s patients, who now have access to a broader range of medical expertise without the need to travel. In addition, the real-time data streams from the Medpod facilitate better decision-making and improved patient outcomes, as the MetroHealth team can swiftly respond to the evolving health needs of their patients.

The flexibility of the Medpod MobileDoc aligns perfectly with MetroHealth’s philosophy of tailored care. Whether it’s providing routine check-ups, managing chronic conditions, or addressing urgent health concerns, the MobileDoc adapts to the specific needs of each patient. This portable medical infrastructure is also optimized for both mobile cellular service and Wi-Fi, ensuring reliable and uninterrupted care.

MetroHealth’s integration of the Medpod MobileDoc into their service offering is more than just an upgrade in technology; it’s a reaffirmation of their dedication to enhancing the lives of the elderly. By embracing such innovations, MetroHealth continues to lead the way in providing compassionate, comprehensive, and convenient care, further enriching the unique MetroHealth experience for all its patients. For more information on MetroHealth in Orange County call 407 326-2071 and for Volusia County call 386 467-4430.

Have you ever been the victim of a crime or scam? For many seniors, the answer is, “Yes, I have!” There are several reasons that seniors are more likely than younger adults to be targeted for scams. Criminals think (sometimes correctly) that seniors are less tech-savvy and more susceptible than younger people. Scammers exploit these vulnerabilities, and they use tricks such as impersonating government officials or creating a sense of urgency to cheat seniors. They also think that seniors are less likely to report being cheated, or to try to recover damages.

Florida is the most senior-friendly state in the nation. Unfortunately, this means that it is also a prime target for unscrupulous scammers. These schemes include various financial crimes that target seniors’ identity, money, or property. They may operate via telephone, internet, mail, or even personal contact, and they cost Florida seniors millions of dollars each year.

Now, Florida seniors and the state’s Office of Attorney General are fighting back. Seniors Vs Crime is a special project of the Florida Attorney General. It began as a crime prevention program, using senior volunteers to educate peers and to encourage fellow seniors to become actively involved in their own protection. From its start in 1989, the project has now grown into a statewide organization that not only educates, but also provides direct aid to senior victims. This organization has become one of the most successful volunteer programs in the nation devoted to assisting and protecting our seniors.

The Seniors Vs Crime Project strives to reduce the victimization of senior citizens who are targeted for specific crimes or scams based on their age. The Project focuses on three objectives: education, investigation, and volunteer opportunities.

Through its Speakers Bureau, the Seniors Vs Crime Project (SVCP) educates seniors on how to avoid becoming a victim. Speakers are experienced and knowledgeable volunteers who talk about scam methods, especially the most current scams, and how seniors might be vulnerable. This educational service is available free of charge to any organization or group who wishes to educate their members.

The SVCP actively comes to the aid of seniors and others who believe they have been victimized by scammers and fraudsters. The program was formed in 1989 by the Florida legislature and serves Floridians in all 67 counties. Seniors vs Crime trains volunteer “Investigative Sleuths” to work shoulder-to-shoulder with potential scam victims. These volunteers are civilians, not police, although many have law enforcement experience. They are trained in fraud investigative techniques, and they conduct their investigations via telephone from SVCP offices.

The Seniors vs Crime Program will come to the aid of senior fraud victims, helping them to establish the facts and to initiate recovery action. The program serves Floridians in all 67 counties. The Project investigates complaints and seeks restitution for seniors in appropriate instances, free of charge. All monies recovered go to the complainant. Each year, it handles thousands of cases, and it has recovered over 16 million dollars plus over 12 million in realized gain for Florida seniors.

Senior fraud victims may request the aid of one of the Project’s “Senior Sleuths.” This trained volunteer will assist in doing everything possible to reach a settlement without cost to the senior.” Senior Sleuths” are successful in a high percentage of cases. To learn more, click on Seniors vs Crime Project or phone 1-800-203-3099.

OurSeniors Radio will broadcast two informative shows featuring Mr. Anthony J. Luizzo, who will discuss senior victimization and how the SVCP can help to prevent or correct it. Mr. Luizzo, a past president of the Society of Professional Investigators, will discuss common scams that victimize seniors. What do you know about Phishing, the Pigeon Drop Scam, Charity Scams, the Grandparents Scam or Romance Scams? Right now, Investment Scams that promise easy profits may be the most common schemes, but criminals are always devising new ways to defraud their victims. These cruel frauds cheat thousands of Florida seniors out of millions of dollars each year.

These informative programs will be presented on one of OurSeniors Radio program. Be sure to tune in each Saturday at 8:00 AM on radio station WNDB, 93.5 FM and AM 1150. Recorded podcast versions will be available on OurSeniors Radio, Youtube, Spotify, Apple, and other podcasting platforms.

Thanks for reading this article, have a great day and do not fall victim to senior fraud.

There have been some changes in the 5-star ranking tables for 2024. Medicare Advantage plans with 5 stars are top-tier plans that are considered “excellent” by the organization that runs Medicare, the Centers for Medicare & Medicaid Services (CMS). This year, fewer plans earned that distinction than in 2023.

Why? One reason may be that changes in the calculation methods were made during the COVID-19 pandemic. The CMS gave more leeway to the plans last year; now they are returning to pre-pandemic standards. Whatever the reason, there are fewer 5-star plans nationwide and in Florida. There are also some new names on the 5-star list that were not there last year.

The table below lists the 5-star plans in most of the Florida counties in OurSeniors.Net’s coverage areas. Each plan listing is a link to a webpage describing the plan and its features. This includes the plan highlights, monthly premium, annual medical deductible, out-of-pocket maximum, doctors in-network, and Rx drug deductible.

Readers who want detailed information about areas not listed may go to the Medicare Plans & Coverage by State website. Enter a zip code and you will find all available Advantage plans with star ratings and other information. Below are listings for most of OurSeniors.Net readers-

Thank you for reading our blog and listening to OurSeniors Radio (8 AM Saturdays on WNDB 93.5 FM and AM 1150.) The new 5-star ratings are important news for seniors, and your favorite senior magazine works hard to keep you informed. Choosing the right Medicare coverage may be a difficult task. Each October, seniors are overwhelmed with advertising and promotions. Some of it may be misleading, omitting important facts. MetroHealth, Inc. can help you make the best decision for your situation. You can reach MetroHealth, Inc. at (407) 326-2071 for Orange County and (386) 467-4430 for Volusia County. Listen to an informative conversation about this topic broadcast on the OurSeniors.Net/Radio October 14th show. Click on Medicare Open Enrollment to hear this program.

OurSeniors.Net knows that creativity does not have an age limit. Neither does the love of life, a sunny disposition, or a happy outlook. There is no better reason to believe these good things than the life of this edition’s “Amazing Senior,” Mr. Lowell Ward.

At 97, he continues to be full of life and creativity and to live every day to the fullest. When an OurSeniors staff writer interviewed him, he commented that he was looking forward to his daily ‘happy hour’ with his son, Tom, and perhaps some friends. He had already enjoyed his morning mimosa. The writer was surprised and asked Lowell if he still drove. “I only drive nails, golf carts and cars,” he answered.

Lowell’s past life (all 97 years of it) has been filled with service to his family, community, and country. He is one of the last living Americans who can say that they served on a World War II submarine. Lowell had not quite finished high school in November of 1944 when his draft notice arrived. He had turned 18, and his country needed him. Like so many other young men at the time, he simply said, “Where do I report?”

After boot camp, he was chosen to attend submariner school. These sailors were an elite group, chosen for their physical and mental abilities. Eventually, he found himself abord the USS Razorback on combat patrol in the Pacific during the closing months of the war. The Razorback is now part of the Arkansas Inland Maritime Museum, preserved as a naval museum. It is a reminder of the courage and determination of that generation who are now OurSeniors.

That 18-year-old boy had been born and raised in small-town America, a little place called Iroquois, South Dakota. He had grown up during the Great Depression, giving him a wealth of personal knowledge and experience, things that most Americans only read about in books. After his wartime experiences, he returned and settled near his sister in another small town, Montevideo, Minnesota. He met the love of his life by asking that sister who she thought was the prettiest girl in town.

“Suzanne Crandall, right across the street,” she said. It must have been good advice; Lowell and Suzanne married, raised three sons who gave them four grandchildren and eight great- grandchildren, and lived happily ever after until Suzanne’s death a few years ago. Along the way, Lowell used the GI bill to earn an undergraduate degree from Macalester College and a master’s from Florida State University. That stay at FSU convinced Lowell and Suzanne that Florida is the place for OurSeniors! They made up their minds and moved, first to the Ft. Lauderdale area and then to the Villages.

Along the way, Lowell always kept his sunny disposition and happy outlook. He faced health problems but managed to beat them. Lowell’s life to date would surely make him an amazing senior, but that is not enough for Mr. Ward! This 97-year-old is one of OurSeniors who is truly engaged in living today and looking forward to tomorrow.

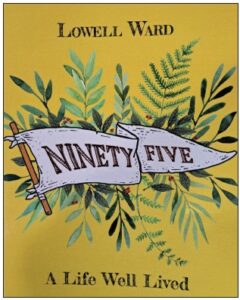

Since retiring, he has written several books and now constructs word puzzles and quizzes for his friends and his own amusement. Two of his books, “Fragments” and I called Her Bunny are available on Amazon’s Kindle site. A third book, “A Life Well Lived,” is being made available through the OurSeniors.Org organization. Just go to https://www.ourseniors.org/a-life-well-lived-by-lowell-ward/ for a simple Donation you will receive a numbered copy. While you are there, check out the details of OurSeniors Radio new radio and podcast productions. Some of those quizzes gave the OurSeniors staff a run for the money. This senior’s mind is as sharp as ever. Just try this one out-

Tomorrow’s news headline reads, “Speak Softly and Carry a Big Stick.” What would be the first sentence of this article?

A. President Roosevelt announces his new foreign policy.

B. A Canadian hockey player has revealed his mantra before 1965 Stanly Cup playoffs.

C. Police Chief Harrinton has responded to Los Angelos riots.

The staff correctly guessed “A”, Roosevelt’s foreign policy. Well, most of us anyway.

Keep thinking, creating, and writing, Mr. Ward! Along with Pat Boone, you are one of the OurSeniors Amazing Seniors! Thank you for your life’s contribution.

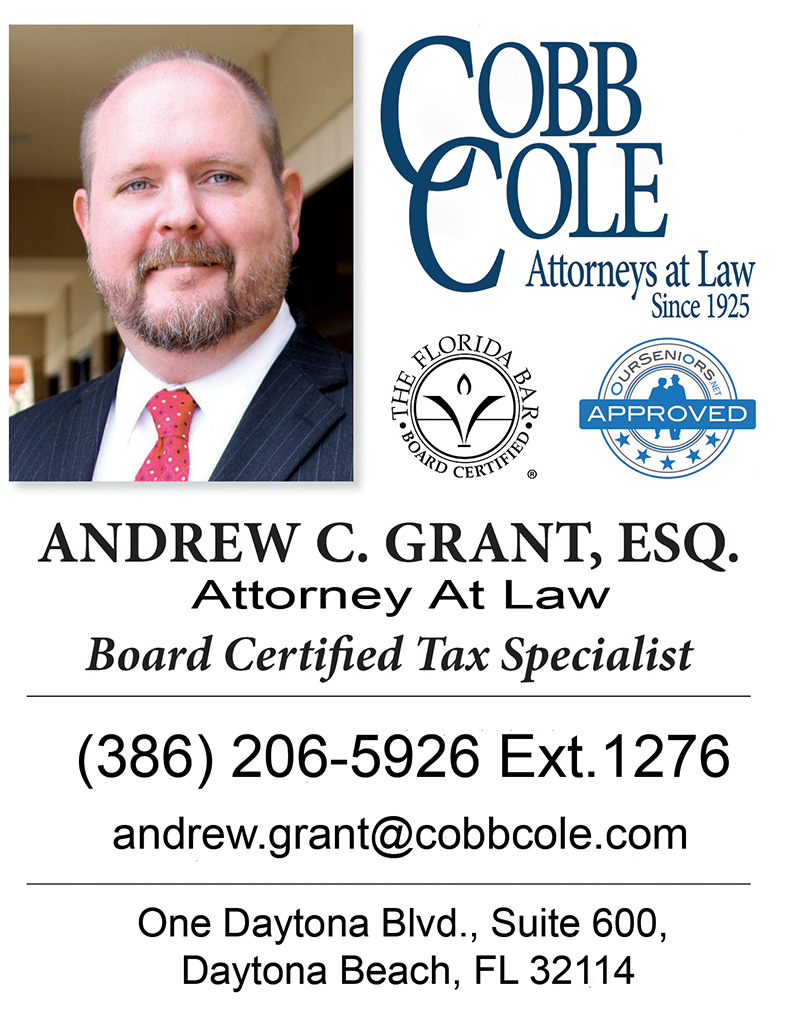

Tax advice abounds towards the end of each year as advisors try to help people minimize the taxes due the next April. Some of that advice is common sense, like making sure you paid enough taxes during the year to avoid underpayment penalties. Some of it only applies to people who can afford it, like maximizing itemizable deductions through charitable gifts. And some of it only applies to people with significant gains or losses. We’ll touch on some of these, and we’ll also look at some estate tax issues people may face.

The first and most obvious tip is to make sure you have enough tax withheld or paid during the year to avoid a large tax bill and underpayment penalties. If you’re employed, make sure your employer withholds enough income tax. If you are on social security and have additional income you may want to have taxes withheld from your social security, because the more non-social security income you have the more your social security is taxable. Underpayment penalties will not apply if you paid 90% of your current-year taxes during the year, or if you paid 100% of your previous year’s taxes during the current year.

The significant boost in the standard deduction a few years ago means that itemizing deductions does not make sense for many people. However, taxpayers with the means and the inclination can still take advantage of charitable deductions by making one large gift to a donor-advised fund this year in place of smaller gifts in later years. The donor gets the tax advantage of the large gift and still directs smaller gifts to charities as the donor wishes.

Another method charitable giving is to give away appreciated assets to charity.

That way the taxpayer avoids recognizing the gain and the charity can sell it without tax consequence. Taxpayers with large IRAs can also direct gifts of up to $100,000 from them without having to recognize the taxable income first.

Taxpayers with investment portfolios may be able to lock in lower capital gains rates now by cashing out appreciated investments, or they may be able to offset gains by selling investments that will give them a loss. Taxpayers with medical debts may be able to deduct them if they are unreimbursed and exceed 7.5% of the taxpayer’s income.

On the non-income tax side, taxpayers need to be aware of current federal estate tax laws. For 2023, any U.S. resident who dies with an estate of less than $12.92 million will not owe any federal estate tax, and that number will go up in 2024 and 2025 depending on inflation. However, in 2026 that $13 million or so of estate tax credit will be cut in half. So, persons with more than $7.5 million, and married couples with more than $13 million, should be considering strategies to lock in the benefits of the current credit amount or methods of minimizing estate taxes after 2026.

Finally, if a spouse dies before 2026, and if the couple had more than $3 million, the surviving spouse should consider filing a federal estate tax return for the deceased spouse. Filing the estate tax return will ensure that the deceased spouse’s estate tax credit will be added to the surviving spouse’s credit when they die. If the deceased spouse had a taxable estate, then the return must be filed within 9 months of the date of death or 15 months if an extension is requested on time.

Income and estate taxes can be complicated minefields, and taxpayers are well-advised to seek professional help if they have questions.

At 2:00 am, the young teenager heard a disturbance down the hallway. Awakening from sleep, she heard her father making noises and her mother screaming. She crept down the hallway to see what was happening. She saw her father on the living room floor having a seizure. The neurologist, who lived across the street, had seen the lights on in the family home and came over knowing something must be wrong. He assured the mother that an ambulance was on the way. The mother yelled at the daughter to go back to her bedroom and remain there. The young teen went into her younger sister’s room to keep her calm still not understanding what was happening. After some time, the mother came to see her daughters and told them that their father was heading to the hospital, and everything would be okay. After a visit with the neurologist that week, it was discovered that the father had a brain tumor. In the two months that followed no additional symptoms showed and the children felt that things had gone back to normal. After two months, a surgery was completed that left their father in a coma. After three days, he passed away. On Valentine’s Day, this family buried their husband and father of 43 years of age. The widow was 36 and the children were 13 and 12. With no plan in place before this tragedy, this family was devastated both emotionally and financially. It was a traumatic time and the heartache continued for many years.

I am Anne Harduk and that was my story as a 13-year-old. As an adult, when I found Dignity Memorial and understood that I could protect families so that no one ever had to experience what my family did, I knew I had found a calling, and I would help families for the rest of my career. I understood firsthand that none of us is guaranteed 100 years on this earth. Everyone should take some time to preplan for future funeral and cemetery needs.

Some might think this is dark or even morbid. I understand. Thinking about death and dying is uncomfortable, especially thinking about our own death. But planning is more about taking care of the people we love. In fact, that is the number one reason why people plan ahead-to make sure that their families never have to go through life’s worst day the wrong way.

Planning can be done in four simple steps. First, we REFLECT-what is important to you; how did you Live, Laugh and Love; Second, we RECORD-our Preplanning Guide is a 23-page book and an excellent tool to answer a tidal wave of questions that your family will have on that day. We provide this free of charge to every family that we meet with. Third, SUPPORT-convenient payment plans are available to fit into every family’s budget. You can beat inflation and lock in today’s pricing for something you need in the future. Fourth, SHARE-tell your family what you have done. This is a gift that one day will show them that you have planned because you love them.

Our advisors are experts at customizing options based on your needs. They do so in a non-threatening meeting or two at our offices or your home. I recommend touring one of our funeral homes and/or cemeteries to determine how we can best meet your unique needs. Ask for your free Planning Guidebook. We’ll make sure to answer all your questions. With offices in Palm Coast, Ormond Beach and Port Orange, we’re located near where you live. Families tell us that once decisions have been made, they feel good and even have fun meeting with us. So, reach out-we’re here to help!

Thank you, Anne Harduk, for sharing your story. Anne Harduk is the Area Sales Manager for Dignity Memorial and has been serving families since 2009. You can reach her directly at Anne.Harduk@dignitymemorial.com; or call one of our offices to ask for her. Palm Coast – 386-854-3565; Ormond Beach – 386-703-3673; Port Orange – 386-854-3799.

One of the questions I get asked the most is “How do I receive from God?” People usually follow that up with “I’ve been praying, reading my Bible, going to church, and paying my tithes. I’ve been doing everything the Bible says to do.” What they don’t realize is that when they say that, they’ve just told me why they don’t receive: they think their performance should earn them something from God. This is a misunderstanding of the balance of grace and faith and their relationship to each other.

The word grace basically means unmerited, undeserved favor. It’s important to understand that grace has nothing to do with you earning anything from God. Grace existed long before you ever came to be. To put it simply, grace is God’s part. Faith is your positive response to what God has already provided by grace. In other words, faith is basically your way of saying yes to God’s grace. Faith only appropriates what God has already provided for you. Therefore, faith is your part.

Grace and faith work together, and they must be in balance.

For by grace are ye saved through faith; and that not of yourselves: it is the gift of God: Not of works, lest any man should boast.

Ephesians 2:8–9

Sometimes we read a passage from Scripture that is so familiar, we don’t stop to think about what it is really saying. In this verse, a profound truth is being declared. It says that we are saved by grace through faith—not one or the other. Think of it this way: Grace is what God does. Faith is what we do. It takes both working together for us to receive salvation, healing, or anything else from God.

Salvation is not dependent on grace alone. If it were, everyone would be saved and going to heaven, because God’s grace is the same toward everyone.

For the grace of God that bringeth salvation hath appeared to all men.

Titus 2:11

God has already done His part; it is now up to you to receive the truth by faith and make it a reality in your life. Amen!

God’s grace has provided not only for salvation but also for every need in your life. That provision is not based on whether you are reading the Bible enough, praying enough, going to church, or even paying your tithes. Before you ever had a financial need, God created the provision. Before you were sick, God, through grace, provided your healing (1 Pet. 2:24). Before you ever became discouraged, God blessed you with all spiritual blessings (Eph. 1:3). God anticipated every need you could ever have and met those needs through Jesus before you existed. That’s the grace of God.

Jesus hasn’t saved, healed, delivered, or prospered a single person in the last 2,000 years. What God provided by grace 2,000 years ago now becomes a reality when a person mixes their faith with it. Faith appropriates what God has already provided. Faith doesn’t move God; He isn’t the one who is stuck. Faith doesn’t make God do anything. Grace and faith work together, and our part is to accept what God has already done. Grace must be balanced with faith.

If you put your faith in what God has already done for you, you’ll have the victory that overcomes the world (1 John 5:4). This is absolutely foundational to your relationship with God and could be the reason that you may not be seeing your prayers answered.

God has done His part by giving His Son, Jesus. His grace has provided everything through the sacrifice of Jesus. This is nearly too good to be true because there is absolutely nothing we can do to earn it and nothing we can do to lose it. Our part is simple: we respond to His grace by faith and appropriate what has already been accomplished.

If you enjoyed what I shared here, visit my website at awmi.net, where you’ll find additional free teachings and resources. If you need prayer, I encourage you to call my Helpline at 719-635-1111, where one of my trained prayer ministers would love to pray with you.

We love you,

Andrew and Jamie